Heat stress threatens to cut labour productivity in SE Asia by up to 25% within 30 years

Global manufacturing hubs in South-East Asia are likely to experience significant falls in productivity over the next 30 years due to rising temperatures and extreme heat stress impacting labour forces.

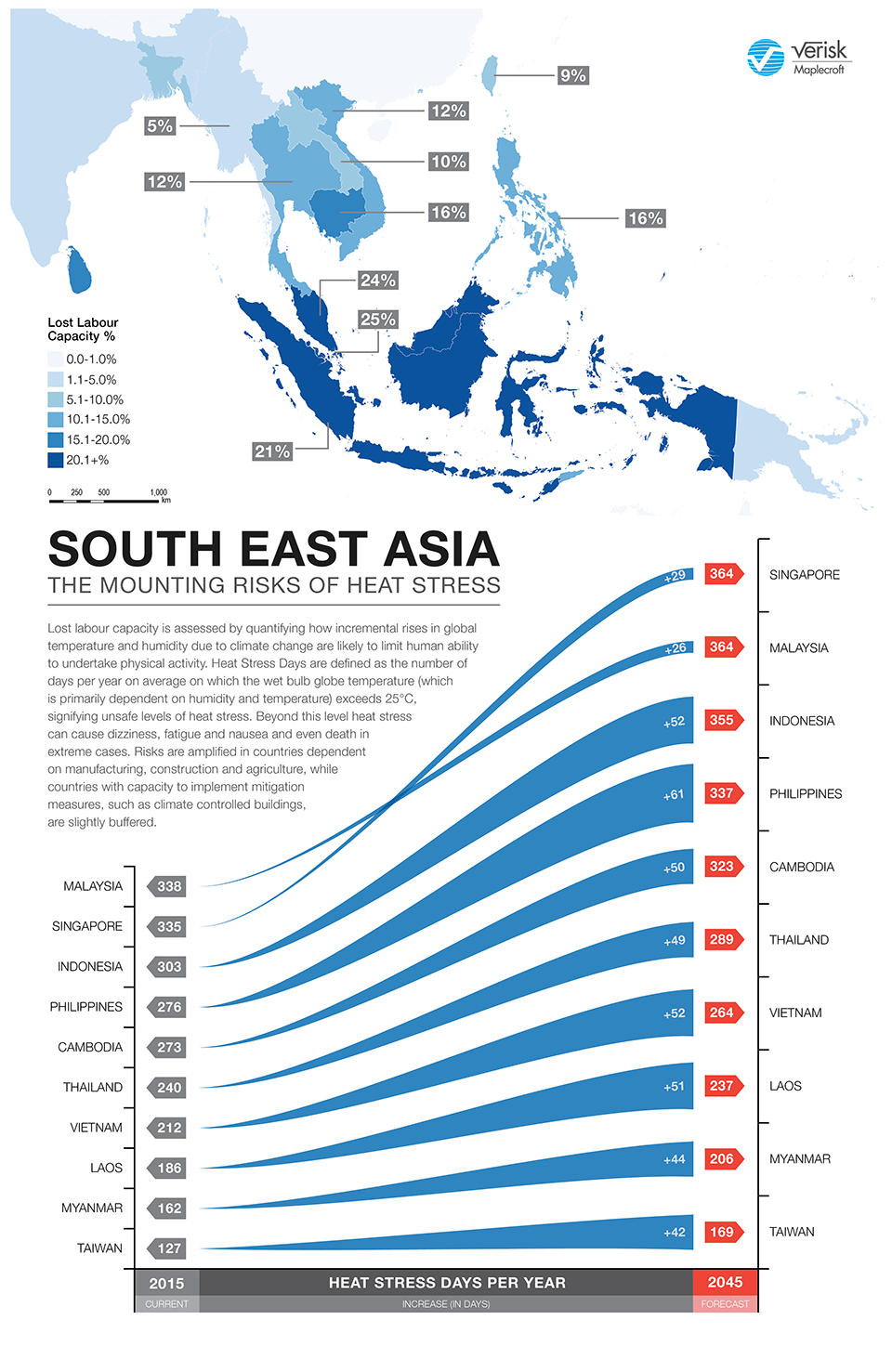

The Heat Stress (Future Climate) Index, one of 20 new indices released this week in its 2016 Climate Change and Environmental Risk Analytics, reveals that within a generation, economies including Singapore, Malaysia, Indonesia and the Philippines could be as much as a quarter less productive than they are today. The Bath, UK, based company, which produces the study annually to help business assess risks to operations, assets and supply chains, used the latest future climate projections to calculate the drop in labour capacity for each country based on the increasing occurrence of conditions that prompt heat stress, and reduce the ability of a workforce to undertake physical activity.

The findings follow predictions by climate scientists that 2015 will be the hottest year on record. Nine of the 10 warmest years on record have now occurred in the 21st Century and we forecast that by 2045 nearly half the world’s population (47%) will live in countries categorised as ‘extreme risk’ in the Heat Stress (Future Climate) Index.

South-East Asian labour forces among most vulnerable to heat stress

Incremental rises in global temperature and humidity due to climate change are likely to increase the number of working days exceeding safe levels of heat stress, which can cause absenteeism through dizziness, fatigue and nausea and even death in extreme cases. Crops and livestock are also highly susceptible to heat stress, driving food shortages, poverty, and migration – factors that can increase the risk of conflict and instability. Risks are amplified in countries dependent on manufacturing, construction and agriculture.

We estimate that South-East Asia could lose 16% of current labour capacity due to rising heat stress over the next three decades – almost double the shortfall of the two next worst affected regions, the Caribbean and West Africa. Singapore and Malaysia are predicted to experience the heaviest toll, with 25% and 24% decreases from current levels, while Indonesia could see a 21% drop and Cambodia and the Philippines 16%. Thailand and Viet Nam are also expected to experience 12% decreases in labour productivity.

This reflects projections that by 2045 the number of heat stress days in both Singapore and Malaysia will rise to 364 (from 335 and 338 respectively), while Indonesia is set to experience an increase from 303 to 355 heat stress days and the Philippines 276 to 337 days.

SE Asia is expected to undergo some of the greatest economic growth in the coming decades: the region’s GDP is set to increase 50% to US$9 trillion, accounting for 13% of the projected rise in global GDP. However, the potential impact of heat stress on labour capital in the region has been largely overlooked in financial modelling and the challenges heat stress presents national workforces in ‘extreme risk’ countries may need to be addressed if these forecasts are to be met. Investors in ‘extreme risk’ countries may also be exposed to rising costs for manufacturing and health care provisions, alongside disruption risks in their supply chains.

45 of 50 most at risk cities located in South East Asia

Drilling down to the local level, we have also calculated the risk of lost labour capacity through heat stress for 1300 commercial centres. South East Asia hosts 45 of the 50 highest risk cities, including the key manufacturing centres of Kuala Lumpur (ranked 6th), Singapore (16th), and Jakarta (17th). The Colombian cities of Cartagena (1) and Barranquilla (23), along with Panama City (43) and Arraijan (42) in Panama, and Manaus (11) in Brazil are the only cities included from outside the region.

Malaysia is home to 20 of the 50 global cities identified as losing the most labour capacity to heat stress, while 13 are found in Indonesia – far more than the neighbouring Philippines (5), Viet Nam (4), Thailand (3), or Cambodia (0). This suggests resilience to heat stress could become a differentiator for nations seeking inward investment.

Businesses warming to programmes tackling heat stress

Far-sighted companies are already implementing policies addressing heat stress across their operations and supply chains to reduce the impact of absences and sickness. We believes that organisations incorporating climate threats into risk analyses, investment decisions, and employee health guidelines will better prepare themselves for the future business environment.

“Climate change will push heat stress impacts to boiling point with significant implications for both national economies and the health of vulnerable workers," states Dr James Allan.

"Governments and business need to identify which assets, sectors, commodities and groups are most at risk and what protective measures should be put in place.”

Dr James Allan, Head of Environment

Our 2016 Climate Change and Environmental Risk Analytics (CCERA) features comparable business risk data and sub-national mapping for 198 countries across 48 separate issues, including climate change vulnerability, ecosystem services, greenhouse gas emissions, natural hazards, and environmental regulation. The CCERA is available via an integrated data and mapping portal, alongside an extensive portfolio of indices quantifying the key political, economic and human rights risks, which has been developed to enable multinational organisations to identify, prioritise and manage threats to global operations, supply chain continuity and corporate reputations.