Commodity prices have skyrocketed in the aftermath of the Ukraine invasion. Brent oil prices have reached USD100 for the first time since oil prices collapsed in 2014. There is also an escalating risk that Western sanctions, such as expelling Russian banks from SWIFT, will target or disrupt Russia's energy export. We take the stock of this crisis to assess what it means for energy geopolitics.

1. How is the combination of high oil prices and security concerns complicating geopolitics

- Although the US has called for a global oil reserve release, oil prices are likely to remain above USD100 unless significant alternative supplies enter the market. A long-lasting high oil price is set to enhance the energy advantage of major oil and gas producers, particularly the US and its allies such as Australia, Saudi Arabia and Qatar. The structural imbalance between the global energy supply and demand will further intensify

- The need to rebalance the oil market will likely place Iran in a favourable position in its nuclear talks with the US. Given the worsening situation in Ukraine and the pressure on oil prices, the US has a strong incentive to conclude the nuclear talks in the coming weeks as a way to lift terrorism-related sanctions on Iran's oil and gas sector. Knowing that the US needs additional oil to ease pressure on the market, Iran has added new conditions to the nuclear talks, making the negotiations harder

- Similarly, we expect Beijing to take advantage of the US being occupied by the Ukraine crisis to urge Washington to soften its hard China policy. On 28 February, Foreign Minister Wang Yi said that China would welcome the US to join China’s Belt and Road Initiative (BRI). Urging the US to jointly build a conflict-free Asia-Pacific, he reiterated a call for the US to stop supporting independence for Taiwan

- Beijing’s relationship with Moscow is under escalating pressure from the West given the global responses to the invasion of Ukraine. If the West punishes China with more sanctions for not distancing itself from Russia, it will also be taking a risk by pushing Russia further into China’s geopolitical orbit. Given the current tight energy market, it will likely be difficult for the US and its allies to adopt hard policies against Russia, China and Iran at the same time

2. How are Western sanctions impacting Russia-China relations?

- So far, sanctions against Russia targeted finance and technology, but have excluded the energy sector. Western governments are trying to strike a balance to avoid severe disruption to Russian exports amid a tight energy market. However, such an all minus energy move has already exerted pressure on energy supply chains and prices, which are now spiking at above USD$100 per barrel

- Russia is not immune from sanctions, and the decision to sanction Russia’s central bank and cut off some Russian banks from SWIFT has started to significantly impact its economy. However, Russia will likely continue its commodity trade and switch some of its exports to Asia by using non-SWIFT local banks from countries that are not US allies. Russia can therefore still get revenues in non-dollar currencies

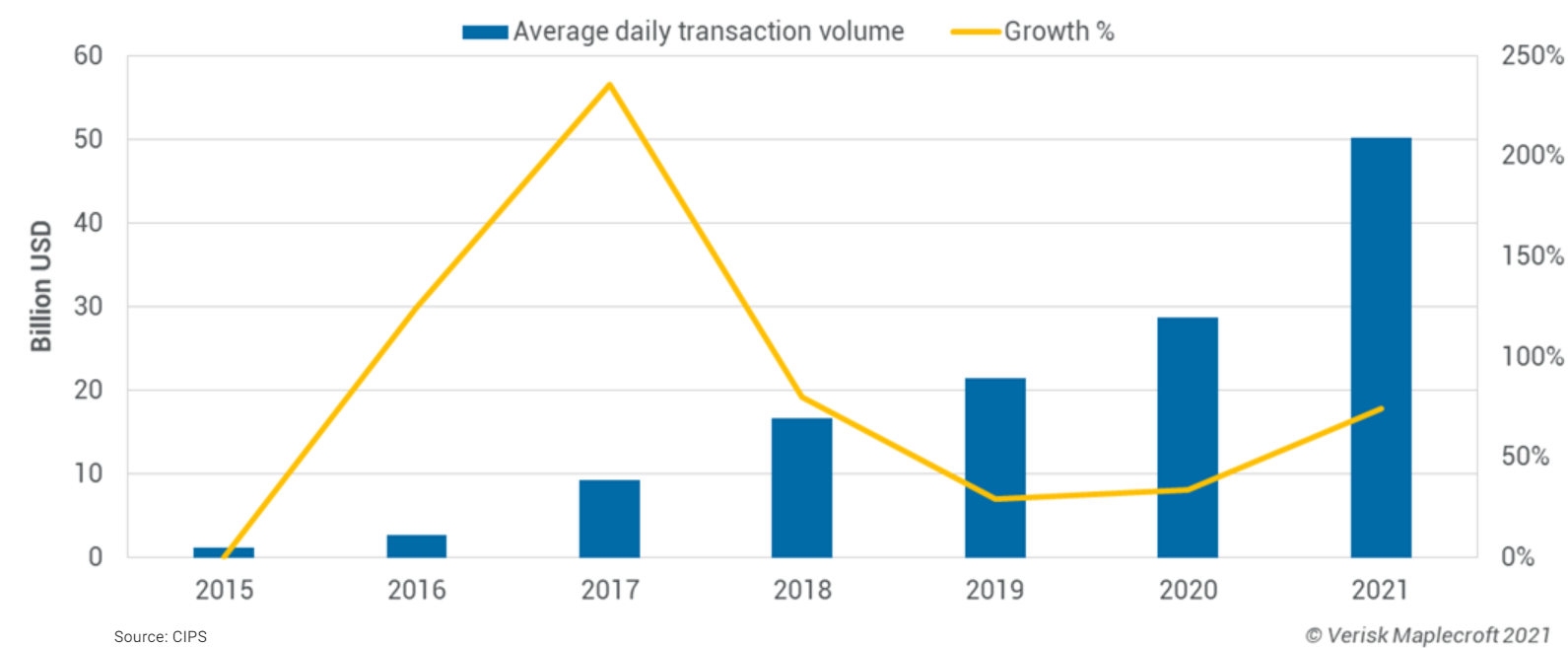

- Expelling some Russian banks from SWIFT payments will also drive it to use a non-dollar system such as China's CIPS. China has been trying to establish a competing economic institution to rival the US-led global system. If Russia joins CIPS, it would significantly boost China's ambition of establishing the Renminbi as an alternative to USD in the long term

- Major oil internationals such as BP and Shell have announced that they will divest from Russia’s energy companies and upstream projects. Because of the US sanctions on Russia, Chinese SOEs will likely face fewer competitors in the Russian upstream sector and have the upper hand in the negotiation of the terms and prices

3. Can US LNG help Europe diversify away from Russia's piped gas?

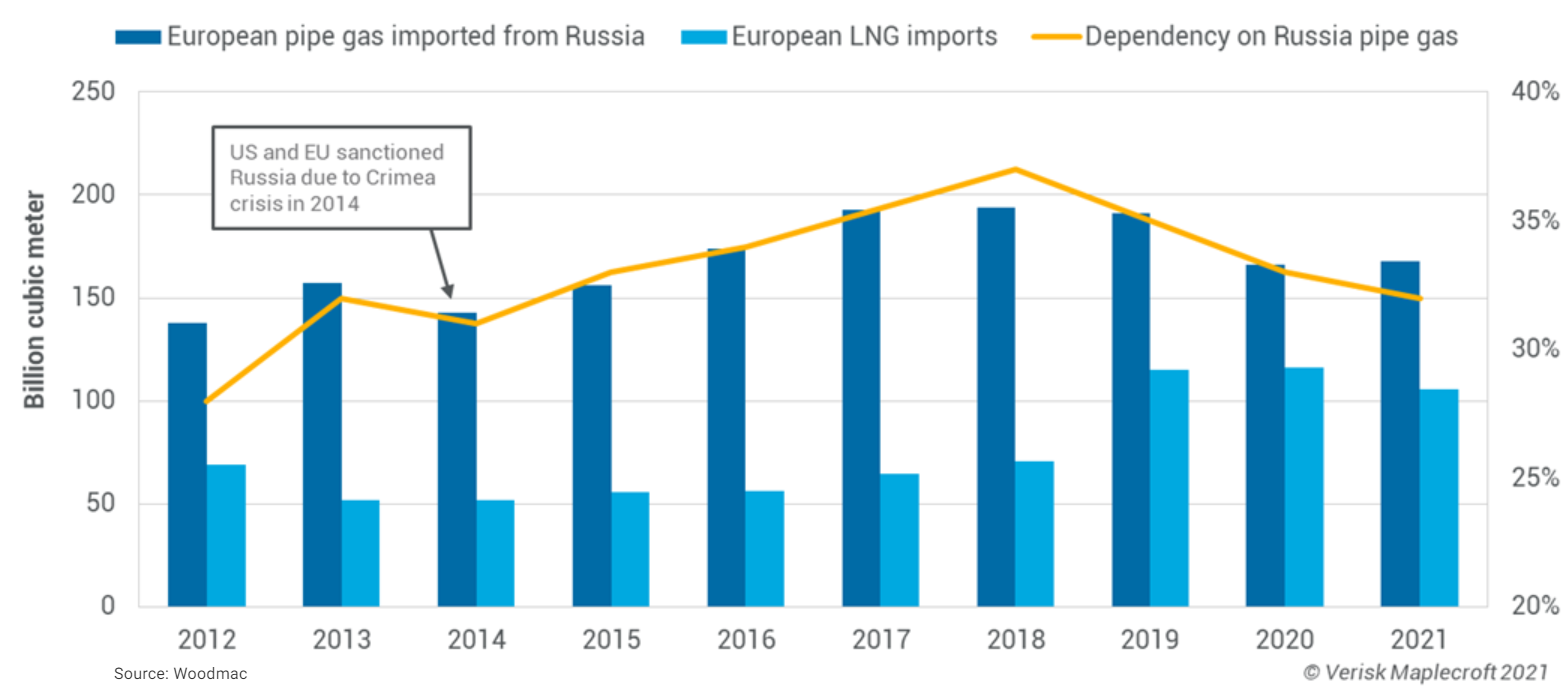

- Under extreme circumstances, if Russia weaponises its gas exports as a response to large-scale sanctions or a deterrent to Western support for Ukraine, it will be difficult for Europe to manage the supply chain disruption. Although Europe has been speeding up gas supply diversification and renewable investment to confront its Russian gas dependence, these measures will require years to take effect and are unlikely to ease such a supply shock and reserve shortage over the next 1 to 2 years. This would likely result in another energy crisis in Europe that will drive high utility bills, disrupt industrial activities and prompt governments to recommission coal and nuclear as a short-term solution

- It is difficult for either Europe or Russia to shift their mutual dependency on energy trade. Both sides are tied physically by the pipeline into an exclusive supply chain with high replacement costs and the risk of legal arbitration. As a reference, it took Russia over 10 years to gradually lower its dependency on Ukraine transit for gas flows to Europe from 65% in 2011 to around 25% in 2021. It is equally difficult for Europe to immediately diversify away from Russian gas with alternative gas supplies (see chart below) or a renewables-based system

- To help Europe overcome potential supply disruption, the US has been discussing with major global gas producers to distribute some production to European buyers, but there are limited options. It is also difficult for Europe to compete with Asian LNG buyers who pay high gas prices of more than USD 30/MMBtu which is unbearable in Europe

- Even if the US, the world-leading LNG exporter, diverted all its supplies – including the new Calcasieu Pass LNG and the sixth production line of the Sabine Pass – to Europe, it can only replace at most 70% of Europe's piped gas imports from Russia. Moreover, more than half of these US LNG supplies are already locked in the Asian market with long-term agreements

4. Can China replace the EU in Russia’s export mix now?

- A handful of Chinese banks with overseas operations are reportedly following the US sanctions and restricting financing for Russian commodities. However, this will likely have a limited impact on Beijing’s overall geopolitical willingness to help Moscow counter Western sanctions and continue energy trade with Russia in the long term. Nevertheless, it is impossible for China to immediately substitute Europe as an importer of Russian gas if the Western sanctions target Russia's energy sector

- Although Russia's Pivot to the East has accelerated gas cooperation with China via gas infrastructure networks in West Siberia, East Siberia and the Far East, all these developments are still in their infancy compared to the mature markets in Europe

- Currently, the export volume to China is still limited because major gas projects started supply to China only 3-4 years ago. As of now, there are only two natural gas trade channels between China and Russia – Power of Siberia-1 (up to 45 bcm) and Yamal LNG (6 bcm). These projects will take over five years to reach their full capacity. Any additional piped gas and LNG infrastructure, such as the newly signed Far East pipeline and the Arctic LNG 2, will take at least five to 10 years to construct before they start to operate

- Moreover, Russia-China gas infrastructure cannot divert piped gas from Europe to Asia because the fields supplying piped gas to China are connected to the pipelines exporting to Europe. When it comes to LNG, China's gas market is a growth area for Russian LNG export but it will only evolve gradually over the next decade