The Trendline – Insurers should brace for more civil unrest warns new Global SRCC Predictive Scores

by Jess Middleton and Torbjorn Soltvedt,

Just under half of the world’s major cities face elevated risks from strikes, riots and civil commotion (SRCC) in the next year, according to new predictive data scores released by Verisk’s global risk intelligence unit, Verisk Maplecroft. The findings suggest the ongoing trend for increasing numbers of costly civil unrest events across the world is likely to continue with the exposure of political violence insurers rising in tandem.

Developed as part of the Lloyd’s Lab accelerator programme, Verisk Maplecroft’s new Global SRCC Predictive Scores provides 12-month forecasts on the risk of severe protests that could result in insured losses occurring in 50,000 counties and districts globally. The machine learning scores validates its predictions against actual insured losses and draws on geospatial data covering the size of recent protests, concentrations of economic value, demographics, and a range of political risk, climate and socio-economic indicators.

No region free from risk

Data from the scores shows that SRCC risks have worsened in all regions over the past two years, barring the Middle East and North Africa.

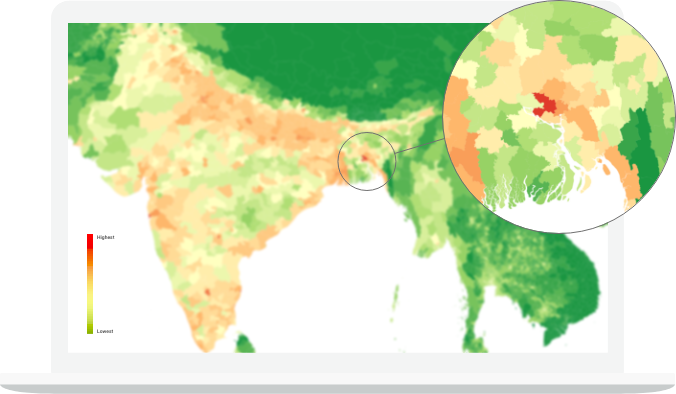

Figure 1: SRCC risks have worsened globally since 2021

The chance of major episodes of unrest emerging in several of the world’s major urban hubs over the next year is also high. When looking at the world’s 561 cities with a population over a million, just under half (45%) sit within the scores two highest risk categories.

The data reveals that insurers are widely exposed to losses linked to unrest in key metropoles in most regions. The 10 highest risk cities globally include: Beirut, Johannesburg, Dhaka, Kolkata, Cape Town, Mexico City, Chennai, Sao Paulo, Mumbai and Hyderabad. Significantly, the granularity of the data pinpoints the districts in these cities where the risks are highest. Notably, central districts often pose higher risks than city suburbs.

A combination of high population density and concentrated economic value means that SRCC risks run higher in urban hubs than in less developed areas. But what sets these higher risk cities apart from the lower end of the rankings is their poor performance on several of the indicators underpinning the SRCC scores, such as higher rates of income inequality, unemployment, and the size of recent protests.

The scores show that similar undercurrents are driving SRCC risks the world over. In total, 251 cities with a population over one million are rated ‘high’ or ‘very high’ risk, including 95 in the Americas, 91 in Asia Pacific, 36 in sub-Saharan Africa, and 23 in the Middle East and North Africa.

The exception are the cities of Europe and Central Asia, none of which feature in the global top 100. After Armenia’s Yerevan (ranked 143rd highest risk), Madrid is the region’s worst ranked city at 194th highest risk, while Barcelona ranks 216th. Zooming out to the full list of 50,000 districts and boroughs globally shows that the department of Paris, which saw widespread rioting in July, is among the top 20% of riskiest locations globally.

85% of US cities face high SRCC risks in next 12 months

While the world’s largest insurance market, the US, has been spared the worst of the economic hardship that has stoked discontent in much of the world, high levels of income inequality mean that many US urban hubs could face an elevated risk of unrest in the next year. The November 2024 election may also be a spark that ignites the US's underlying SRCC risk factors.

No US cities feature at the top end of the risk rankings, but the protests sparked by the death of George Floyd in 2020, which resulted in $2.5bn to $3bn in insured losses, serve as a reminder that damaging bouts of unrest are no longer limited to territories that have traditionally been deemed politically unstable. The US is a case in point with 33 cities with a population over 1 million rated as high risk by the Global SRCC Predictive Scores.

Unsurprisingly, this list is headed by the country’s largest cities, including top-ranked New York City, Washington D.C., Philadelphia, Boston, Chicago and LA. But several smaller cities – including the likes of Louisville, Milwaukee and Memphis – are scored as 'high' risk. It is a similar story in several of the US’s fastest growing urban centres, including Austin, Nashville and Raleigh.

Cutting-edge analytics key to navigating fast-moving political violence landscape

Data from Verisk Maplecroft’s Global SRCC Predictive Scores underscores the complex challenges facing political violence insurance providers. Socio-economic tensions driven by persistently high living costs present the most immediate threat to the world’s major urban hubs in the next 12 months. In the longer term, increasing rural-to-urban migration, rising inequality and the impacts of the escalating climate crisis are just a few of the myriad interconnected issues that could threaten to aggravate unrest in the coming years.

"As these dynamics combine to fuel a rise in SRCC risks globally, already high levels of demand for political violence insurance will rise further," said Torbjorn Soltvedt, Principal Analyst at Verisk Maplecroft. "Against this backdrop, close collaboration with providers of political risk analytics will become increasingly vital for insurers looking to better understand SRCC risks across countries, regions and cities as they evolve."