Europe - 5 risks to watch

The Trendline

by Hugo Brennan and Mario Bikarski and Winifred Michael and Eileen Gavin,

Corporates, investors, and insurers with business interests in Europe will need to contend with a dynamic risk landscape in 2024. Diving into our Global Risk Data, we have identified the top five risks to keep tabs on: the potential for an electoral swing to the right to deliver a less progressive and more Eurosceptic EU, weak economic fundamentals to erode the UK’s climate ambitions ahead of a crunch election, disruption and policy shifts linked to farmer protests, the continued geopolitical fallout from the war in Ukraine, and waning appetite to drive forward the energy transition in some quarters.

An electoral swing to the right to deliver less progressive, more Eurosceptic EU

Europe is the worst performing region globally on our predictive Government Stability Index in 2024-Q1, which measures the potential for changes in government executives in the months ahead. A swing to the political right could change the policy landscape in member states and at the EU level. Far-right parties are currently in power or propping up governments in Italy, Hungary, Finland, Slovakia, Sweden, and (likely soon) the Netherlands. This could extend to Portugal, Belgium, and Austria by the end of the year, which would equate to one-third of EU member states.

The biggest barometer of European political sentiment in 2024 will be the EU parliamentary polls in June, where 400 million voters are eligible to have their say. Current polling suggests the centrist ‘grand coalition’ will retain a majority in the Strasbourg-based legislature. But the far-right Identity and Democracy group looks set to become the third biggest bloc, which suggests an EU that is going to be more polarised, Eurosceptic, and less progressive on policy issues such as immigration, climate change and human rights. A strong showing for right-wing parties in the EU parliamentary election may also give the far-right AfD a boost ahead of state polls in Germany, which are themselves a litmus test ahead of federal elections in Europe’s biggest economy in 2025.

Weak economic fundamentals to erode UK’s climate ambitions ahead of crunch election

One European state that looks set to buck the rightwards shift is the United Kingdom, where Labour holds a commanding 20+-point lead in the polls over the incumbent Conservatives. While the polls will narrow ahead of an election, which would likely be held in the autumn, we expect UK voters to elect a centre-left government for the first time since 2005. Investors may welcome the change after the instability of recent years, and certainly don’t fear Labour’s manifesto in the same way they did former leader Jeremy Corbyn’s left-wing platform in 2019.

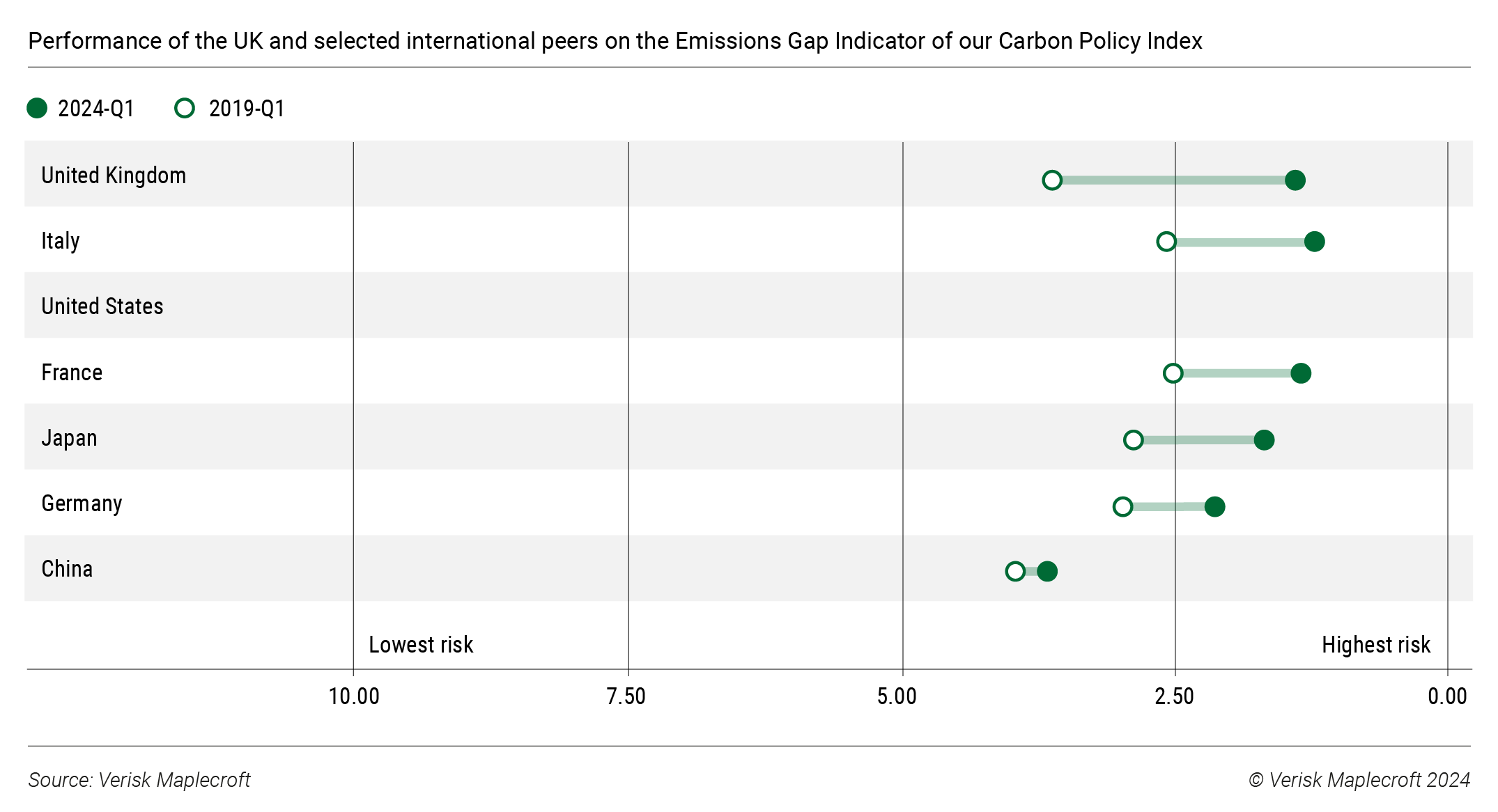

Since 2019, the UK has seen significant deterioration on several of our economic indices, including those covering economic growth, borrowing costs, and the tax burden, ensuring the next government will be holding a weak fiscal hand. One area of focus for a Labour government will be reversing some of the ‘greenlash’ policies of the latter Tory years. These have contributed to the UK seeing a very significant deterioration in its performance on our Emissions Gap Indicator – which measures the gap between a country’s current greenhouse gas emissions and its stated emissions target – over the past five years (see chart below).

While Labour leader Keir Starmer has drastically reined in his ambitious green investment plans due to the fragile state of the UK’s public finances, he retains a pledge to stop issuing oil and gas licences in the North Sea and reinstate a ban on the sale of new petrol and diesel cars from 2030. Delivering on these promises is essential if the UK hopes to meet its 2050 net-zero aspiration. More productive ties with the EU are also likely, but Labour will not seek to rejoin the EU’s customs union or single market.

Farmer protests stoke disruption and policy uncertainty

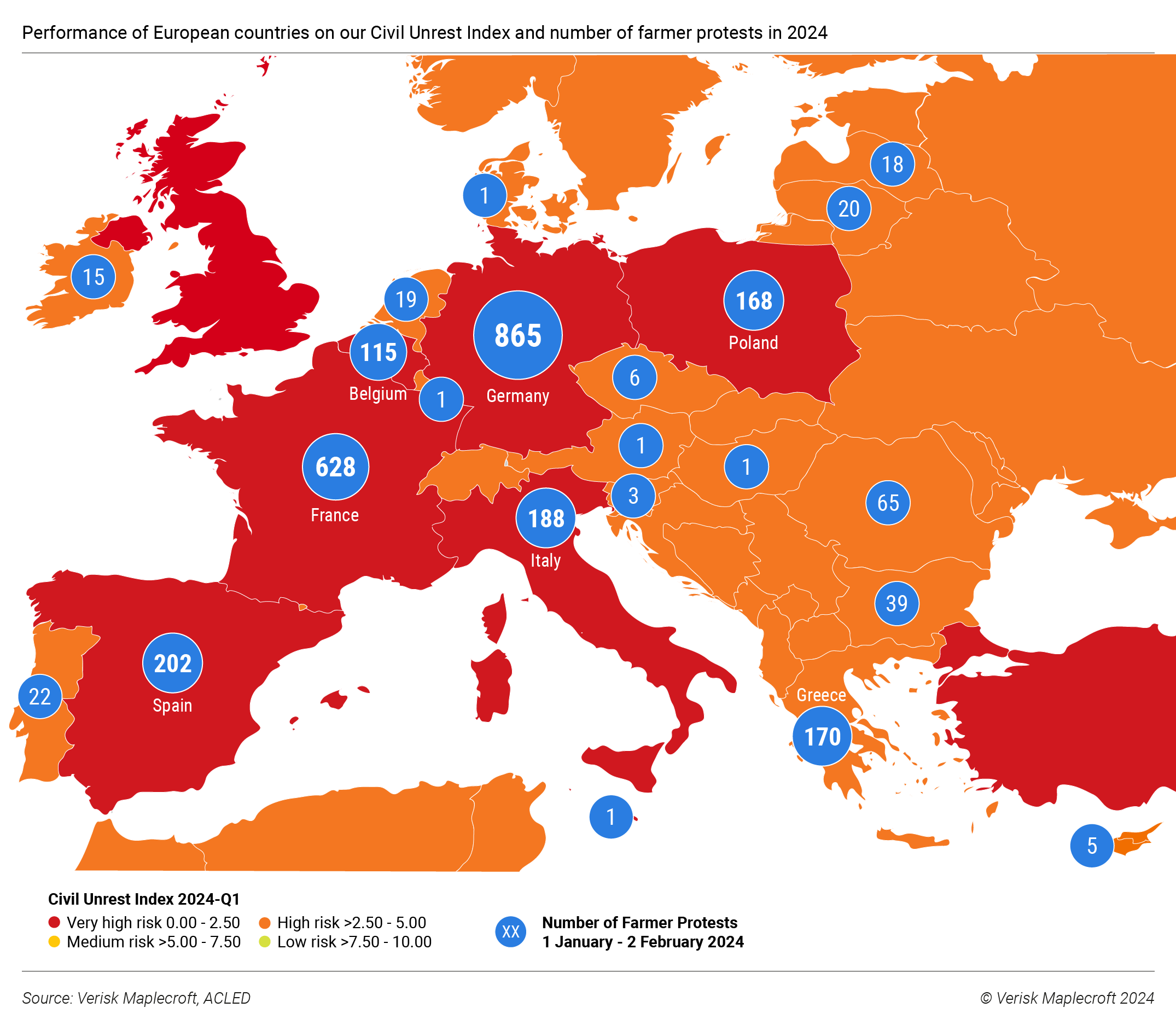

Farmer protests have become a source of business disruption, both from the roadblocks themselves and from the shifts in policy that are undermining investor certainty in the agriculture sector. The start of the year has been characterised by protesting farmers blockading major roads and border crossings across the EU, with the highest-risk-ranked countries on our predictive Civil Unrest Index being the hardest hit – including Germany, France, Italy, Poland and Belgium (see map below). The grievances of European farmers are varied, but include higher input costs, subsidy cuts, foreign competition, and EU environmental regulations – all topics the far-right will seek to capitalise on at the polls.

European farmers have already won a concession from the EU, with Brussels agreeing to delay rules that would have made payments under the Common Agricultural Policy dependent on them setting aside land to encourage biodiversity. Others will likely follow in the months ahead. Farmers are pressuring the EU and national governments to increase state support, scale back policies aimed at reducing emissions from the sector, and halt negotiations on free-trade agreements that would open the door to more foreign food imports. A failure by national and EU leaders to quickly placate farmers risks protests escalating and spreading to even more EU member states.

Geopolitical fallout from Ukraine war set to continue

Russia enters 2024 with more confidence following the failure of Kyiv’s counteroffensive and signs of some Western support for Ukraine waning. Neither side is set to win or lose the war in 2024, nor sue for peace. Kyiv is shifting to a new strategy of ‘active defence’ rather than reconquest, while Moscow is content to wait it out until the US presidential election in November, which President Putin hopes will deliver a more favourable geopolitical setting. US-Russia tensions declined under former president Trump, and he has pledged to resolve the war within 24 hours if re-elected – most likely by pressuring Kyiv to cut a deal with the Kremlin or lose White House support.

In the meantime, we can expect more sanctions and a greater focus on enforcement from the West (the EU announced its 12th sanctions package in December 2023). Additional cases of Russia expropriating the assets of Western firms are also likely, particularly if the G7 goes ahead with its threat to confiscate USD300 billion in frozen Russian central bank reserves. Further acts of sabotage against critical infrastructure and war-related disruption to supply chains in the Black Sea cannot be ruled out, with potential knock-on effects to energy, shipping, and insurance prices.

Sovereign ESG landscape: Europe’s transition conundrum a serious headache for governments

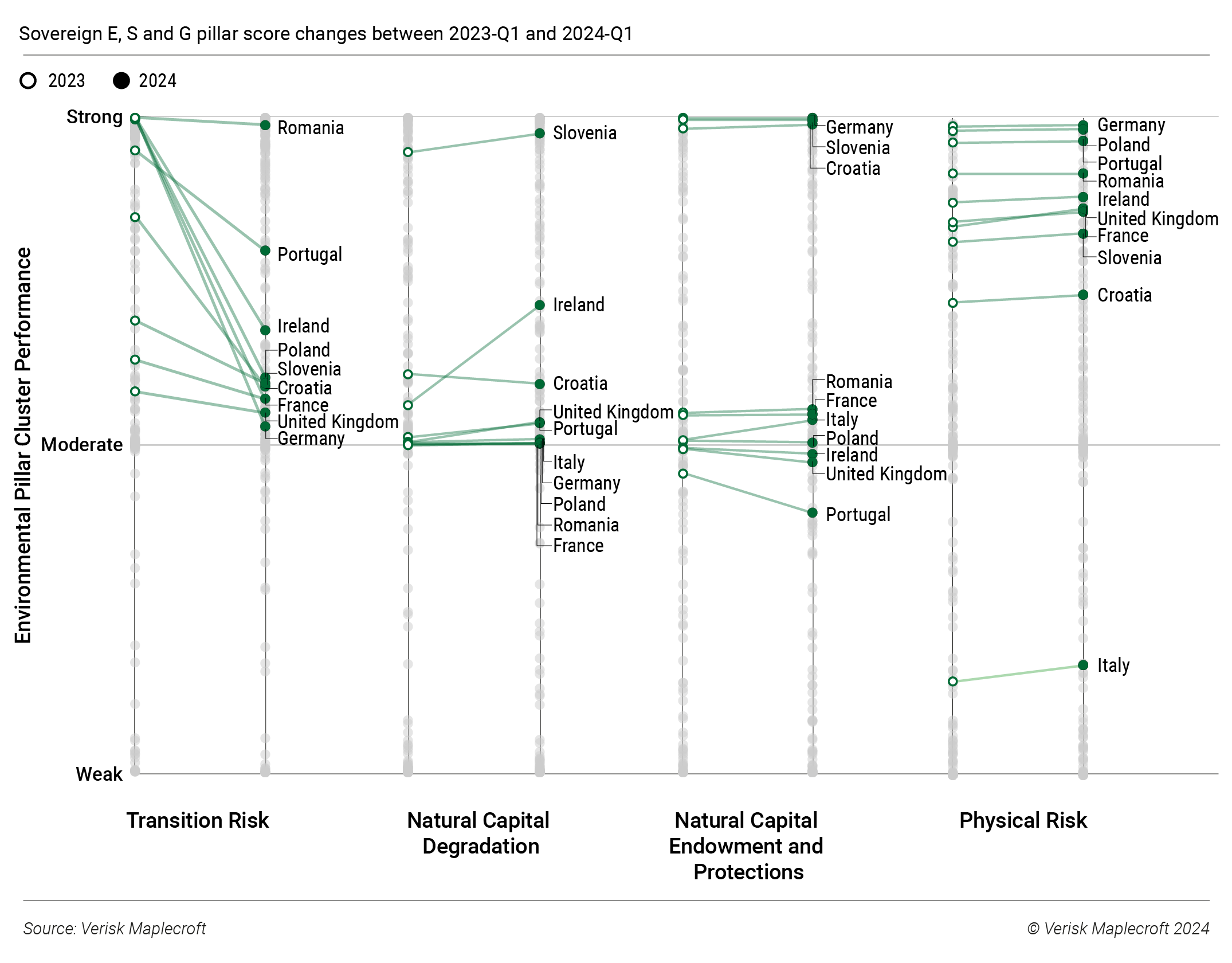

As we approach mid-decade, the impacts of the pandemic and the Russia-Ukraine crisis remain prevalent, and very much still in evidence according to continental Europe’s performance on our Sovereign ESG Ratings. In all, 27 countries have registered declining scores this past year, versus just 11 improvers (with six unchanged).

Notable fallers are Germany, Belgium, Hungary, and Poland, as well as the likes of Portugal, Ireland, and the Scandinavians, mostly due to a significant deterioration on the Transition Risk dimension of the Ratings (see chart). This underlines the continuing difficulties of reconciling energy security needs with the energy transition.

As inflation eases in 2024, recent Social-pillar weaknesses should subside, with the notable exception of the UK, due to the ongoing impact of the cost-of-living crisis. Nevertheless, tensions surrounding the cost of the transition will continue to play out in multiple arenas, from farmers’ protests to the rise of the right-wing populist anti-ESG movement. This is also encouraging a more retrograde social policy stance on the part of certain governments, creating business-operating and investor risks.