Turbulence in energy sectors as COVID-19 spreads globally amid oil price war

by Dr Kaho Yu,

The rapid spread of the coronavirus from China around the world is having a dramatic domino effect on the global economy, and there is no sign of the situation improving. As of early March, thousands of new cases of COVID-19 have been confirmed in nearly 60 locations outside China. Approaching 110,000 people have been infected worldwide, and nearly 4,000 deaths have been reported. Fears of the fast-spreading coronavirus continue to weigh on the global commodity market, especially the already oversupplied oil market.

Low oil prices – good news for Chinese consumers amid the COVID-19 outbreak?

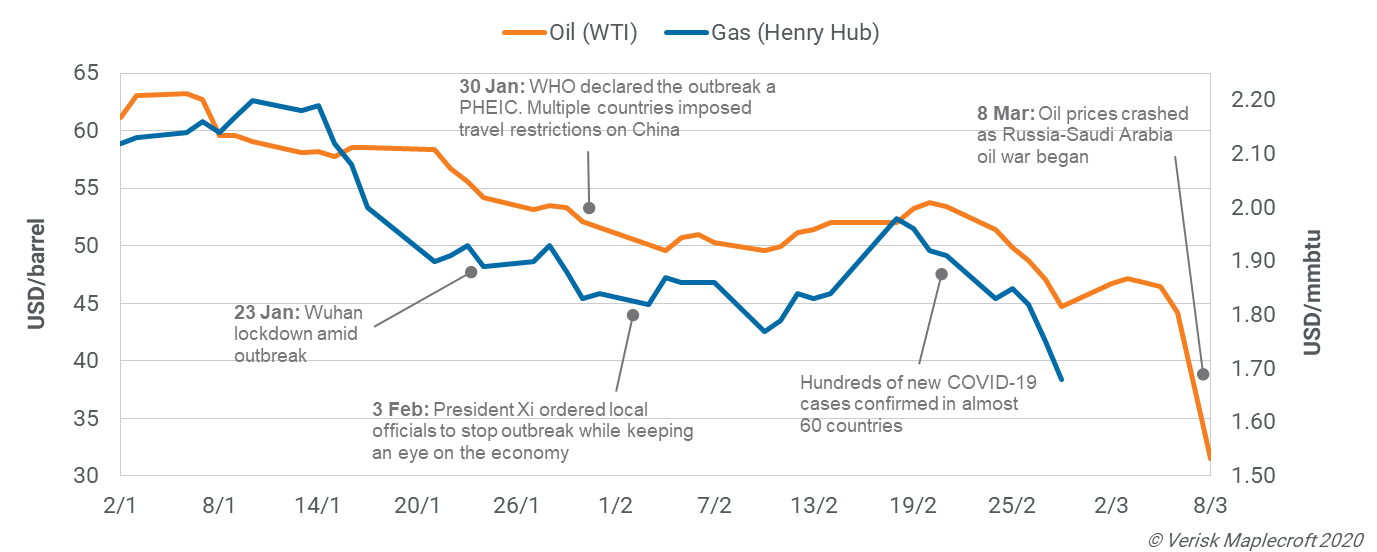

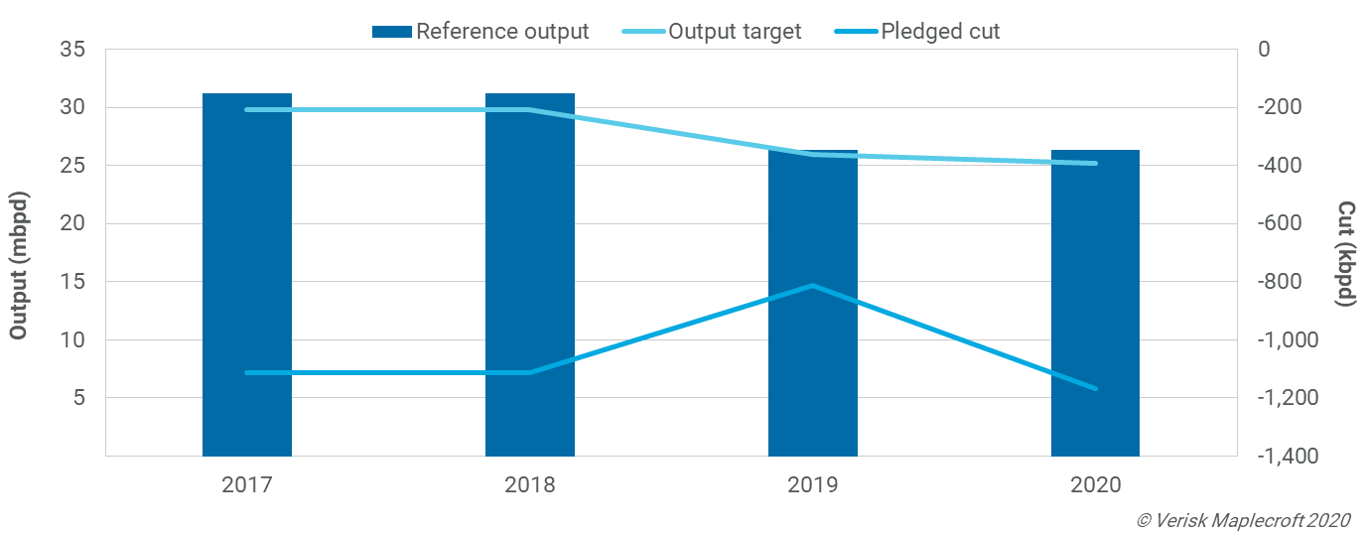

As the figure below illustrates, oil prices fell sharply following the outbreak of the coronavirus and came back gradually in mid-February after a decline in new reported COVID-19 cases in China. However, oil prices have dropped dramatically again in March, due both to the rapid spread of the coronavirus around the world and the protracted price war between Russia and Saudi Arabia. The oil titans raised their production in a standoff following the collapse of OPEC+ cut negotiations. This has brought the West Texas Intermediate (WTI) down almost 50% below its recent two-month high.

While oil demand was already weak before all this started due to the US-China trade war, the COVID-19 pandemic will have a further significant impact on the already oversupplied oil market in 2020 Q1 and Q2. The race between Russia and Saudi Arabia will keep the oil price low until a further OPEC+ production cut or a massive economic stimulus is announced.

Although low oil prices are not good news for China's oil and gas sector, in particular domestic production, they will likely support real incomes and GDP growth in the country, which relies heavily on oil imports. Even so, long-lasting low oil prices would not necessarily offset the broader effects of a weaker global economy.

Balancing coronavirus containment against economic disruption, a dilemma for Beijing

Investors have been waiting for Beijing to announce economic measures in response to the COVID-19 outbreak. Chinese President Xi Jinping's first visit to Wuhan, the centre of the pandemic, on 10 March 2020 sent a powerful message that Beijing believes the worst of the national emergency could be over soon.

In the last two months, all industries have been affected by local-level virus containment – supply chains, material procurement, equipment relocation, cash flow, downstream demand, logistics, and labour movement have all been affected.

The central government has been encouraging businesses to resume work, which many have done, but business disruption remains in place because local authorities have been using various administrative measures, such as extra health inspections and transportation restrictions, to ensure no new cases are registered. With no end to the global outbreak in sight, we believe any full resumption of business before Q3 is unlikely.

Resumption of business won’t ease coronavirus impact on global supply chains

Read moreBeijing has also postponed the ‘Two Sessions’ meeting – the top political and economic planning event of the year originally scheduled for 3-5 March 2020. Beijing’s decision to postpone the meeting marks a symbolic departure from a 35-year-old tradition; the event was not deferred during the SARS epidemic in 2003. While Beijing has not announced a new date for the two sessions meeting, we expect it to introduce various stimulus policies in key sectors (such as construction, manufacturing and finance) to cushion economic slowdown, including increasing investment, relaxing loans, and reducing the tax burden.

COVID-19 presents a mixed scenario for Chinese SOEs

Due to the collapse in demand caused by the COVID-19 outbreak, Chinese state-owned enterprises (SOEs) have been using force majeure declarations to get rid of loss-making trading deals. We expect some of them to use force majeure as leverage to propose price revision in exchange for upstream participation. The renegotiation strategy is in line with SOEs’ plan to reposition themselves as upstream oil and gas players rather than importers.

The impact of the pandemic on Chinese SOEs’ overseas production is far smaller than its impact on their domestic business. Considering the outbreak as a temporary issue, state-owned enterprises will be unlikely to scale down their overseas investment plans, which usually have a much longer timeline beyond 2020. However, due to the virus containment measures, alongside reported salary and headcount cuts, a number of small and medium-sized enterprises and SOEs are likely to end up in bankruptcy or restructuring, before life-saving stimulus measures arrive.