Equities & Corporate debt

Location-specific climate, natural capital, human rights and political risk data for global investment strategies

Screening companies for ESG risks is now a crucial step in today’s investment due diligence, and if there’s one thing climate change has taught investors about risk, it’s that location counts.

Using geospatial risk data to map the location of a company’s assets to current and future threats can reveal hidden vulnerabilities, which traditional analysis and ESG ratings can’t capture. Manufacturing hubs in areas of rising civil unrest, data centres in the path of damaging storms, mines located in human rights hotspots. Value at risk.

Our new Asset Risk Exposure Analytics (AREA) provides the next step in the evolution of risk and opportunity analysis for equity portfolios.

Our equity and corporate debt solutions

-

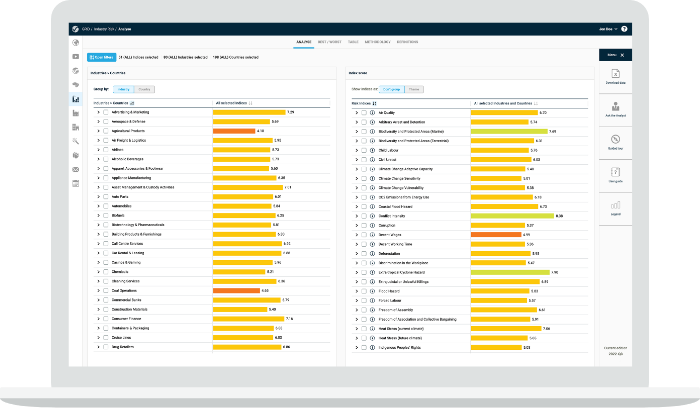

Asset Risk Exposure Analytics (AREA)

AREA helps investing professionals rapidly identify and fully understand inherent risk exposures, enhancing risk screening and investment due diligence through independent, industry-specific ESG risk data.

Learn more -

ESG and climate risk research and advisory

Through leveraging our unique datasets and applied expertise, we provide trusted advice and support to enhance how you assess real asset ESG and climate risks, strengthen your due diligence, and report against disclosure frameworks like TCFD.

Learn more

Learn how our data and analysts can help support

Get in touchRelated content

Solutions

Global Risk Data

Global risk datasets covering 190+ environmental, social, political, economic issues for 198 countries