Global revenue from compliance carbon pricing tools surpassed the USD100 billion mark in 2023, but not all is well in this evolving market. A North-South divide in carbon policy development is growing and the implications could be far reaching. Potential trade disputes and regulatory inconsistencies are on the rise as the developing and developed worlds clash over domestic economic and industrial priorities while balancing the global need to combat climate change. Global companies will inevitably be caught in the crossfire.

Our data shows that the widening rift over the development of carbon markets is deeply influenced by differences in regulatory capability, priorities and ambition across regions. The development of Paris Agreement Article 6 is also driving the standardisation of carbon markets and bilateral trade of carbon credits at the global level, heightening regulatory requirements.

As more countries adopt carbon pricing tools – such as emissions trading schemes and carbon taxes – companies face increasing carbon-related premiums and operational challenges, especially in regions where carbon markets and policy frameworks are still evolving. With resilience becoming a key focus, it is essential for businesses to integrate these developments into their strategic planning and risk evaluation.

Carbon policies are tightening globally

The direction of travel for strengthening carbon policies is undeniable. Our data shows that only 20 countries have failed to strengthen their carbon policies since 2018. In contrast, most nations, including major emitters like China, India, and the US, have strengthened their policies, raising regulatory implications for businesses worldwide (see Figure 1).

Figure 1: Carbon policy implementation has strengthened in most countries

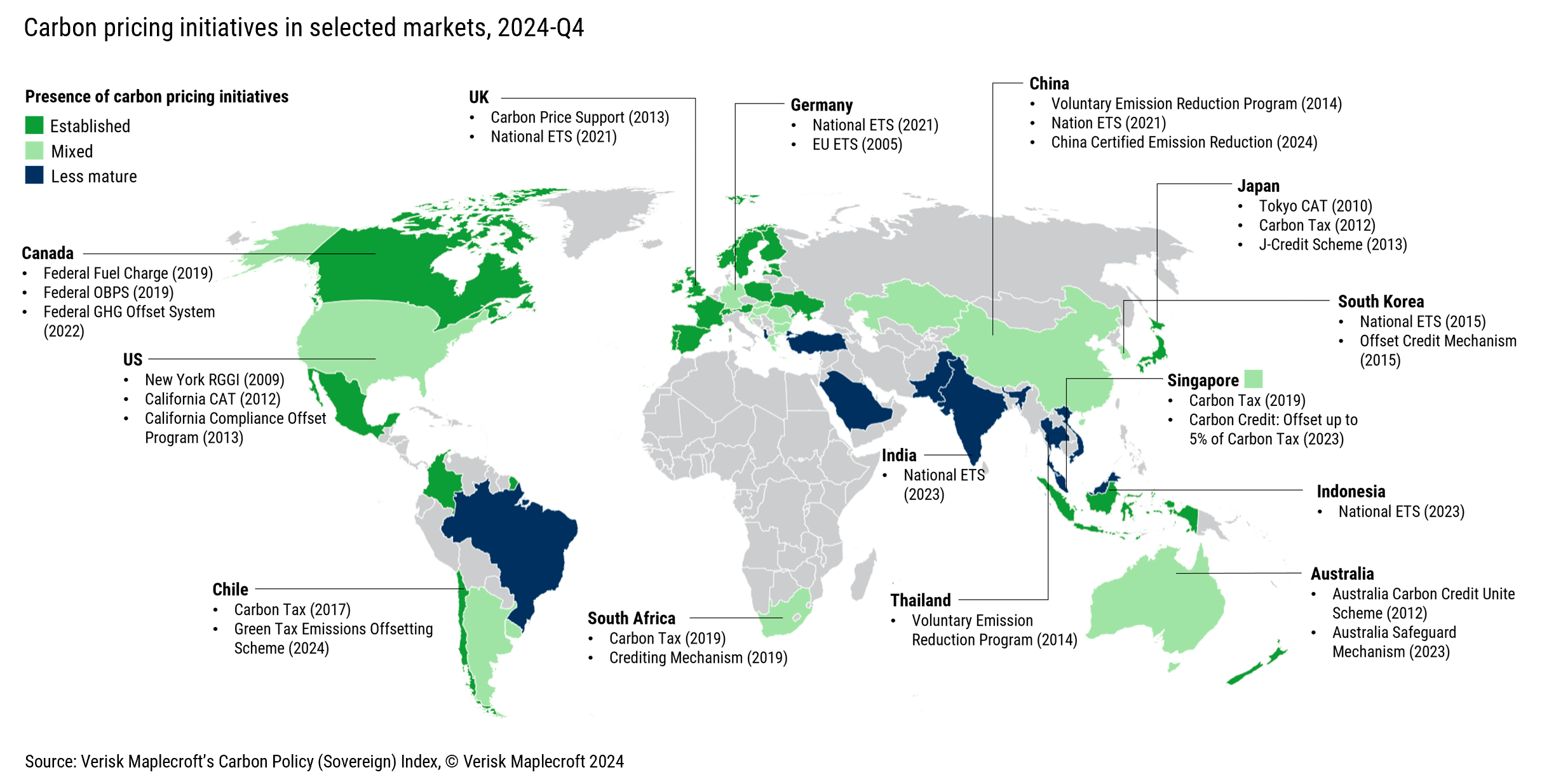

Underlying indicators of the index show that carbon pricing initiatives are an emerging driving force behind the improvement, alongside traditional policy support for renewables and climate change mitigation laws. As we near the end of 2024, 60 countries have adopted carbon pricing initiatives. These countries use or develop a wide range of carbon pricing tools - such as national emissions trading schemes, voluntary carbon markets, carbon taxes and Article 6 corresponding adjustments - to incentivise emission offset, especially in hard-to-abate industries like aviation, steel, cement and petrochemicals. These initiatives have led to significant shifts in supply chains, as businesses adapt to the cost implications of carbon pricing tools.

Pace of carbon pricing implementation varies globally

While many countries are advancing their carbon pricing initiatives, Figure 2 shows variations in the pace of implementation and policy choice (e.g. carbon tax, voluntary market, industry standards). Europe’s initiatives are more established, with clear market structures in place, while newer markets like Singapore, South Korea, and Japan are exploring tools tailored to their unique economic and environmental needs. In contrast, developing markets like China and India have less mature systems, but the potential for sudden regulatory tightening in response to global pressures could rapidly shift compliance costs and market dynamics.

This emerging North-South divide in carbon pricing development is likely to drive trade disputes and regulatory uncertainties in climate governance. The lack of consistent carbon product standards across regions further complicates trade, as it hinders cross-border transactions and limits market integration, increasing the risk of regulatory conflicts.

Diverse carbon pricing mechanisms fuel trade dispute risks

The large carbon price gap between established and developing markets, combined with the EU's Carbon Border Adjustment Mechanism (CBAM) – a tariff imposed on carbon intensive imports – is increasing the risk of trade disputes. Our Industry Risk Data highlights agriculture, transportation, and electric utilities as the most vulnerable sectors due to their high CO₂ emissions, making them particularly exposed to CBAM when sourcing from lower-priced regions, such as China and ASEAN.

CBAM recognises only direct carbon pricing tools like carbon taxes and ETS, excluding traditional regulations (e.g. emission standards), indirect carbon pricing, and voluntary carbon markets. This exclusion has drawn widespread criticism from developing countries for being protectionist, discriminatory, and potentially incompatible with international trade laws, including the General Agreement on Tariffs and Trade and the Paris Agreement. Lower-cost producers like China and India may view CBAM as a trade barrier rather than a genuine climate measure, increasing the likelihood of trade disputes.

Figure 3: Top industries facing increased exposure to higher carbon pricing due to their hard-to-abate emissions

Regulatory divergence complicating cross-border trade

The divergence of market standards is another major challenge facing cross-border trade of carbon credits. Different markets adopt various approaches and standards, affecting credit recognition, valuation, and methodologies for carbon projects. For example, advanced markets traditionally prefer nature-based solutions, such as forest conservation. In contrast, developing countries prioritise urban-based solutions or transition credits, like those for retiring coal plants. Some newer markets blend policy tools with voluntary markets to create incentives, such as Singapore allowing voluntary credits to offset carbon taxes.

The absence of a universal standard for carbon credits results in inconsistencies in credit integrity, verification methods, and pricing, complicating international trade. This lack of standardisation undermines trust, reduces market liquidity, and increases transaction costs, making it difficult for countries to integrate carbon markets globally.

Lack of diplomatic consensus at COPs hinders alignment of carbon market mechanisms

Upcoming discussions at COP29 will aim to address cross-border carbon trading issues by enhancing the integrity and standardisation of carbon markets, particularly cooperation under Article 6.2 and voluntary market mechanisms under Article 6.4. These mechanisms are crucial for market development and price discovery.

However, achieving global consensus remains challenging and will require extensive diplomatic efforts. Key challenges include agreeing on carbon credit integrity standards, pricing for internationally transferred credits, aligning with climate finance goals, and managing corresponding adjustments for nationally determined contributions (NDCs). The UN supervisory body for Article 6.4 will likely face pushback from major players like China, India, and the EU, further complicating negotiations. These hurdles suggest that a fully unified global carbon market standard is unlikely in the near term, leaving businesses to navigate ongoing regulatory uncertainties and associated risks.