Our primary focus this quarter has been on how countries are shaping up to meet the challenges of the energy transition – whether they’re developing the necessary policy environment to implement the deep emissions cuts required, whether their dependence on fossil fuel export revenues is a significant impediment to decarbonisation, and how the structure and carbon intensity of their economies will shape their ability to meet their targets.

As the United Nations Framework Convention on Climate Change (UNFCCC) readies its global stocktake, the culmination of two years of data-gathering on climate progress, our findings suggest that we are still very far from where we need to be. This is not a moment for investors to retreat, however; the acute need for more private finance to work alongside public to help countries address these transition risks will be a central focus at COP28 in Dubai this month.

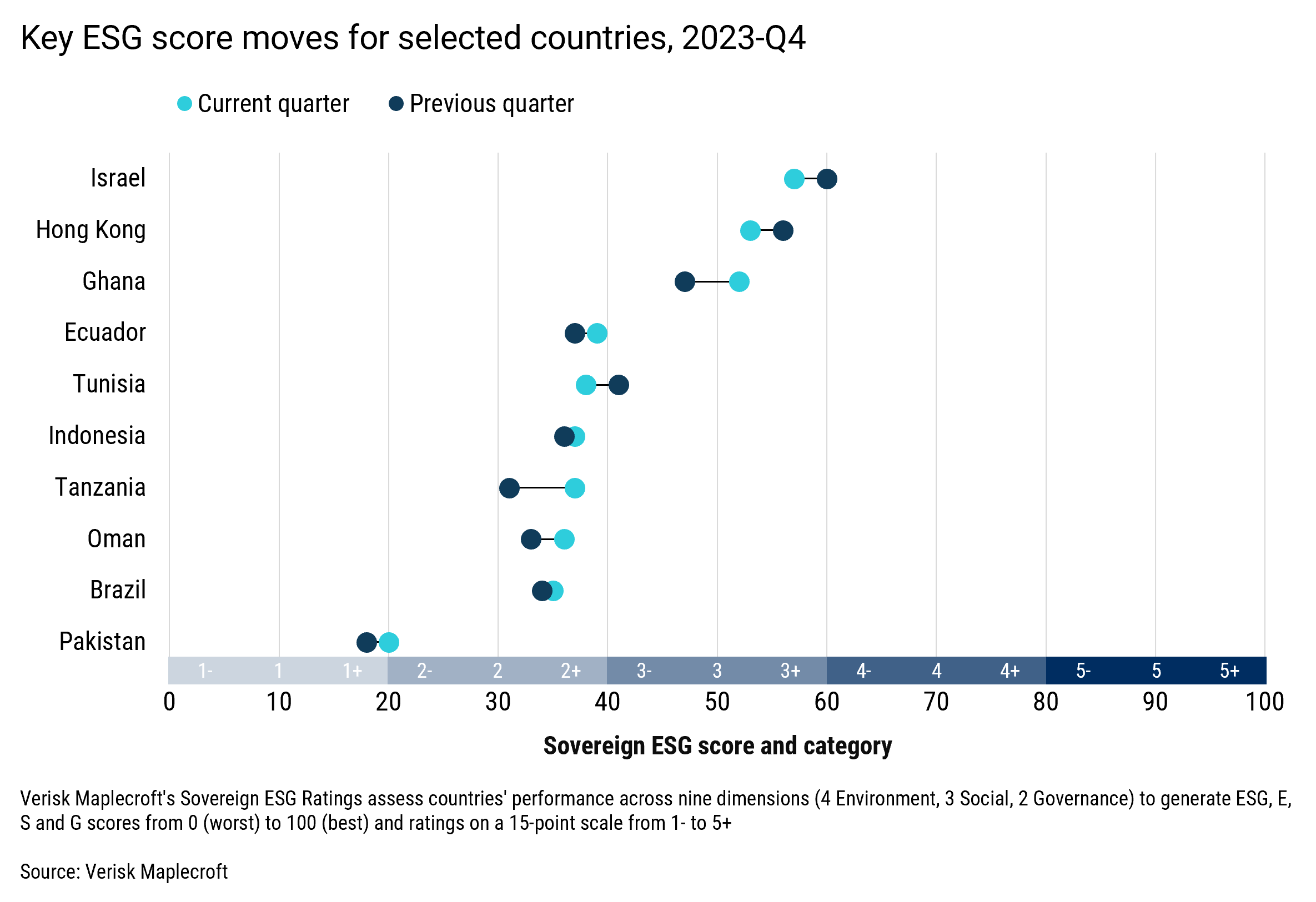

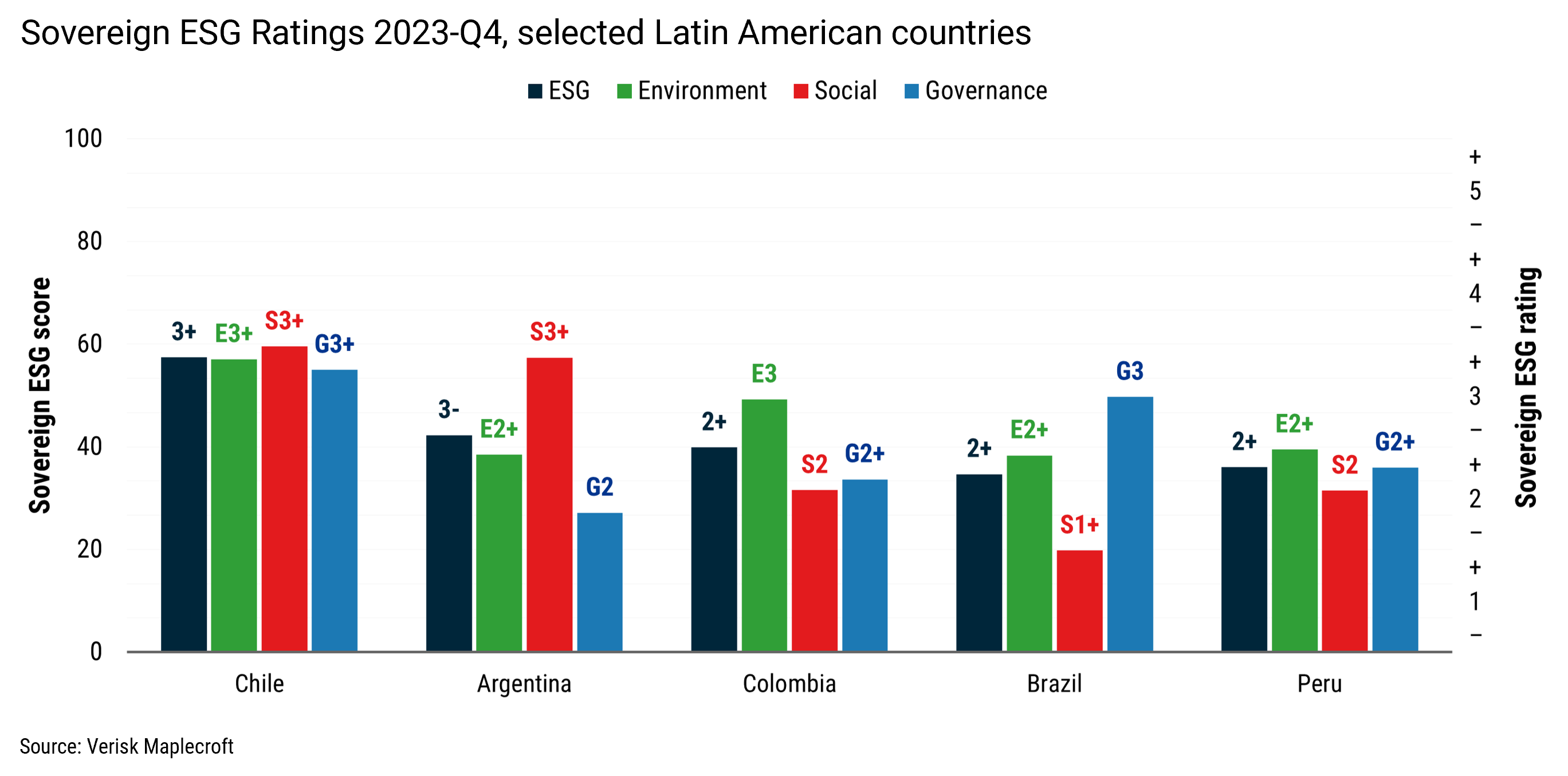

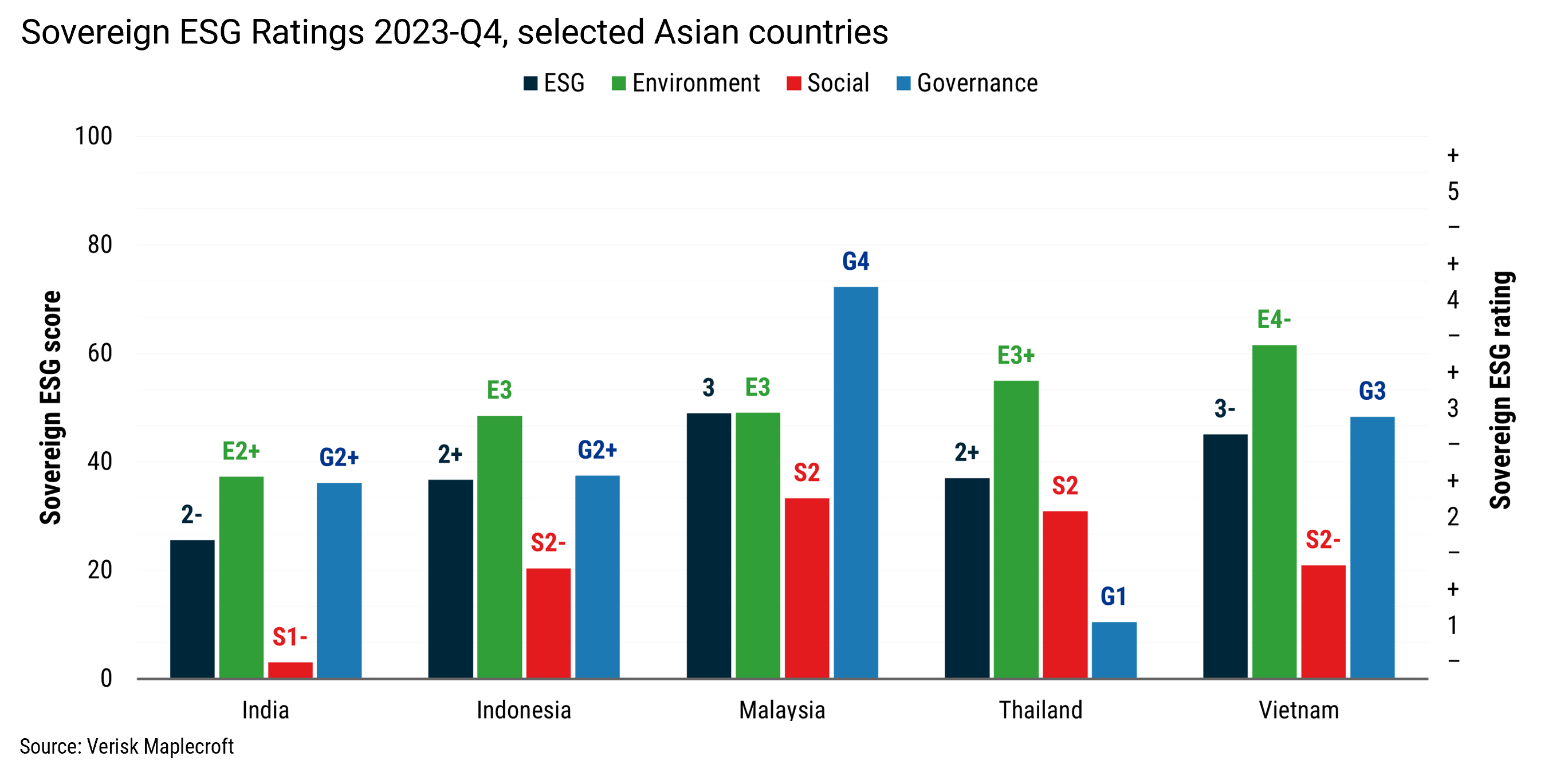

Taking a broader view of investment risk highlights some positive momentum across our global Sovereign ESG Ratings this quarter: the headline ESG scores of 79 countries improved, while 54 fell. The ratings of 19 countries were upgraded, including for Algeria, Lithuania, Oman and Tanzania. Twelve were downgraded, including Austria, Belgium, Colombia, Hong Kong, Serbia and Tunisia.

However, in every region the average score change was minimal, at less than 1, and over the course of the past year every region has seen a decline in scores, the greatest being in Oceania which has fallen by over 2 points. On average, Environment scores fell by 1 point this quarter, while Social scores improved by 2 points and Governance remained largely unchanged. However, this belies a high level of dispersion in the scores, particularly across the Human Rights, Institutional Strength and Sources of Instability dimensions.

Environment: A focus on transition risk – fossil fuel dependence still key theme

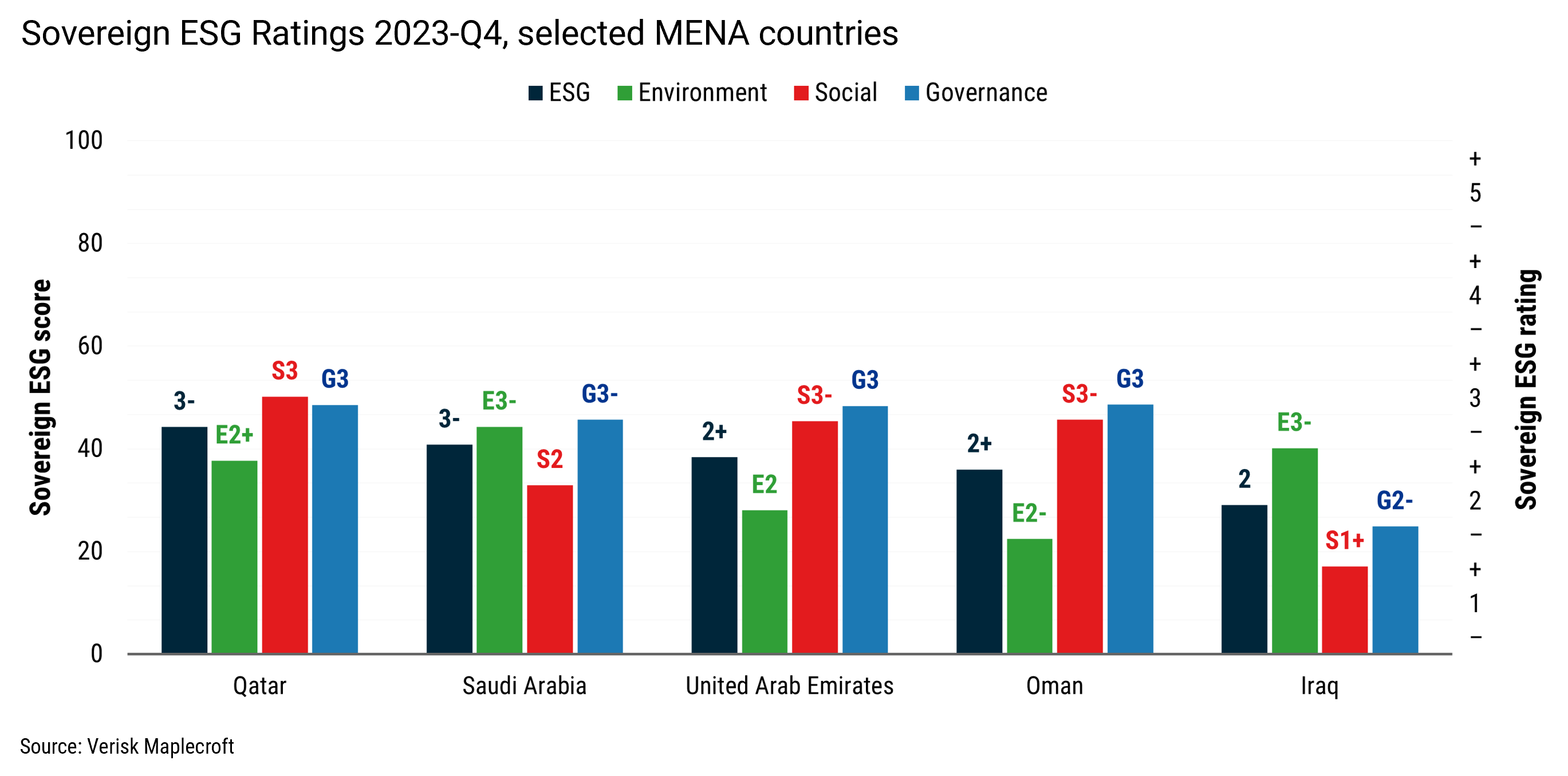

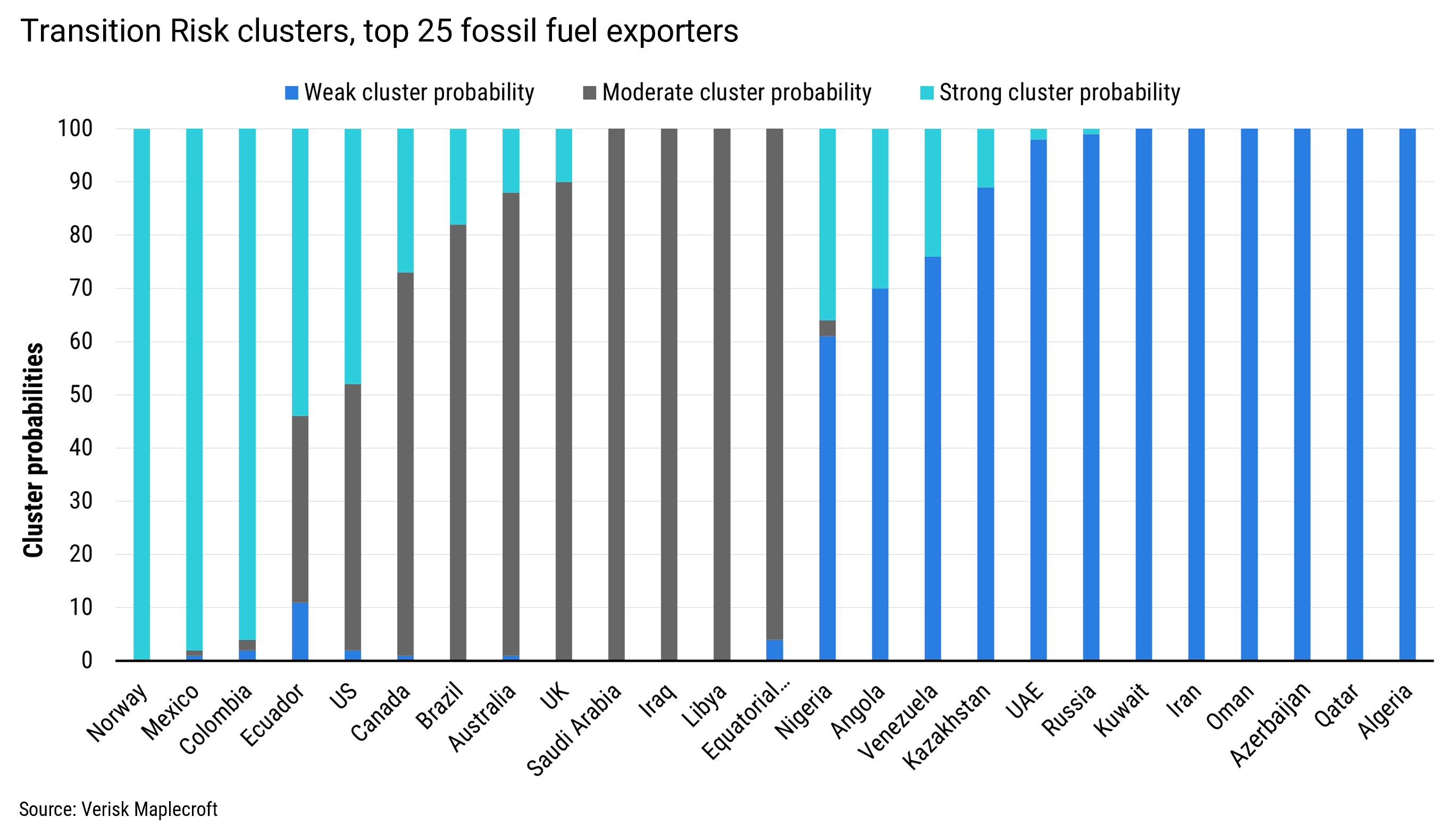

Reducing the production and consumption of fossil fuels is essential for the energy transition, but the centrality of oil and gas to many economies presents a considerable barrier to both setting and achieving decarbonisation ambitions and targets. The Transition Risk dimension of the Ratings paints a complex picture of where progress is and isn’t happening.

Inputting into Transition Risk, our Dependence on Fossil Fuel Exports Index is generated from annually-updated data and reflects sustained high, and in many cases increasing, levels of dependence. This has been a contributing factor to ESG score declines for many states, although a few key exporters bucked the trend. With high prices reducing the economic incentive for oil producing-countries to press ahead with transition strategies, there is an increasing risk that economies that delay decarbonisation will be later forced into more abrupt or disorderly transitions that could create significant socioeconomic and political ruptures.

Key fossil fuel exporters lack policy environment for progress on decarbonisation

Our data shows that most of those countries that have the greatest need to reduce their economic dependence on hydrocarbon exports are also among those with the least policy space to take the decisions and the action required. That doesn’t just mean export diversification policies, but the measures required for reductions in the GHG intensity of economies. Some progress is being made, but across most oil exporters there is a clear absence of the necessary legislative framework for decarbonisation. Moreover, the trend for fossil fuel intensity of Middle Eastern economies, as assessed under our Economic Transition indicator, is also moving in the wrong direction.

Emissions gaps will test sovereigns

Taking a longer-term view, since the start of 2020 just 33 countries have improved on their Transition Risk Rating scores, while 133 have deteriorated. Counter-intuitively, however, this does not necessarily represent the stalling progress it appears to. One cause of these declines has been a reduction in the underlying scores for the Emissions Gap underlying index, which contributes to falling ESG scores in several countries. This metric reflects the difference between a country’s current greenhouse gas emissions and its stated target. This means that when a country updates its target, the gap – the scale of its challenge – increases to reflect that higher level of ambition. This is represented as a burden in the ratings, because it implies up-front economic cost and sovereign risk, but of course the more ambitious the target the better in terms of global progress towards Net Zero.

It is important, therefore, not to take the Emissions Gap performance in isolation but to consider, as we do in the Transition Risk pillar, the policy context and the enabling environment that is critical to delivering upon the ambition.

Emissions reduction is enormous challenge for most, especially amid unsupportive policy environments

Given this context, closing the emissions gap is a considerable challenge for most countries, with the vast majority falling into the high or very high risk category with a score of 5 or less on our underlying index. Moreover, many countries have not yet created the policy conditions to deliver on these decarbonisation targets, with 105 countries rated very high risk category on our Capacity and Intent to Implement Carbon Policies underlying index. This exemplifies the still-disjointed state of carbon policy that Jamie Dimon, head of JPMorgan characterised as a game of ‘whack-a-mole’.

The cluster probabilities that drive the Transition Risk scores in our model, and provide multi-dimensional comparison across countries, reflect a broad divergence in performance, even among countries with similar economic profiles.

Governance: Crime and instability

The second main driver of changes to our Ratings this quarter has been in our Sources of Instability dimension in the Governance pillar, where 48 countries’ scores fell and 59 improved. Moves were largely driven by an update to the data source for homicide rates within our Crime Index. Countries that saw significant improvements in their Governance score as a result included Tanzania, Ghana, Thailand, Jordan, Chile and Hungary. A better crime profile also contributed to broader improvements in Kazakhstan, Albania, India and Oman, alongside enhanced government stability.

On the other hand, several countries are exhibiting deteriorating overall performance on their Sources of Instability, some despite improving crime figures, including Israel, which has been hard hit by large-scale public protests in recent months over the government’s proposed judicial reforms, and Gabon, following the August military coup that ousted President Ali Bongo.

Social: Human rights resetting

On the S pillar we have seen a continuation of the shifting Human Rights cluster groupings of last quarter, and this has been driven by a small fundamental improvement at a global level and in every region bar Asia and the Middle East, and across all input indices. Taken together the moves of the past two quarters have resulted in improving Human Rights dimension scores for 47 countries and deteriorations for 90.

Considering E, S and G – Always interdependent

As we focus on climate risk, and especially on the transition, it is important for sovereign investors to consider the interplay between these broader S and G issues and how they might intensify over investment horizons – the threat of food and water insecurity; protections for human and workers’ rights; rising levels of civil unrest; political instability; corruption and crime amid stress and scarcity. Taking a holistic approach to these factors is vital for investors looking to understand the multi-dimensional risk profile of sovereign issuers.