Recent events in Myanmar show that the country’s civilian government in exile is determined to garner international support for boycotting or sanctioning business linked either directly or indirectly to the ruling military regime.

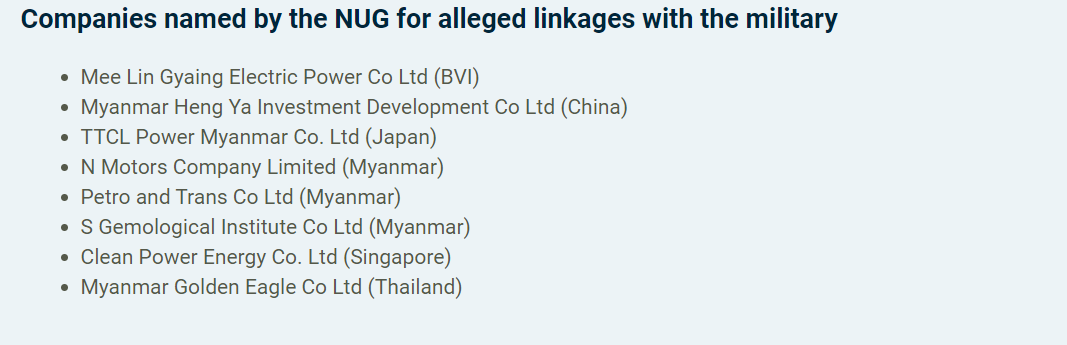

In a statement dated 30 August 2021, the National Unity Government (NUG), Myanmar’s civilian government in exile, named eight foreign companies for allegedly "undertaking illegal investments by seeking permits and endorsements" from the Myanmar Investment Commission, which has been controlled by the military government since the coup in February 2021. The NUG further threatened the named companies with prosecution if they failed to suspend their "illegal investment activities" immediately.

Worsening ESG profile makes Myanmar risky for corporates

The NUG’s statement has highlighted the regulatory unpredictability faced by businesses amid the turmoil over who is the rightful authority in Myanmar. While the civilian government in exile has been seeking international recognition as the government since its establishment in April 2021, the ruling junta has declared the exile organisation illegal.

The tussle underscores the reputational risks facing foreign companies with investment and a presence in Myanmar since the coup. The pro-democracy coalition is unlikely to be able to effectively prosecute the named companies, but we expect the statement to attract media and human rights watchdogs to investigate whether the broader group of foreign companies might have any linkages with the military government or sanctioned entities.

We anticipate international companies in Myanmar will face growing pressure over the integrity of their ESG policies. Although many of the corporates have attempted to justify their stay by highlighting their contributions to Myanmar’s weakening economy, it has become increasingly difficult for them to adhere to international best practices in the country.

Myanmar’s ESG profile continues to deteriorate, and its scores across our key political and human rights indices has been declining since the coup in 2021-Q1 (see below). Myanmar is the 2nd worst performer in our 2021-Q3 Civil Unrest Index and the 14th worst in our 2021-Q3 Modern Slavery Index. While civil unrest and strikes continue to disrupt essential government functions and daily business activities, the weakening economy driven by the coup and the pandemic has intensified forced labour and violations of workers’ rights.

The military likely to maintain control

Although the military has been trying to regain power by means of intense repression, it is still unable to gain full control over the country. This is also why on 1 August 2021 the armed forces extended the state of emergency from the initial one year to two years to consolidate their power. They are also reportedly planning to disband the National League for Democracy (NLD), the main opposition party which was ousted in the coup.

Given the extension to the state of emergency, we expect the political competition in Myanmar to continue. Our Government Stability projections indicate that Myanmar will remain in the high risk category for at least the next two years and will only slightly improve ahead of the planned election in 2023.

Neither the government in exile nor opposition NLD will be in a position to compete with the military government, which we expect to hold elections only when it is confident of winning. But in order to undermine the junta’s revenue sources, the NUG and NLD will likely continue to call for international support to boycott or sanction foreign investors with direct or indirect military linkages.

However, we do not expect the military government to dissolve the NLD. Chinese diplomatic pressure is significant in this respect, given that Beijing has conveyed to the military leaders that keeping the NLD alive is a condition for continued Chinese support – including bilateral trade and investment. Although China has started referring to the military as Myanmar’s government, Beijing had forged a close relationship with the former NLD-led government, which included settling multibillion-dollar infrastructure deals in the country.