Americas - 5 risks to watch

The Trendline

by Jimena Blanco and Robert Munks and Gunther Baumgarten and Arantza Alonso and Eileen Gavin,

The Americas enter the 2024 electoral supercycle with elections in major North American economies, Mexico and the United States. The outcome of both ballots – and Canada, if a snap election were called – will have lasting impacts on global trade patterns, FDI inflows in Latin America and the Caribbean (LAC) and cross-border cooperation to tackle the region’s most pressing structural challenges. Greater economic integration and security cooperation are required if the region is to stall the negative trend of sluggish growth and growing insecurity. Political winds in the Americas will also influence future trends in democratic governance, with a potential intensification of ongoing democratic erosion, and whether the region remains a leader in ESG-linked sovereign issuances in 2024 and beyond.

North American elections: heading towards change, not continuity

Scheduled polls in the US and Mexico, and a possible snap election in Canada, leave North America facing the prospect of new administrations across the board. Global implications loom for economic, trade, energy and foreign policies, as even unchanged leaderships in Canada and the US would be facing demands to adapt to a deteriorating geopolitical outlook by year-end.

Our Government Stability Index underlines the historic closeness of US leadership elections, and we expect the same in November – with a tight result doing little to soothe political polarisation and social discord. Unprecedented levels of disinformation on social media and the disruptive influence of generative AI have the potential to upend traditionally low levels of political violence around the polling process itself.

Mexico’s election will be less domestically fraught, but outgoing President Andrés Manuel López Obrador will burden his successor with a record fiscal deficit. More positively, we expect the new president to be more amenable to an accelerated energy transition with a greater focus on renewables.

Growth and diversification of organised crime

Transnational criminal groups and street gangs in the Americas have become exponentially more sophisticated and organised, allowing them to expand both their geographical reach and their portfolio of illicit activities. This has driven a rapid and severe deterioration of the security situation in multiple locations across the region, including cities located in previously peaceful countries such as Chile, Costa Rica, Ecuador, and Uruguay.

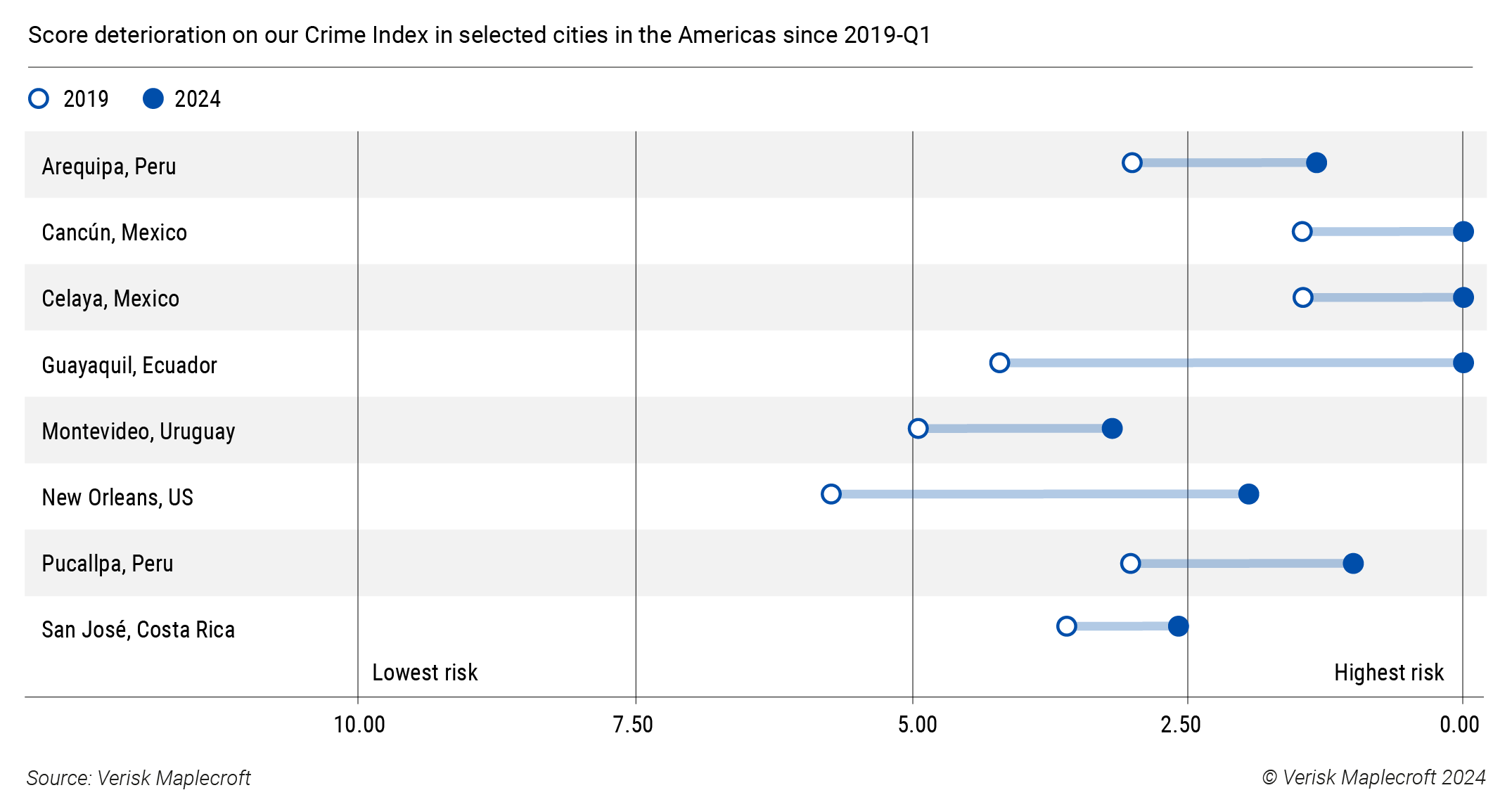

Ecuador saw the largest increase in risk globally on our Crime Index from 2023-Q1 to 2024-Q1, while its largest city and main economic hub, Guayaquil, experienced an exceptional increase over the last five years (see below). We expect the situation to worsen. Ecuador’s case exemplifies how powerful transnational organisations – such as Mexico’s Sinaloa cartel – have rapidly captured trafficking routes and illicit markets by teaming up with local gangs. The use of explosives, political assassinations and kidnappings have undermined the business environment and increased the challenges ahead for the Noboa government, elected amid the security crisis.

The expansion across borders by criminal organisations poses an ever-increasing risk for businesses that are diversifying their supply chains within LAC. With these organisations’ continuing adoption of advanced technologies – such as AI and blockchain technology – many more illegal activities will become exploitable, increasing the vulnerability of business to external threats that many local law enforcement agencies are unprepared to tackle.

Quality of justice the latest victim of democratic erosion

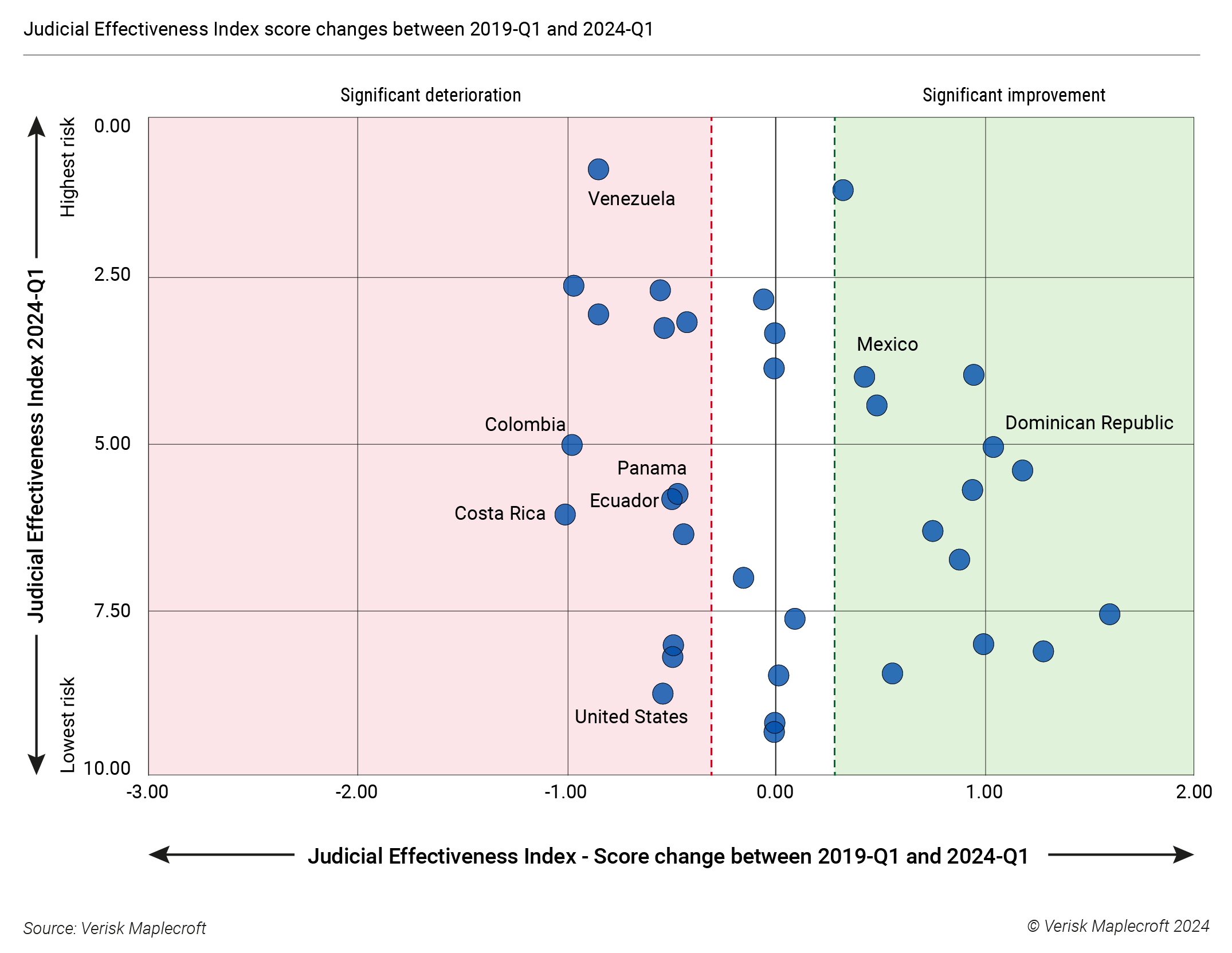

Democracy has weakened in the Americas since the last electoral supercycle of 2018-2019, with our Democratic Governance Index recording a significant increase in risk across the region in the intervening period. The election of populist governments with illiberal tendencies – both on the left and right of the political spectrum – contributed to the erosion of democratic norms and institutions. As a result, judicial systems have seen their independence, authority, and overall capacity to uphold the rule of law undermined by the two other powers.

The undercutting of courts’ ability to fulfil their function is reflected in our Judicial Effectiveness Index, which reveals increasing risks for most countries in the region in the last five years. This includes major economies like the US and Colombia, as well as smaller ones like Panama, Ecuador and Costa Rica, which experienced significant to exceptional deteriorations in the index. This trend is likely to continue and spread to other countries, such as Mexico and the Dominican Republic, where elections in 2024 could sustain illiberal trends.

Uneven application of the law, higher financial and time costs for resolving legal disputes, and challenges in securing contract enforcement are just some of the outcomes companies could face in the region should the trend for judicial ineffectiveness continue.

LAC growth at the behest of geo-economic fragmentation

As the West looks to secure access to critical resources and diversify its supply chains, reshoring will increasingly place LAC at the centre of geo-economic competition and fragmentation. The tug-of-war between geostrategic rivals will force LAC governments to balance short-term trade and investment relationships, with the stability of those partnerships in the longer-term.

A key challenge will be the need to mitigate their potential economic exposure to rising competition between the West and China. Our data shows that 20 countries around the world have experienced an exceptional increase in the risk of trade or economic sanctions since 2019-Q1, with China being second only to Afghanistan in the list of countries most impacted by this trend. These commercial tensions with the West are translating into a shift in Chinese investment patterns in LAC, prioritising deals that support high-tech industries in China instead of infrastructural development and food security, which drove the rapid rise of Chinese investment at the turn of the century. Chinese FDI inflows to LAC fell 17% in 2022 against 2020-2021 levels and by 50% against the 2010-2019 average.

Political shifts in LAC, a weaker external environment, and the need to sustain tighter monetary policies to combat inflation means the region’s growth outlook will remain subdued in 2024. Our Economic Growth Index shows that LAC was the region that recorded the highest increase in risk year-on-year in 2024-Q1, with major economies like Argentina recording an exceptional increase in risk, while Uruguay, Costa Rica and Colombia all recorded a very significant increase in risk.

LAC sovereigns at risk of S-washing

LAC sovereigns continue to lead in the EM issuance of green, social, sustainable, sustainability-linked and transition (GSS+)* bonds globally. According to the Climate Bonds Initiative (CBI), LAC sovereigns had issued a cumulative USD81.1 billion as of November 2023 (or 17% of the global GSS+ sovereign total).

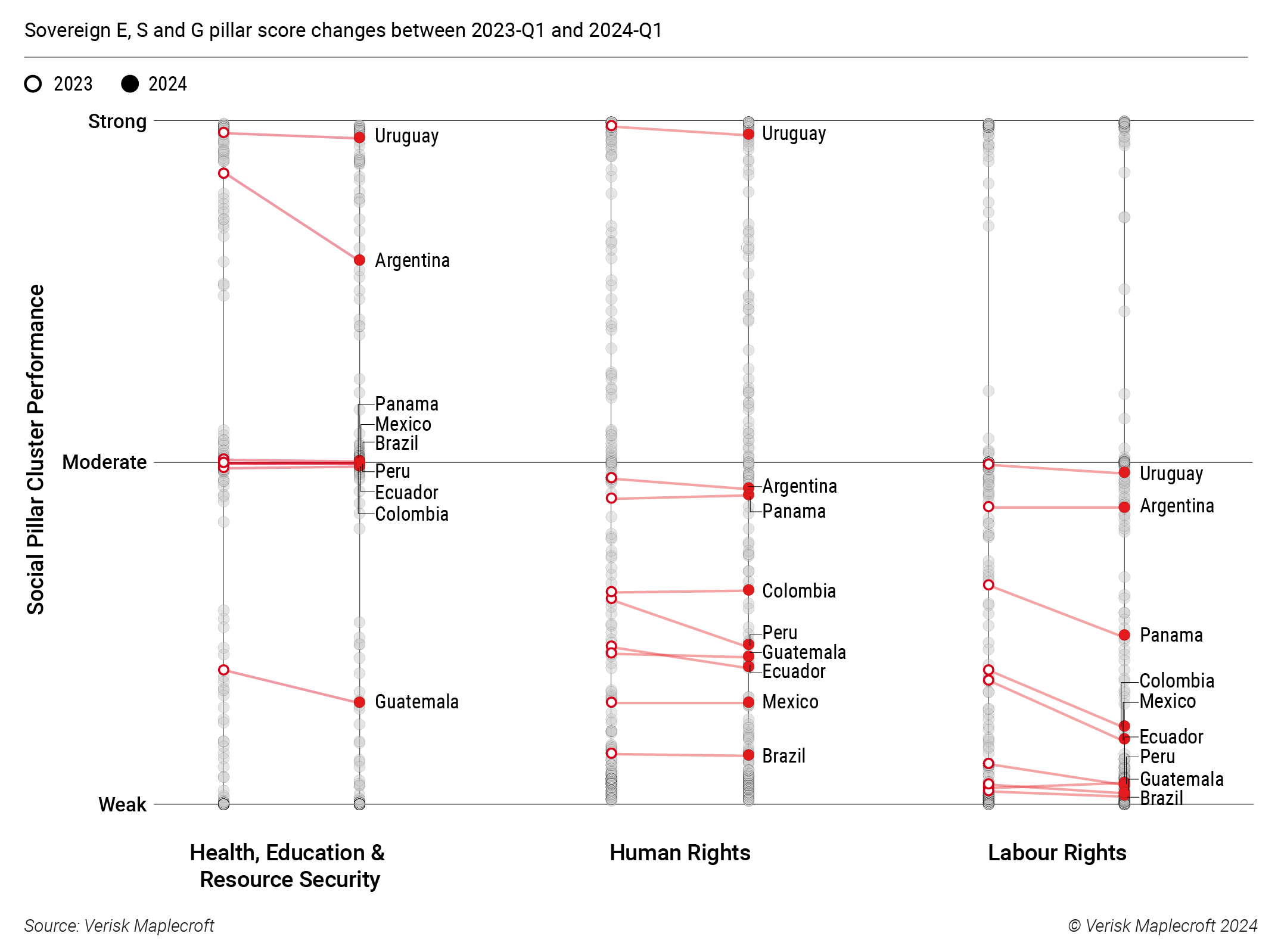

The distinguishing LAC feature is a focus on the S, with social and sustainability bonds prioritised over pure ‘green’ instruments (which, by contrast, predominate in Africa). This not only reflects the regional need, but also an (often-hard-won) understanding that social and environmental objectives must be taken together in support of a just transition.

Yet data from our Sovereign ESG Ratings shows next-to-no progress on the S pillar. This underlines our view that LAC governments competing for scarce capital will need to offer very well-structured GSS+ instruments.

By well-structured we mean the use of best-in-class taxonomies and ESG data, along with transparent (and suitably ambitious) use-of-proceeds and project-impact criteria aligned closely with global standard-setters. Otherwise, they run the risk of being accused of S-washing, a decline in investor confidence and, ultimately, higher borrowing costs.

*Grouped under the GSS+ acronym, these ‘use of proceeds’ instruments must be linked to projects with positive environmental outcomes (green/blue bonds), social benefits (social/SDG/orange bonds), or a mixture of both (sustainability, sustainability-linked and transition bonds).