In recent years, rising conflict, political instability and the effects of the climate crisis have had a profound impact on the global human rights landscape. Our data shows that these complexities are intensifying amid a global decline in workers’ rights, which is raising the stakes for multinational companies trying to navigate an expanding raft of supply chain due diligence regulations.

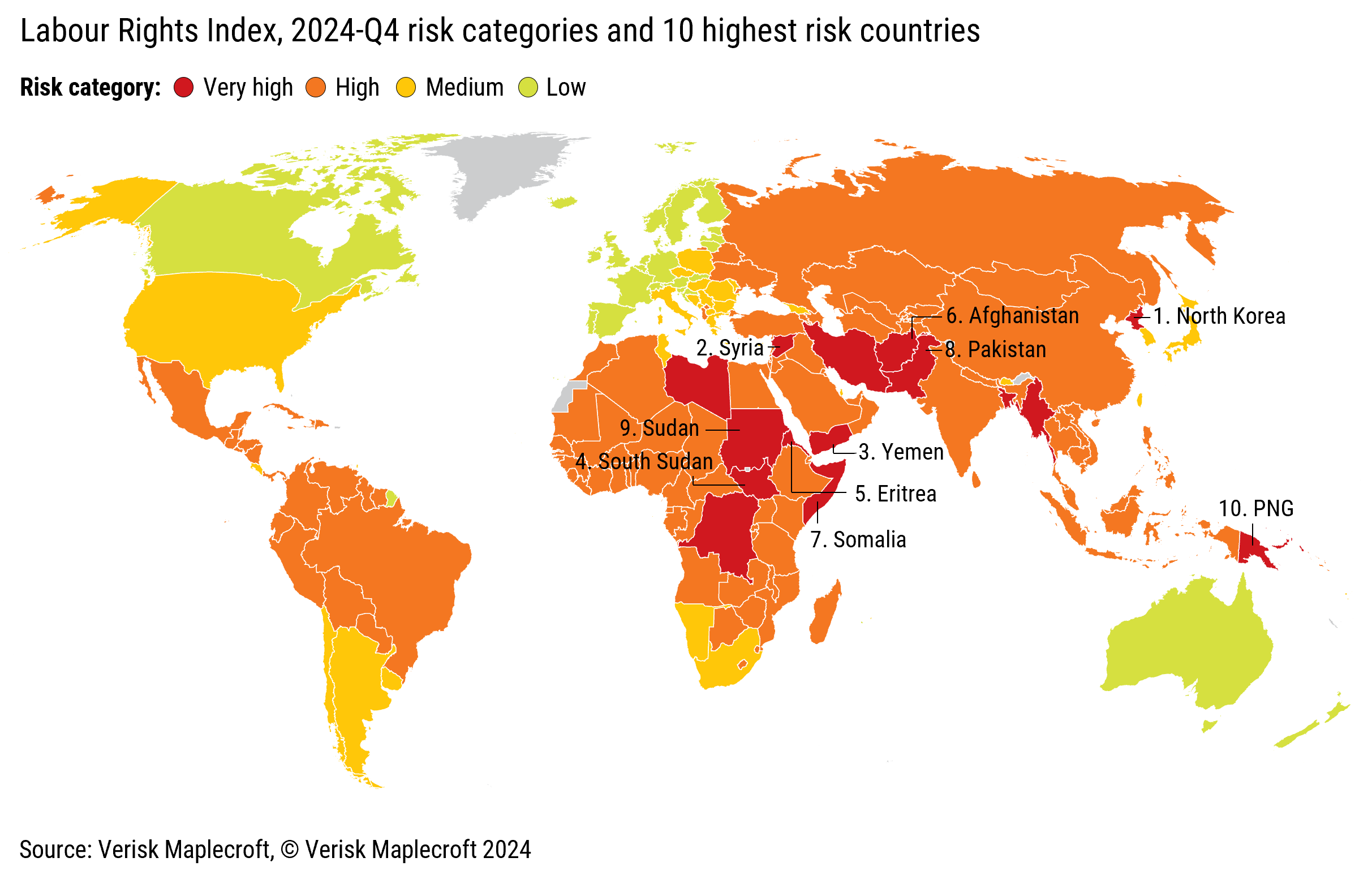

Over half of all countries, 109 in total, have seen an increase in risk on our Labour Rights Index in the past five years, with 32 registering a significant deterioration. The index, which combines data on issues such as modern slavery, migrant rights and working conditions, shows that the global picture has worsened most on worker safety, discrimination, collective bargaining and child labour.

The downward trend, which is being driven by an uptick in breaches of workers’ rights and poor enforcement of labour laws, shows the need for global companies to ensure their supply chain risk assessment processes are robust. The decline encompasses key sourcing hubs and major developed economies alike. In total, 117 countries are now categorised as ‘high’ or ‘very high’ risk – home to more than 80% of the world’s population.

The upshot for business is that managing these issues is becoming a more pressing challenge, especially in the face of rising regulation from supply chain laws such as the EU’s CSDDD (Corporate Sustainability Due Diligence Directive), the German Supply Chain Due Diligence Act (LkSG) and the Devoir de Vigilance in France.

Below, we home in on a few of the major trends emerging from the data, including challenges associated with supply chain risk management, diversification and an uptick in trafficking risks in Europe and North America.

Labour rights concerns persist in Mexico and Vietnam despite surging investment

We’ve previously identified supply chain diversification as a major theme to watch in the global risk landscape, as companies increasingly pivot towards alternative markets in a bid to reduce their exposure to the strategic competition playing out between the West and China.

This trend has continued apace throughout 2024, with Mexico and Vietnam solidifying their position as the two main beneficiaries. Mexico, for example, was the primary source of imports into the US in the first half of this year, and foreign direct investment (FDI) into the country continues to surge. Vietnam’s share of US imports has more than doubled since 2018, and the country reported a record $37bn in FDI in 2023.

Figure 2: US imports from Mexico and Vietnam have surged amid slump in China trade

But diversifying to new locations doesn’t guarantee reduced risk exposure, and businesses must remain vigilant in identifying and addressing potential threats wherever they operate.

Indeed, Vietnam ranks among the highest risk countries globally for several key labour rights issues, and our data shows that modern slavery, forced labour and trafficking risks have significant worsened in the country over the past five years.

This trend, coupled with the fact that our data highlights stalling progress on several civil and political rights issues, illustrates that increased economic engagement with Western partners has not driven improvements in worker protections or Vietnam's overall human rights environment.

Figure 3: Labour rights risks high across the board in Mexico and Vietnam

In Mexico, security issues such as criminal violence and attacks on human rights defenders continue to dominate the human rights landscape. On the labour rights front, Mexico receives a high risk rating on all 12 of our indices, with the country performing particularly poorly on issues like forced labour and freedom of association.

Human trafficking a growing concern in major Western democracies

Global businesses are increasingly recognising the need to monitor their exposure to human rights risks when sourcing from emerging markets. However, our data shows that Western companies may soon need to deploy similar efforts closer to home.

As shown in the chart below, human trafficking risks have worsened in several major Western economies over the past five years, primarily due to an uptick in cases involving vulnerable migrant groups.

Figure 4: US, Italy underperform compared to Western peers on our Trafficking in Persons Index, but risks also rising in UK, Canada

The US, for example, has fallen to 120th highest risk on our Trafficking in Persons Index (TIP), down from 131st in 2019. As highlighted in our recent research, trafficking in the US often involves migrant children, some 140,000 of whom crossed into the country unaccompanied in 2023. In February last year the US Department of Labor announced it had found over a hundred migrant children working illegally in meat processing facilities in eight states.

Concerns around trafficked migrant labour are also rising in Canada. In July, a UN report denounced the country’s temporary foreign worker program as a “breeding ground for contemporary forms of slavery”, noting that threats of deportation are preventing workers from reporting exploitation. The country now ranks 180th on our TIP index, down from 195th in 2019.

Similar trends are playing out in parts of Europe, with the likes of the UK and Italy also registering a significant increase in risk on the TIP. Our Industry Risk Data flags agriculture as the highest risk sector in both countries.

The extent of the issue was demonstrated earlier this month, when the Group of Seven (G7) democracies announced plans to create specialised police units to target trafficking gangs.

“Migration is increasingly being framed as a security issue in parts of the Global North, creating an atmosphere in which already vulnerable groups are being stigmatised and driven into the shadow economy,” notes Dr James Sinclair, our Director of Human Rights. “As a result, company policies typically used for mitigating risk when sourcing from emerging markets may soon need to be considered in developed economies.”

Credible data vital in a volatile risk environment

The issues impacting the global labour rights landscape are as varied as they are challenging. With the legal and reputational stakes rising for companies with global supply chains, those that innovate their due diligence measures stand the best chance of both overcoming present challenges and safeguarding their operations against future developments. Leveraging cutting-edge risk data will be key to making this a reality.