Sovereign ESG Ratings: Governance challenges mount amid electoral supercycle

by Emma Whiteacre,

This quarter saw few gains for sovereign sustainability: only 22 countries saw their scores improve on our Sovereign ESG Ratings, while 83 worsened. Across the range of thematic issues that we assess, progress tends to ebb and flow depending on political prioritisation and economic cycles.

The current global landscape, of heightened geopolitical tensions, political instability, stubborn inflation and the physical impacts of climate change, is far from conducive to ESG gains, but some countries are nonetheless managing to deliver progress in meaningful areas.

Beyond headline governance, human rights and climate transition concerns, sovereign investors can gain compelling insight into broader sovereign performance by considering risk issues that are critical for both quality of life and long-term economic growth prospects. This quarter we assess the governance challenges brought about by the 2024 electoral supercycle, as well as progress on factors such as air quality and digital inclusion.

Figure 1: Sustainability setbacks on a global scale, but green shoots of progress in Africa

Countries facing mounting governance challenges as the election calendar marches on

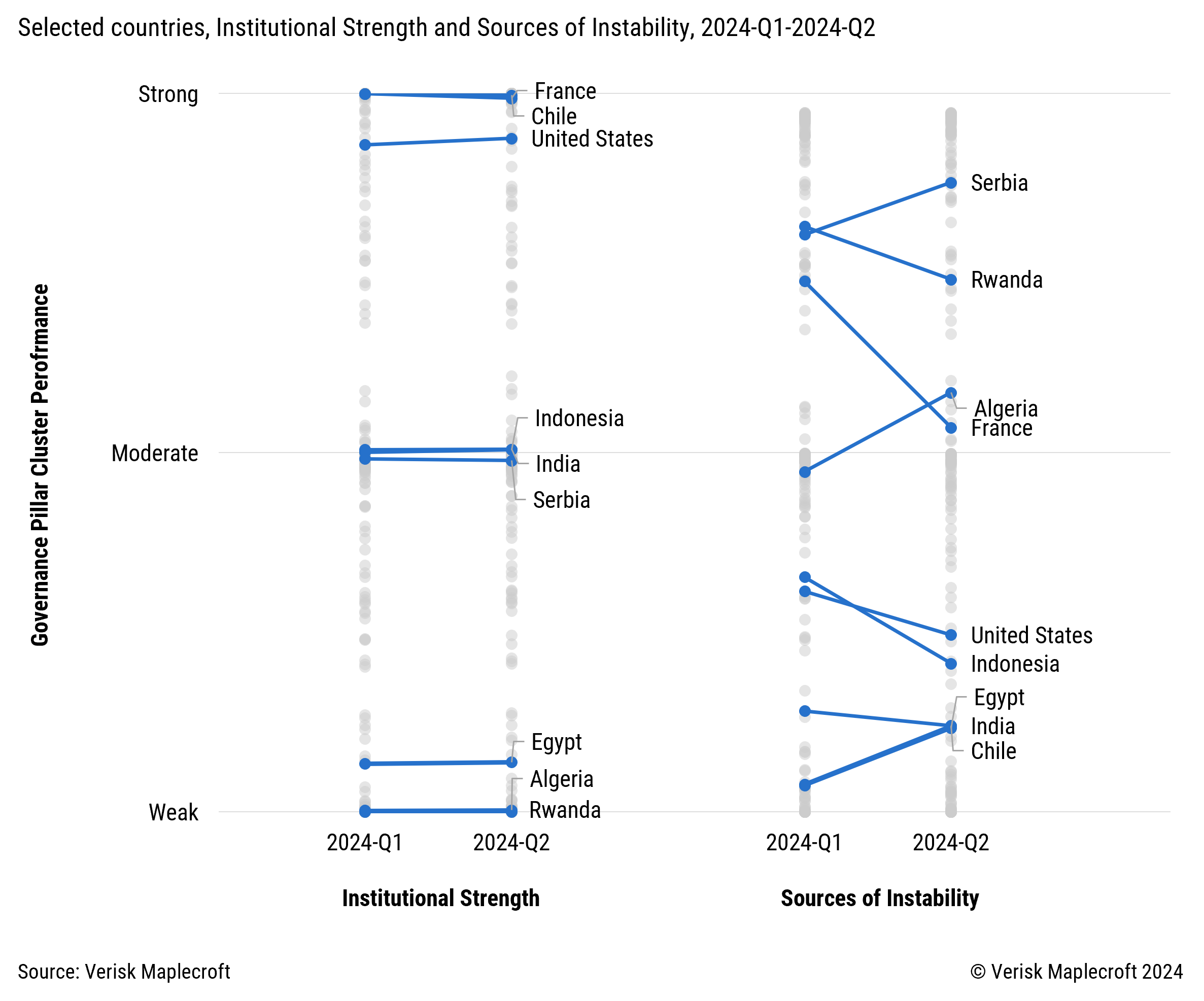

The rising political temperature in many countries is a key factor in directing attention away from the sustainability agenda. Recent and forthcoming elections are driving increased risks to stability, and in some cases putting political institutions under pressure. Figure 2 shows some of the key moves this quarter across our two Governance dimensions: Sources of Instability and Institutional Strength.

Indonesia’s February presidential election, won by Prabowo Subianto, was far more peaceful than that of 2019 but did see increased civil unrest, with protests mainly focusing on alleged interference by current president Jokowi in Prabowo’s favour.

The year’s most pivotal election, in the United States, will take place in November against a backdrop of rising challenges to the executive from key institutions – including the first impeachment of a cabinet member, the Secretary of Homeland Security, for 150 years and an impeachment attempt against President Biden in December.

The US’ governance profile has weakened in recent years because of rising political polarisation, exemplified by the Capitol riots of January 2021, and there is considerable scope for renewed instability as we head towards the election. As shown in Figure 2, the US remains robust in terms of institutions, but lags behind many of its wealthy peers in relation to political stability, largely as a result of high civil unrest and crime risks.

France is also exhibiting rising risks, albeit from a much higher base, driven by increasing divisions within the executive over the country’s fiscal trajectory, as well as heightened civil unrest. Ahead of the European Parliament elections in June, in which we’re expecting to see rising representation among far-right groupings, other EU states facing a deterioration in their Sources of Instability include Germany, Latvia, Lithuania and Spain.

Rwanda, which is gearing up for a general election in July, has registered a decline on the Sources of Instability dimension as a result of the government’s tightening control of, or bans on, opposition groups, media and society, which have effectively curtailed legitimate mechanisms for channelling discontent.

On the other hand, there has been a meaningful improvement in the risk landscape for terrorism and civil unrest in Algeria. There have been no significant terrorist attacks in the last 12 months, while civil unrest risk declined over the past quarter after a spike in demonstrations connected to the Israel-Gaza war receded. Protests may once again gather pace if citizen anger rises over the lack of genuine competition in upcoming presidential elections this September.

Mixed progress on quality of life factors

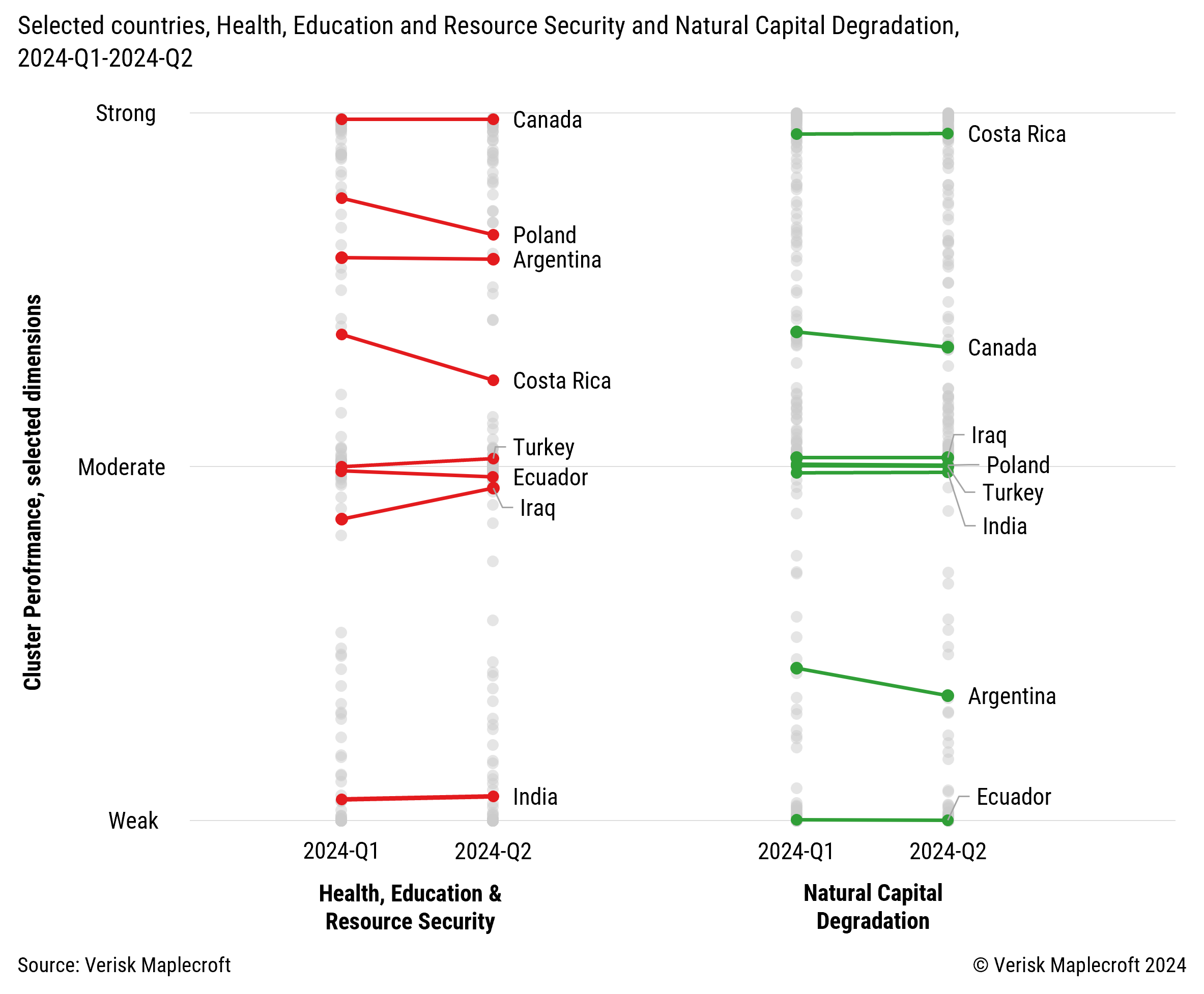

The metrics captured on the Natural Capital Degradation and Health, Education and Resource Security dimensions of the Ratings – such as air quality and digital inclusion – are very material to economic growth and delivery of the 2030 Sustainable Development Goals (SDGs).

As EM sovereigns look to raise much-needed finance in support of the SDGs, impact-focused investors working with treasuries and other government ministries can look to include these metrics in green, social and sustainability ‘use of proceed’ bond projects, or potentially as key performance indicators in sustainability-linked bonds.

Clearly, the costs of inaction on metrics such as air quality and digital inclusion are considerable in terms of life expectancy and economic progress. And the benefits of targeted investment can be multifold, including on the macro side, via longer-term fiscal stability and external creditworthiness.

These factors are therefore very much in creditors’ interests. However, updates to the underlying data this quarter shows that progress on these measures is far from universal.

Indeed, data from our Air Quality Index shows that 103 countries have seen their scores slide this year, eight by a significant margin, with Argentina and Canada among those seeing broader declines on the Natural Capital Degradation dimension and consequently in their overall ESG score as a result. But 86 countries’ scores improved, 21 by a significant margin, including Kosovo, Albania and Malaysia.

Pivoting onto our Digital Inclusion Index, which assesses access to information and communications technology, and is an important marker of socioeconomic development, shows that meaningful progress has been delivered in fourteen countries. This includes Iraq, where nascent political stability and an economic rebound is supporting confidence and fuelling the acquisition of consumer goods including mobile phones and computers. Turkey, which similarly faces relatively low levels of connectivity, is seeing rising broadband and mobile penetration, in addition to increased access to ICT via secondary school enrolment.

But 19 countries have seen their scores weaken significantly, highlighting the diverging progress being made on the issue at a global level. This includes Ecuador, which has seen downgrades on a range of indicators feeding into the index - including freedom of opinion and expression - amid an ongoing security crisis.

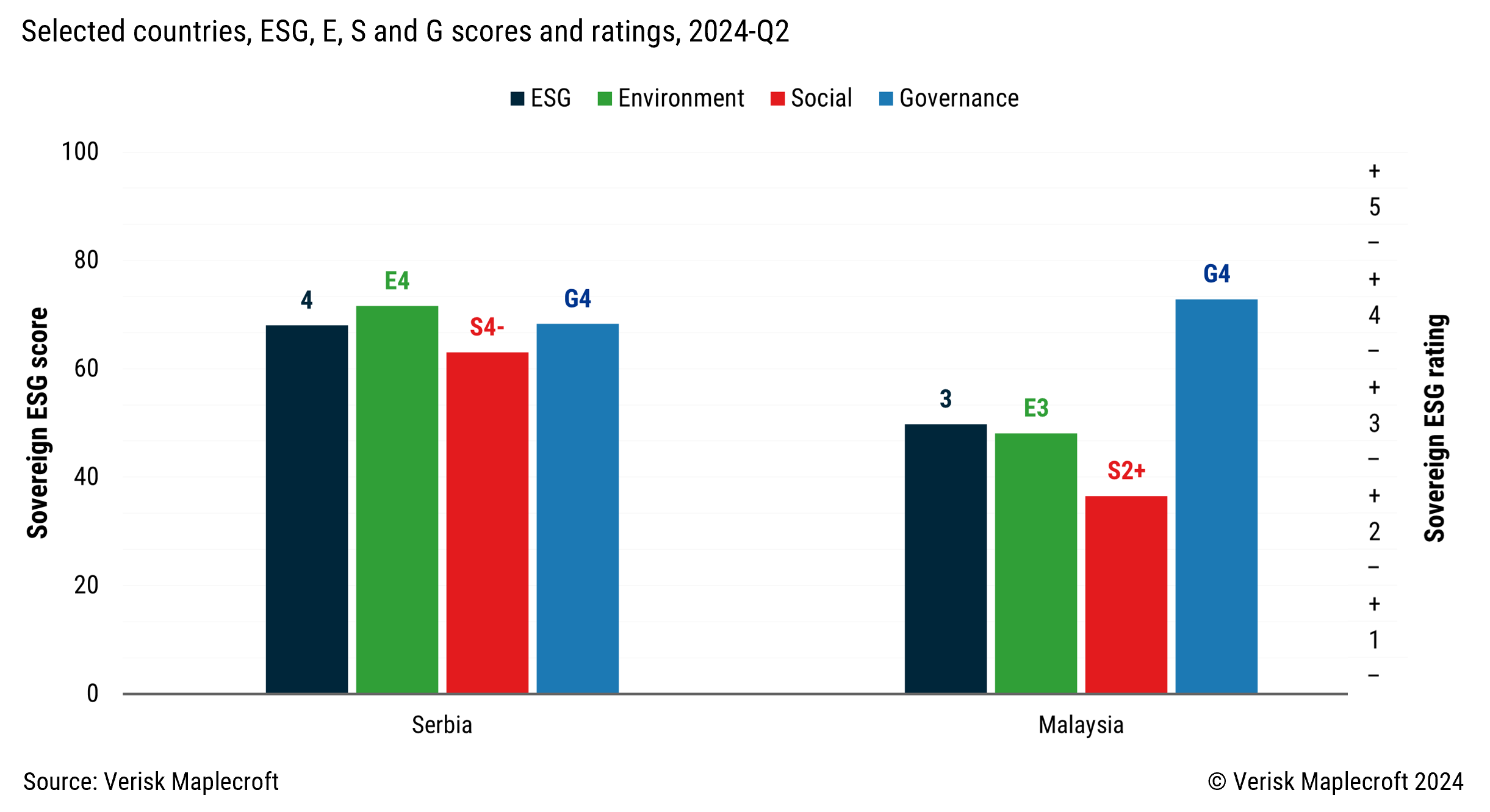

Getting it right

It is worth highlighting two countries, Serbia and Malaysia, that have made positive progress this quarter across all three of our E, S and G pillars, with Serbia making particular progress on digital inclusion and earning a Governance rating upgrade to G4, and Malaysia delivering air quality improvements and better implementation of labour rights protections.