Environmental Risk Dataset

Geospatial insights into nature-related risks to resilience and sustainability

Organisations are coming under pressure to determine how they interact with nature, both in terms of their impacts, but also how much their operations, investments, and strategies depend on natural capital. Both regulators and investors are asking for data-led reporting related to complex areas, including biodiversity, deforestation, water pollution, air quality and waste generation. At the same time, businesses need to successfully anticipate, manage and mitigate disruptions to operations and supply chains from the growing impacts of natural hazards. The amplifying role of contextual factors such as climate change, geopolitics and evolving legislation is also increasingly on the agenda.

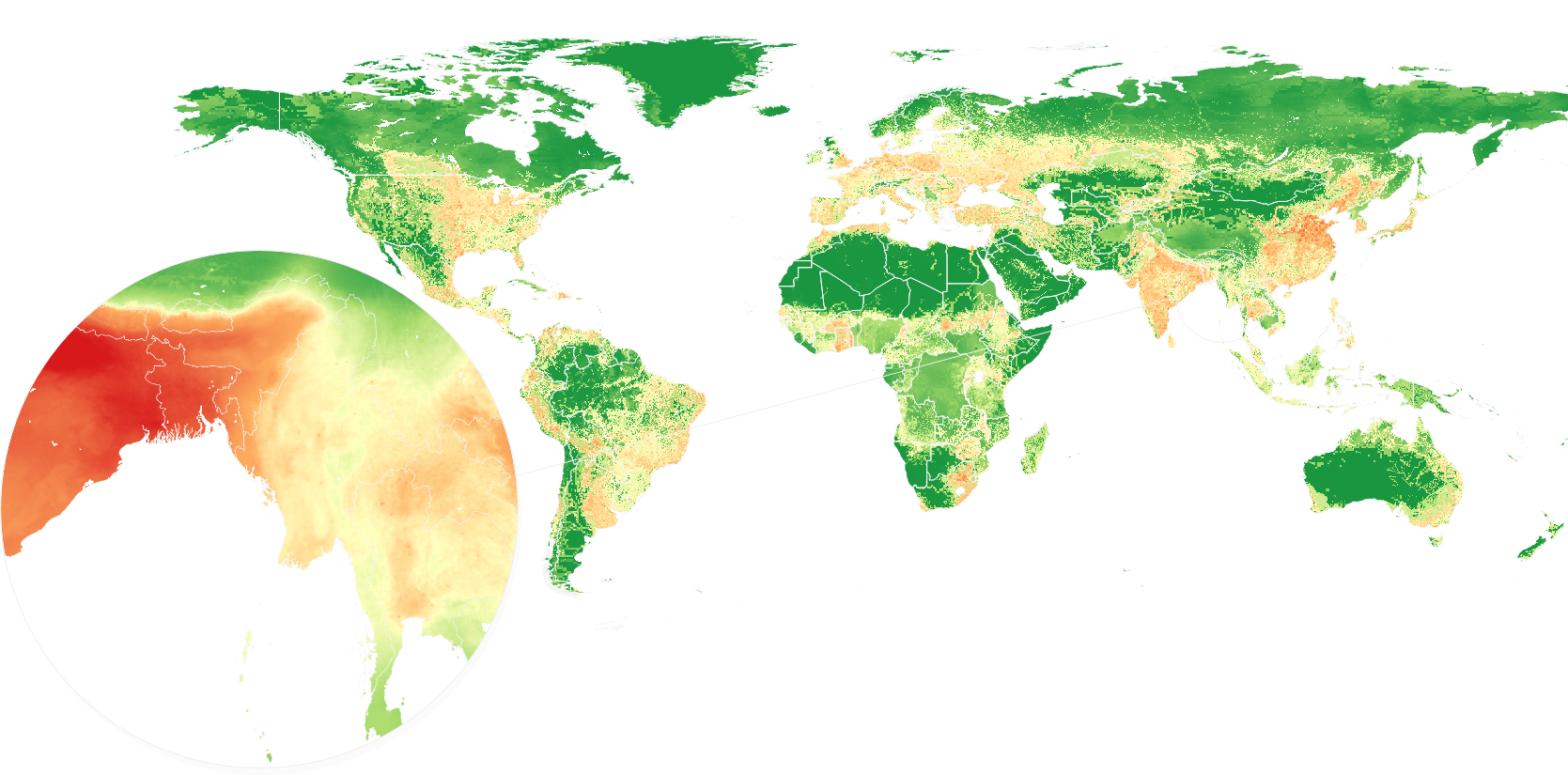

Our Environmental Risk Dataset provides organisations with a global view of their exposure to nature risk and natural hazards, comparable across 198+ countries. Granular subnational data enables screening of assets, suppliers, and portfolios for 22 risk factors covering the state of the natural environment, the legislative situation, and physical threats. The Dataset enables companies to assess their risk exposure, highlight resilience gaps, identify opportunities to reduce impacts and dependencies, and report those risks and exposures in line with international benchmarks such as the recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD) and the Science Based Targets Network.

Other factors, such as governance, corruption, poverty or indigenous peoples’ rights, can be integrated from other datasets to provide further understanding into the overall environmental risk landscape, while our Climate Risk Dataset offers powerful geospatial insight into how climate change will evolve over time.

The depth and breadth of the issues covered in the Environment Risk Dataset provides powerful, geospatial insights that help companies to:

-

Assess

Perform global risk assessments across operations, supply chains and portfolios

-

Report

Align with requirements of the TNFD and other frameworks

-

Locate

Spot commercial opportunities in new and existing markets

-

Mitigate

Isolate exposure to nature-related and natural hazard risks and develop effective mitigation strategies

-

Navigate

Comprehend the legal and regulatory landscape related to natural capital

-

Understand

How your exposure is affected by contextual factors such as governance, indigenous peoples’ rights and poverty

-

Enhance

Build resilience and improve your strategic planning with data-led decision making

The data

Our Environment Risk Dataset features global risk indices and subnational mapping covering risks to nature, alongside hydrometeorological and geophysical natural hazards, providing a comprehensive picture of the evolving risk landscape.

198

Countries

36

Risk issues

22

Subnational indices

Example issues include:

Natural capital

Biodiversity

Marine & terrestrialDeforestation

Pollution

Air, water, etcCircular economy

Waste generation

Recycling

Natural hazards

Physical risks

Including: Tropical storms, Seismic, Drought, WildfireExposure

Economic, societal, infrastructureImpacts

Economic, societal, infrastructureRegulatory

Deforestation

Interconnected factors in other datasets: Indigenous peoples’ rights, Climate hazards and societal vulnerability, Governance, Poverty, Civil unrest, Government stability

Want to learn about the deeper levels of the indices, the methodology or how they can help you?

Benefits

Benefits

Credible

Our reputation as the leading provider of global risk analytics offers you the confidence needed to make strategic decisions based on data you can trust

Support

An in-house team of experts are on hand to help you with all your needs, from TNFD reporting to global asset screening for disruption and resilience risks

Complete

With data also covering climate change, governance, macro-economics, and social risks we can provide an end-to-end environmental risk solution

Comprehensive

With 190+ climate, environmental political and social risk indices we are uniquely placed to help you understand how these risks interconnect and affect resilience

Transparent

We are transparent in our methodologies, enabling you to interrogate the underlying data and fully understand how we arrive at our risk scores

Features

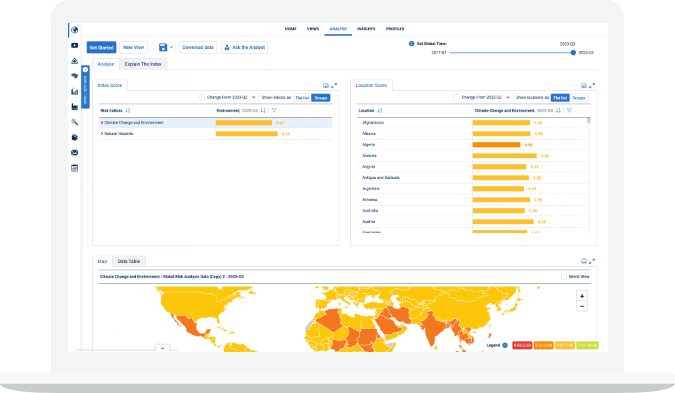

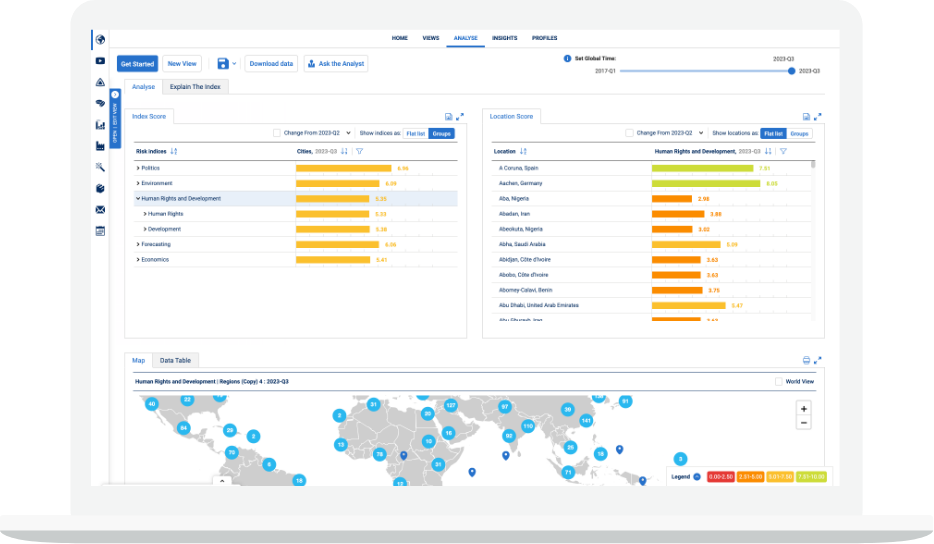

Advanced analytics

Created by our in-house scientists and data experts our environmental risk indices have been developed to deliver the highest degree of accuracy

Granular

Location scores and interactive maps identify risks at both national and subnational levels across the globe, enabling deeper analysis and more targeted risk prioritisation

Consistent

All our indices use the same comparable scale, helping you identify, prioritise and compare all risks consistently via our GRiD platform or through API

Geospatial

Input your asset or supplier locations into our GRiD platform and combine with our data for instant global risk assessment

Get in touch to learn more about our geospatial insights into nature-related risks to resilience and sustainability

Related content

Capabilities

Climate & environment

Building corporate and investor resilience to climate and environmental risks