Multiple COVID-19 shocks mean no respite for oil and gas sector in near future

by Dr Kaho Yu,

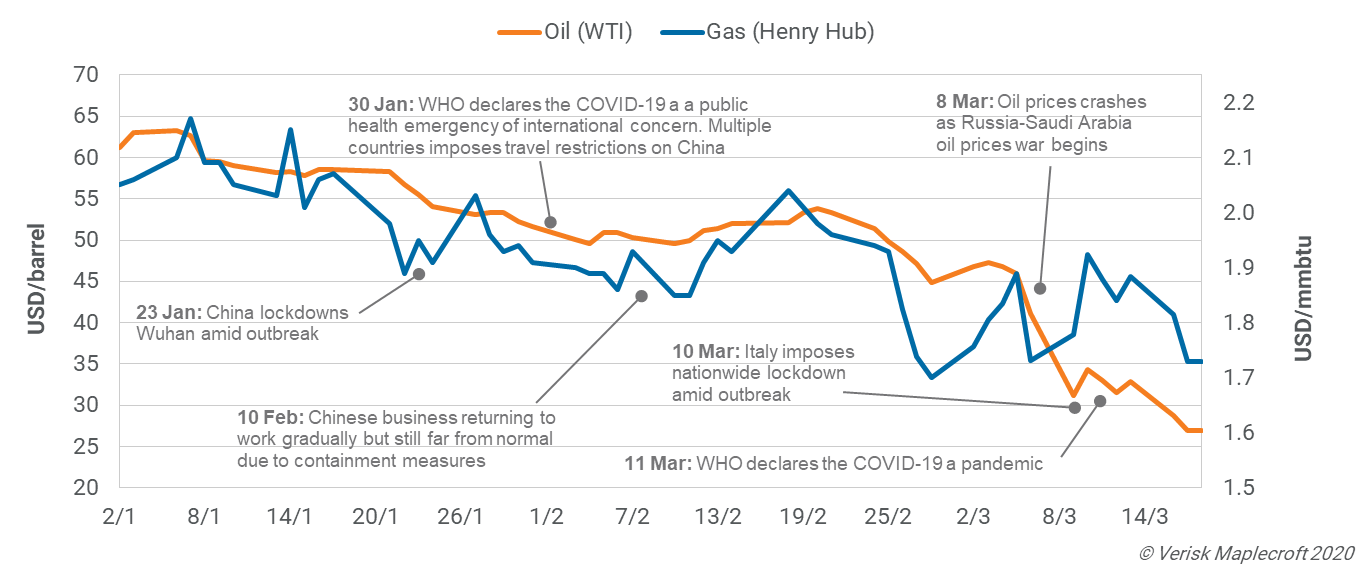

What makes the recent oil price collapse special is that it is not merely the result of Russia-Saudi supply competition but also slumping demand as the world battens down the hatches during the COVID-19 pandemic (see Figure 1). Travel restrictions and personnel quarantines due to drastic containment measures, first in China and now in Europe and the US, will continue to limit the use of jet fuel and slow down industrial activity over the coming months.

It comes at the worst possible time for the upstream market, which is already oversupplied following a warm winter and the new Ukraine transit deal with Russia. This means the likelihood of a bounceback for the sector won’t occur until…

COVID-19 putting global energy supply chain under stress

According to our sister company Wood Mackenzie:

'Global oil demand has lost almost 3 million barrels per day (b/d) in 2020-Q1 due to the COVID-19 outbreak'.

Sharp demand drops in Asia, particularly China, are unlikely to return to normal at least until mid-April. As a result, exporters have been eyeing alternative storage and refining destinations, such as Europe’s large wholesale market. However, this will likely change over the coming weeks as the COVID-19 in Europe continues to escalate.

However, Europe’s major oil and gas players, notably Italy and Germany, have been hit hard by COVID-19 and have taken drastic containment measures such as the suspension of industry and lockdowns. We expect similar responses across Europe to have further negative impacts on domestic oil and gas demand growth in the region for the rest of the year.

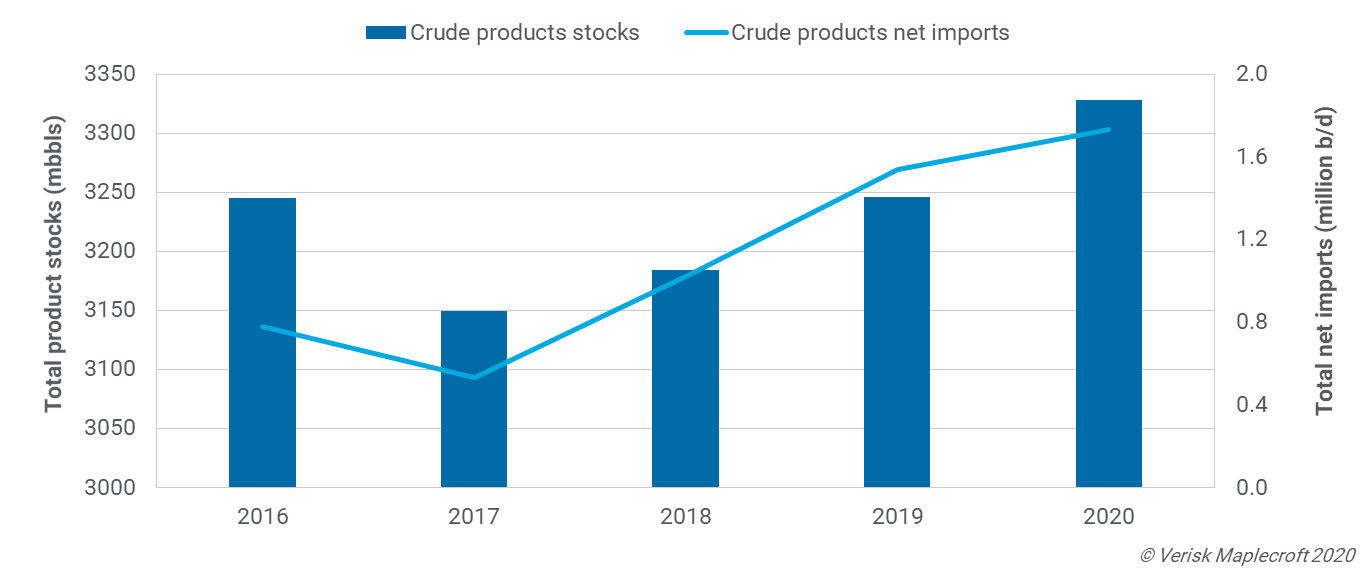

Other than the COVID-19 effect, regular pipeline and shipment imports and high storage levels have strained Europe’s ability to take in extra spot volumes. In Europe, the utilisation of oil and gas storage facilities has increased in recent years, underpinned by increasing trade movements and stock volumes (see Figure 2). Furthermore, low oil prices will likely cut investment in energy infrastructure, limiting the expansion of storage capacity in Europe.

Despite declining demand, large-scale force majeure declarations are unlikely to happen in Europe. Chinese oil and gas buyers have been using these to cut or delay loss-making contracts, or to renegotiate pricing during the height of the outbreak in China in February. Yet, US-Europe LNG contracts are more flexible with cargo destinations, and European buyers can resell the LNG in the spot market in case of limited domestic demand.

Containment measures limiting production activities

On the downstream side, crashing oil prices would normally lead to a surge in refining for cheaper fuels that help mitigate the price impact on overall business performance. It is unlikely to happen again this year due to the impact of COVID-19. As such, companies with global trading and retail networks will be in a better position to take the refining margins.

While a falling global fuel demand will likely strain the onshore and offshore storage capacity, producers will likely have to curb oil drilling to adjust to lower levels in the coming weeks. Since jet fuel has a shorter shelf life than other products, it normally cannot be stored for long periods, reducing the commercial incentive for its production. Unless the aviation industry bounces back soon, refiners will likely have to curtail jet fuel output and decline offers from producers.

Turbulence in energy sectors as COVID-19 spreads globally amid oil price war

Read moreApart from this, we also expect significant operational disruption over the coming months. Facilities, such as refineries, platforms, ports, and LNG terminals that are highly labour-intensive will likely face workforce shortages due to containment protocols.

Although automated facilities can run closer to full capacity, a disrupted global supply chain due to delayed production and travel restrictions will likely force some energy companies to reduce or stop production.

Lesson learnt: Diversification strategy needed for risk mitigation

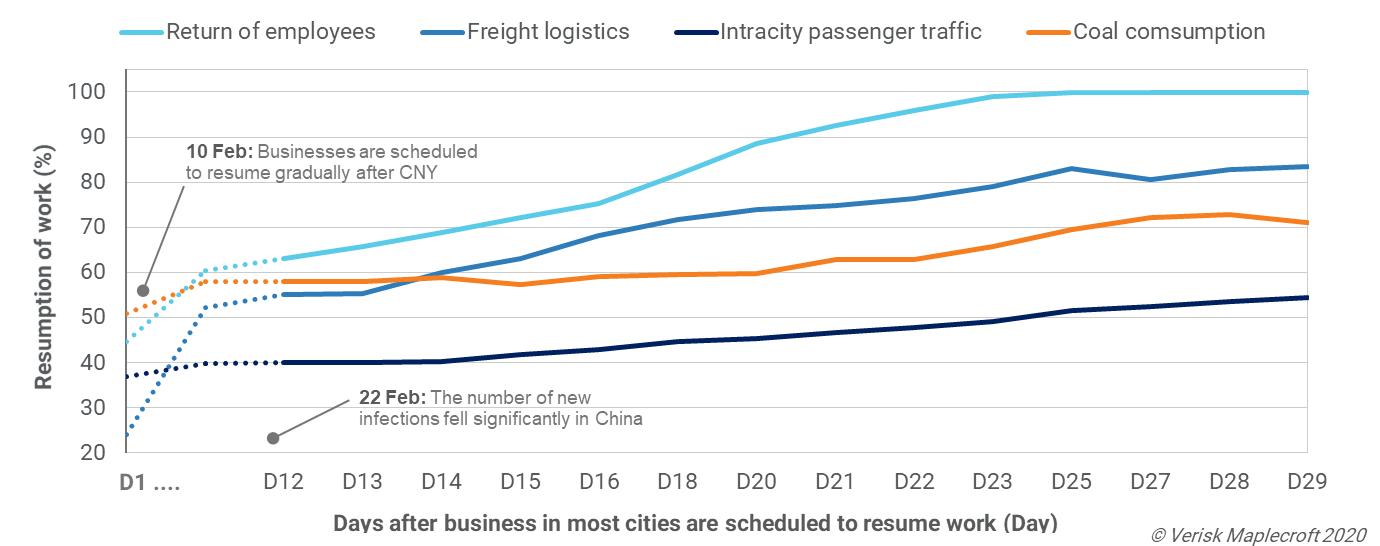

Although the COVID-19 containment timeline is highly unpredictable, we expect disruption on the global energy supply chain to last till at least Q2 or even Q3 in the current economic climate. Compared to the US and Europe, however, China has more policy momentum to boost the economy. Sign of economic stimulus from Beijing has the potential to place a floor under oil prices but sharp demand recovery is unlikely before a full resumption of business activities (see Figure 3).

When the virus first broke out in China and spread to nearby Asian countries, Europe became the alternative destination for oil and gas cargoes. Given that COVID-19 is now spreading in Europe, a comparatively stabilising Asia, particularly India, will likely be the next destination if Europe-bound cargoes are eventually diverted or resold due to containment measures.

One lesson is that the performance of oil and gas players is highly weighted towards the outbreak in the countries they operate in and the level of exposure to China. There will be an increased need for a diversification strategy when oil and gas businesses come back online.