Climate risk assessment & reporting

Advancing TCFD-related physical risk disclosures

The growing impacts of climate change and the proliferation of mandatory climate disclosure regulations and voluntary reporting standards mean the need for robust, science-based climate risk data has never been so great. Our Climate Scenarios data enable companies and financial institutions to undertake rigorous global assessments of their current and future physical risk exposures, simplify the reporting process, and align with:

- The recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and International Sustainability Standards Board’s (ISSB) IFRS Sustainability Disclosure Standards.

- California’s Greenhouse Gases: Climate-Related Financial Risk Act

- The European Union (EU) Corporate Sustainability Reporting Directive (CSRD) and aspects of the forthcoming Omnibus Package

- China’s Corporate Sustainability Disclosure Standards (CSDS)

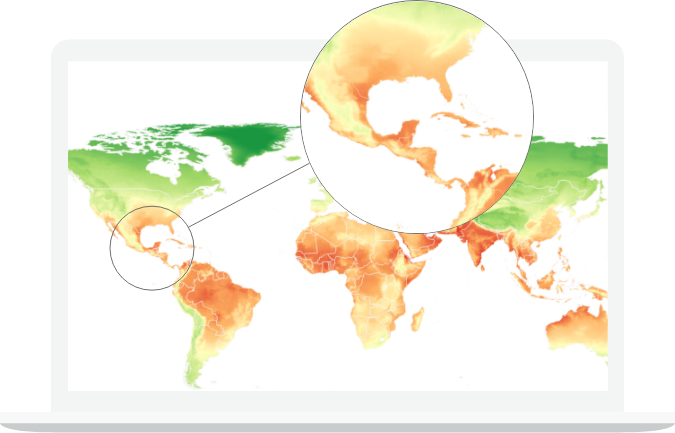

Using the latest scientific data, our new Climate Scenarios dataset covers 17 physical climate risks across seven time periods, three climate scenarios and 198 countries at subnational levels. They provide accurate, geospatial risk insights into the exposure of global operations, supply chains, assets, and portfolios for issues ranging from extreme temperatures and precipitation to drought and sea level rise.

With concern growing over the potential of climate-related risks to impact the resilience of business, asset values, portfolio returns, and even the stability of financial systems, organisations must underpin their risk assessments, scenario analyses and disclosures with credible data and metrics. With over 15 years’ experience quantifying environmental risks and an international reputation as a leader in global risk, our Climate Scenarios can provide the assurance regulators and stakeholders need that your organisation is taking steps to safeguard against future risks.

Who is it for?

-

Corporations

Our integrated data solutions are tailored to help organisations meet evolving disclosure requirements, especially the Corporate Sustainability Reporting Directive (CSRD) - a prominent reporting standard for many businesses who will need to apply the new rules in the 2024 financial year

-

Investors, banks, and insurers

Disclosure of climate risk impacts on assets and portfolios is no longer optional. We can help you meet and exceed client’s and regulators’ expectations over transparency and commitments to managing climate risks

Our offering

Climate scenarios

Climate Scenarios

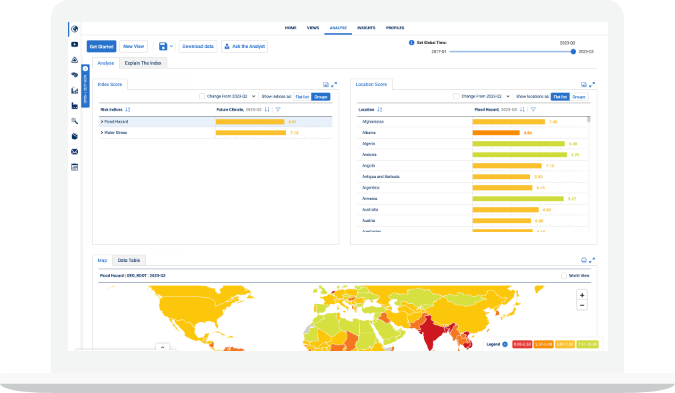

Part of our wider Climate Risk Data, the Climate Scenarios feature over 300 subnational risk indices enabling organisations to understand their exposure to physical climate hazards and how this may evolve over time. The scenarios can be combined with locational data on operations and suppliers via our GRiD platform or you can access them through API to integrate within internal risk systems

Climate risk advisory

Will Nichols

Head of Climate and ResilienceClimate risk advisory

We deliver an end-to-end climate advisory service. From comprehensive portfolio and asset-level risk assessments and tailored scenario analysis to climate change strategy development, disclosure drafting and enabling access to our underlying metrics at the subnational level, we can assist at every stage of your reporting journey

Producing a data-driven physical climate risk assessment

Producing a data-driven physical climate risk assessment

Read our guide on how to best approach climate risk assessment and reporting

Benefits

Benefits

Quality

Developed by our in-house team of climate scientists, the Climate Scenarios use the latest CMIP6 climate model projections and robust scientific methodologies

Confidence

Our in-house team of climate scientists have worked with the largest organisations in the world and are ready to assist with all your climate reporting challenges

Openness

We are transparent with our methodologies, allowing you to examine the underlying data and understand how we derive our indices

Protection

With indices covering 190+ climate, environmental, political and social risk issues, we are uniquely placed to help you understand how these risks interconnect and affect your business

Ensuring your success

Corporates

-

Reporting

Enhance your reporting capabilities, aligning with TCFD and ISSB recommendations

-

Risk assessment

Gain a comprehensive understanding of your physical risk exposure and identify future risks and opportunities

-

Scenario analysis

Pinpoint where hazards pose different challenges or opportunities for your business under projected future emissions pathways

-

Operational resilience

Minimise climate-induced operational disruptions and identify vulnerabilities across global operational footprints

-

Supply chain vulnerability

Identify climate-driven vulnerabilities and disruptions across global supply chains to implement mitigation strategies and discover diversification opportunities

-

Strategy

Systematically assess climate risks and opportunities and plans to enhance resilience and enable future growth

Investors, banks, and insurers

-

Due Diligence

Incorporate our risk datasets into your investment decision-making processes to align with OECD responsible business conduct guidance

-

Risk Assessment

Identify and assess physical climate risks and opportunities impacting your holdings across your entire portfolio

-

Scenario analysis

Inform investment decision-making with the granular data required to confidently navigate the implicit uncertainty in today’s climate scenarios

-

Value at risk

Use exposure data to understand the potential financial impacts to your assets

-

Stress testing

Enhance your financial and operational resilience through climate-related stress tests based on our robust data and expert advice

-

Reporting

Strengthen stakeholder trust with comprehensive and transparent climate-related disclosures in full alignment with TCFD / ISSB recommendations

Related content

Products & Solutions

Environmental Risk Data

Geospatial insights into nature-related risks to resilience and sustainability