Verisk Maplecroft unveils Climate Risk Dataset providing ‘end-to-end’ geospatial insight into physical and transition risks

We are delighted to announce the launch of our new Climate Risk Dataset, which will provide multinational organisations with powerful, geospatial insight into the most pressing issue facing global business today. The Dataset has been developed as an end-to-end solution for insurers, corporates, banks, and investors to identify exposures to current and future climate risks.

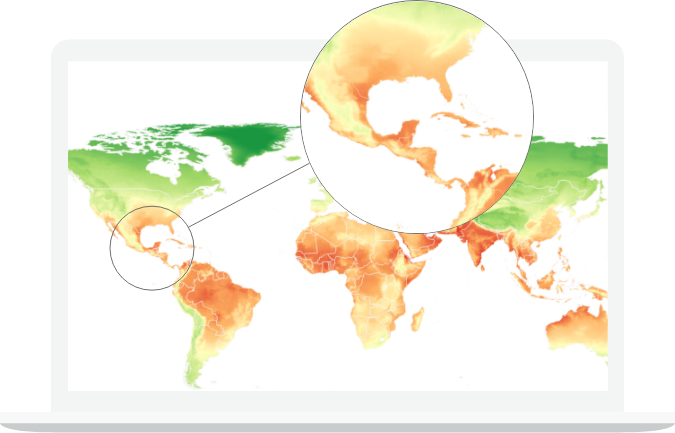

Created by an in-house team of climate scientists, and based on the latest climate model projections, the Climate Risk Dataset features our newly released Climate Scenarios, which assess how physical risks, such as heat, precipitation, drought, and sea level rise, will evolve over time across different emissions pathways. In addition, the Dataset includes global risk indices covering climate-related socio-economic vulnerabilities and an array of transition issues to deliver a comprehensive assessment of all aspects of climate risk the world over.

“Navigating the direct and indirect impacts of climate change is an imperative for multinational organisations if they are to build resilience to a heating world,” our Director of Climate and Resilience, Dr Richard Hewston, says. “This is dependent on effectively identifying, managing, and reporting climate risk exposures – a complex task that needs quality data you can trust.”

The Climate Risk Dataset covers 32 hazards and issues globally. Its Climate Scenarios encompass 16 physical climate risks across seven time periods and three emissions pathways. This amounts to over 330 global climate hazard risk indices with subnational granularity to assist with the identification of risks to assets and specific locations across global operations, supply chains and portfolios.

The Dataset also includes updated subnational socio-economic indices measuring the adaptive capacity of nations, the sensitivity of societies to climate change, and overall climate vulnerability, which complement our existing national-level transition indices quantifying risks associated with emissions, climate litigation, carbon policies, and environmental regulations.

The depth and breadth of the data will help companies:

- Perform global risk assessments across operations, supply chains and portfolios

- Align with climate reporting standards, such as the Task Force on Climate-related Financial Disclosures and the European Sustainability Reporting Standards (ESRS)

- Stress test resilience, insurance and investment strategies

- Identify commercial opportunities in new and existing markets

- Isolate areas of low resilience and develop effective mitigation measures

- Understand legal and regulatory challenges stemming from the energy transition

- Assess the socio-economic impacts of climate change worldwide

While many companies are beginning to create mitigation plans for physical threats, ‘cascading’ climate risks are largely going under the radar. With data covering over 170 environmental, political risk, and human rights issues, our research into the interconnected nature of risk can also enable companies to identify where secondary climate impacts, such as food insecurity, migration, economic stability, and civil unrest, will emerge.

“From exposure to climate hazards and their ‘cascading’ impacts, to responses to the energy transition and rising regulatory obligations, companies need to demonstrate, convey, and instil confidence in their current and future performance,” adds Hewston. “The Climate Risk Dataset has been developed to help them do just that.”