Producing a data-driven physical climate risk assessment

Mandatory reporting in line with the recommendations of the Task Force for Climate related Financial Disclosures (TCFD) has sprung up across the globe as governments follow investors in demanding companies set out how they plan to identify and manage climate risks. The UK, EU, Japan, Singapore, and Canada already have requirements in place, while the SEC in the United States is mobilising to bring in similar regulations. Other reporting standards, such as ISSB, CDP and the EU’s European Sustainability Reporting Standards (ESRS) are also coalescing around the TCFD framework.

This is clearly no flash in the pan. Understandably, far-sighted companies are looking to prepare for mandatory reporting, but also recognise that embedding climate change into enterprise risk management can be as much about spotting opportunities as avoiding threats. However, getting to grips with the finer details of TCFD remains a significant challenge for some companies – with lack of knowledge and data gaps particular pain points.

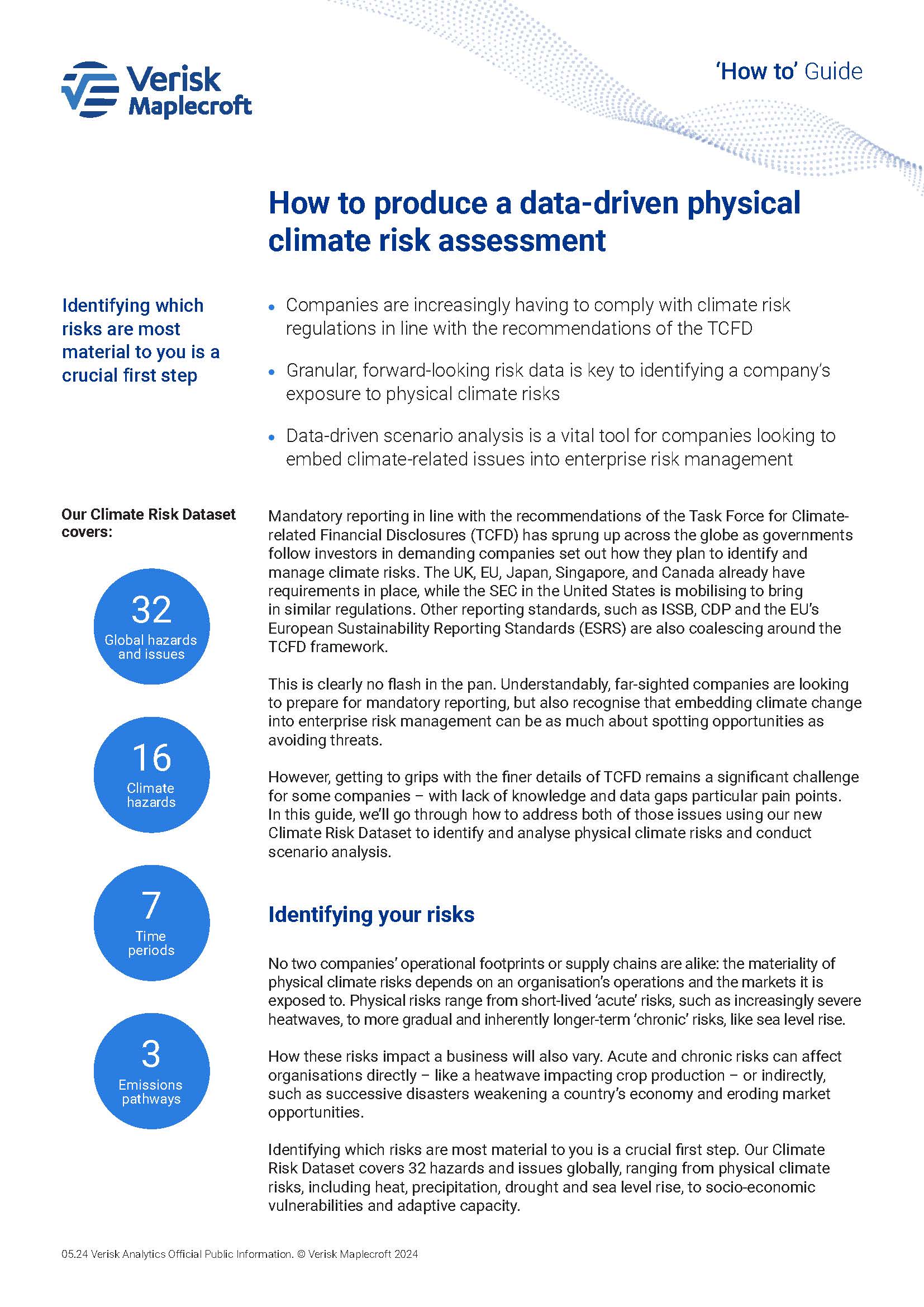

In this guide, we’ll go through how to address both of those issues using our new Climate Risk Dataset to identify and analyse physical climate risks and conduct scenario analysis.

How to produce a data-driven physical climate risk assessment

Please complete the form to download the guide.