Political Risk Dataset

Geopolitical tensions, economic instability, conflict and the energy transition have transformed the world we live in. This increasing uncertainty makes it imperative for companies to put the resources in place that allow them to identify, monitor and anticipate how and where political risks will impact the resilience of their operations, investments and supply chains.

From civil unrest and resource nationalism to regulatory changes and government stability, our comprehensive Political Risk Dataset captures the full range of structural and dynamic political risks, enabling you to track the trajectory of a fast-evolving risk landscape and identify commercial opportunities.

Our unique array of risk indices and predictive analytics help enhance risk monitoring, strategy development, scenario planning and market entry by enabling better decisions based on data you can trust.

Used by leading multinationals across the globe, our indices help:

-

Identify

Identify, analyse and benchmark the full spectrum of national and subnational political risks

-

Comply

Drive focused, credible and effective due diligence processes

-

Strategise

Evaluate new country entry opportunities and inform strategy development

-

Anticipate

Track countries’ trajectories, monitor emerging risks and anticipate new threats

The data

The Political Risk Dataset provides rigorous, accurate risk indices and predictive analytics into the full range of dynamic and structural political risks to inform better decision-making and strategic planning .

198+

Countries

46

Indices

15%

Subnational

Example issues include:

Dynamic

Government stability - predictive

Interstate tensions

Conflict intensity

Civil unrest – current and predictive

Terrorism risk

Structural

Corruption

Democratic governance

Resource nationalism

Rule of law

Energy, food & water security

Governance effectiveness

Regulatory environment

Judicial independence

Interconnected factors in other datasets: Poverty, Education, Political risk, Civil unrest, Food security, Energy security, Regulatory frameworks

Want to learn about the deeper levels of the indices, the methodology or how they can help you?

Benefits

Benefits

Convenient

Easily identify and analyse threats across the full spectrum of political risk through our GRiD platform and data, or integrate into internal systems via our API

Credible

Our reputation as the world’s leading provider of global risk analytics offers you the confidence and accuracy you need to make critical decisions based on data you can trust

Consistent

All our indices use the same comparable scale, helping you identify, prioritise and compare risks across more than 190+ environmental, political, social and economic issues

Features

Advanced analytics

Created using a unique combination of predictive modelling, event tracking and expert judgement by our analysts to ensure the highest degree of accuracy

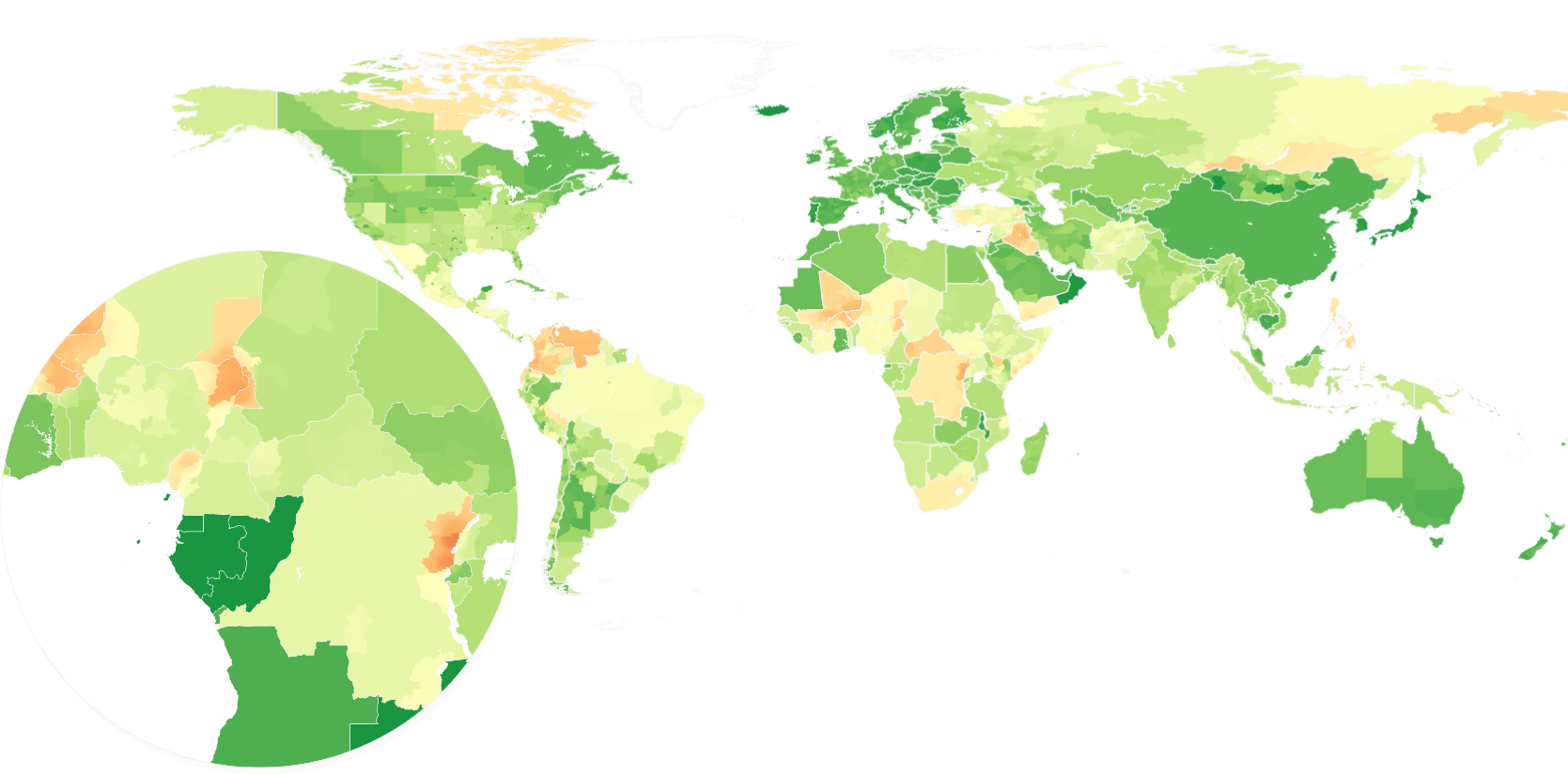

Granular

Location scores and interactive maps identify risks at both national and subnational levels across the globe, enabling deeper analysis and more targeted risk prioritisation

Transparent

Detailed index definitions, methodologies and source information are fully available

Strengthen your political risk resilience with our world-leading risk data

Related content

Capabilities

Geopolitical & country risk

Forward looking, strategic insight on key markets and global issues

SRCC Predictive Model

The market’s first predictive SRCC data solution – global in scope, granular in detail