LGIM’s new Future World ESG Emerging Markets Government Bond Index Funds powered by Verisk Maplecroft data

Legal and General Investment Management (LGIM) has today announced the launch of the L&G Future World ESG Emerging Markets Government Bond Local Currency Index Fund, offering investors access to a significantly enhanced sovereign risk ESG framework for the integration of ESG across sovereign debt. This fund will be followed by the launch of the L&G Future World ESG Developed Markets Government Bond Index Fund and the L&G Future World ESG Emerging Markets Government Bond (USD) Index Fund, in the next few months. LGIM utilised the depth and breadth of Verisk Maplecroft’s portfolio of sovereign ESG risk analytics in the development of the new investment products.

Alongside a range of environmental, social and governance (ESG) factors, the funds will also incorporate a new proprietary fourth ESG pillar, referred to as “Geopolitical stability/risk”. This risk factor aims to identify risks beyond headline sustainability metrics, which we believe provides a more comprehensive risk assessment of investing in Government debt.

As presented by the World Bank1, there is an ingrained income bias that impacts sovereign ESG scores and the fund seeks to eliminate this. The aim is to facilitate a fairer allocation of capital to nations which require debt issuance to advance their economies and reward those countries that are on a path to improving their ESG credentials.

Through the creation of ‘wealth bands’ which are implemented into our Index Fixed Income Sovereign Risk ESG Future World fund range, we believe we are taking a significant step towards levelling the playing field. These bands are mutually exclusive and the strategy exclusion thresholds are wealth-band specific. The bands apply tiered thresholds for exclusions based on different levels of country income. As a result, the funds in the range aim to provide investors with exposure to sovereign debt with deeper ESG integration, factoring in forward-looking sovereign risk factors and adjusting for wealth bias.

Talking about the new fund, Lee Collins, LGIM’s Head of the Index Fixed Income Desk said: "Following 18 months of research and development, we are delighted to be launching our first, LGIM designed, Index fixed income Sovereign ESG products, collaborating with industry leaders like JP Morgan & Verisk Maplecroft to bring this to market. Whilst ESG integration in equities and corporate bonds exposures is a well-trodden path, it’s fair to say that developments in the Sovereign ESG sector have lagged behind. We believe that with several unique features, these new products will offer investors a deeper ESG integration in the asset class."

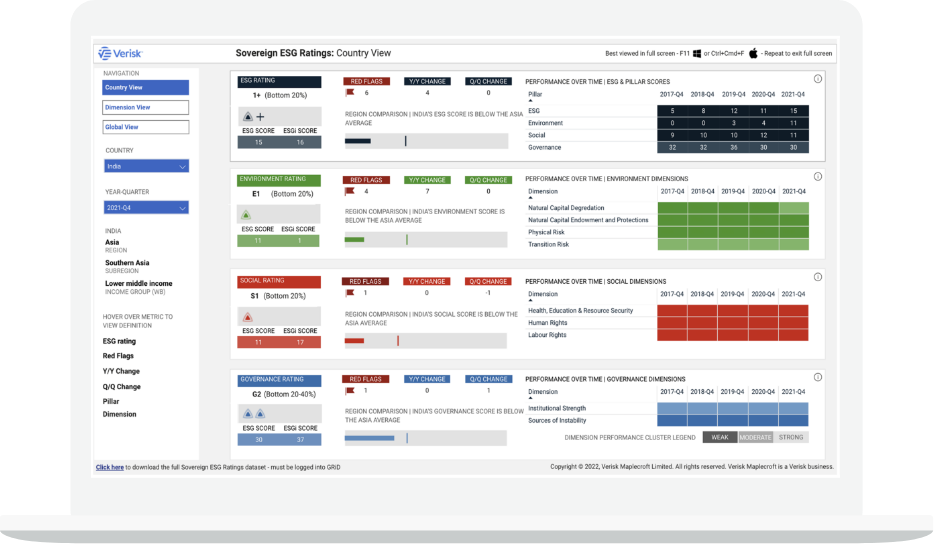

LGIM has also designed and implemented a proprietary sovereign ESG score momentum factor to be incorporated by the fund range. This provides an ethically consistent means of rewarding countries trending positively but also penalising those countries trending down, helping to amplify risk signals which we believe are key to future growth within sovereign ESG. The funds represent a significant evolution in the consideration of ESG risk across sovereign debt, both identifying risks beyond headline sustainability metrics, controlling for income bias and imposing meaningful exclusions and tilts without sacrificing investment performance. Using sovereign risk ESG data powered by Verisk Maplecroft - an industry leader in sovereign ESG data analytics - the fund will be underpinned by the LGIM Sovereign Risk ESG data framework that is calculated quarterly and spans c.200 countries across all markets.

James Lockhart Smith, VP of Markets & ESG at Verisk Maplecroft commented: “We are delighted to be working with LGIM on their new Sovereign ESG Index funds. The scale of fast-evolving environmental risks, as well as persistent social and governance deficits, has increased the need for sovereign debt investment products that use ESG criteria in an impactful way. Verisk Maplecroft sees this relationship as critical to deepening ESG incorporation across government bond markets."

The funds’ scoring methodology is also designed around key sustainable investment bodies, initiatives and issues such as: the United Nations Global Compact, the Climate Change Initiative, UN Sustainable Development goals and the Organisation for Economic Co-operation and Development, alongside labour conditions and human rights factors. This builds on LGIM’s established relationship with JP Morgan, leveraging its best-in-class fixed income methodologies.

Shaku Pithavadian, Managing Director, Deputy Head of Global Index Research at JP Morgan added: “We have leveraged our best-in-class fixed income benchmark methodologies and new means of index construction to enhance customized product design for our clients. We are pleased to work with LGIM to integrate their bespoke Sovereign ESG framework in a scalable index solution.”

The funds have been categorised as Article 8 under the Sustainable Finance Disclosure Regulation. The L&G Future World ESG Emerging Markets Government Bond Local Currency Index Fund will be immediately available to institutional investors in the UK, and to those investors in the Netherlands, Germany and Sweden by the end of 2023.

Important information:

-

Key Risk Warnings

The value of investments and the income from them can go down as well as up and you may not get back the amount invested. Past performance is not a guide to future performance. The details contained here are for information purposes only and do not constitute investment advice or a recommendation or offer to buy or sell any security. The information above is provided on a general basis and does not take into account any individual investor’s circumstances. Any views expressed are those of LGIM as at the date of publication. Not for distribution to any person resident in any jurisdiction where such distribution would be contrary to local law or regulation.

A summary in English of investor rights associated with an investment in the fund is available from www.lgim.com/investor_rights.

The risks associated with each fund or investment strategy are set out in the key investor information document and prospectus or investment management agreement (as applicable). These documents should be reviewed before making any investment decisions. A copy of the English version of the prospectus and the key investor information document for each fund is available at https://fundcentres.lgim.com/ and may also be obtained from your Client Relationship Manager.

A decision may be taken at any time to terminate the arrangements made for the marketing of the fund in any EEA Member State in which it is currently marketed. In such circumstances, shareholders in the affected EEA Member State will be notified of this decision and will be provided with the opportunity to redeem their shareholding in the fund free of any charges or deductions for at least 30 working days from the date of such notification. Where required under national rules, the key investor information document will also be available in the local language of the relevant EEA Member State. Information on sustainability-related aspects on the funds is available on https://fundcentres.lgim.com/ The decision to invest in the funds should take into account all the characteristics or objectives of the fund as described in its prospectus and in the key investor information document relating to the fund.

This financial promotion is issued by Legal & General Investment Management Ltd in the UK. Registered in England and Wales No. 02091894. Registered office: One Coleman Street, London EC2R 5AA. Authorised and regulated by the Financial Conduct Authority. In the European Economic Area, this document is issued by LGIM Managers (Europe) Limited, authorised and regulated by the Central Bank of Ireland as a UCITS management company (pursuant to European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2011 (as amended) and as an alternative investment fund manager (pursuant to the European Union (Alternative Investment Fund Managers) Regulations 2013 (as amended). LGIM Managers (Europe) Limited’s registered office is at 70 Sir John Rogerson’s Quay, Dublin, 2, Ireland and it is registered with the Irish Companies Registration Office under company no. 609677.

-

About Legal & General Investment Management (LGIM)

Legal & General Investment Management is one of Europe’s largest asset managers and a major global investor, with total assets under management of £1.22trillion ($1.5tn, €1.3tn, CHF 1.3tn). We work with a wide range of global clients, including pension schemes, sovereign wealth funds, fund distributors and retail investors.

For more than 50 years, we have built our business through understanding what matters most to our clients and transforming this insight into valuable, accessible investment products and solutions. We provide investment expertise across the full spectrum of asset classes including fixed income, equities, commercial property, and cash. Our capabilities range from index-tracking and active strategies to liquidity management and liability-based risk management solutions.

1 Source: World Bank Group: A New Dawn Rethinking Sovereign ESG PDF

2 LGIM internal data as at 30 June 2023. These figures include assets managed by LGIMA, an SEC Registered Investment Advisor. Data includes derivative positions.