Major emitters to prioritise economic recovery over climate action

by Franca Wolf,

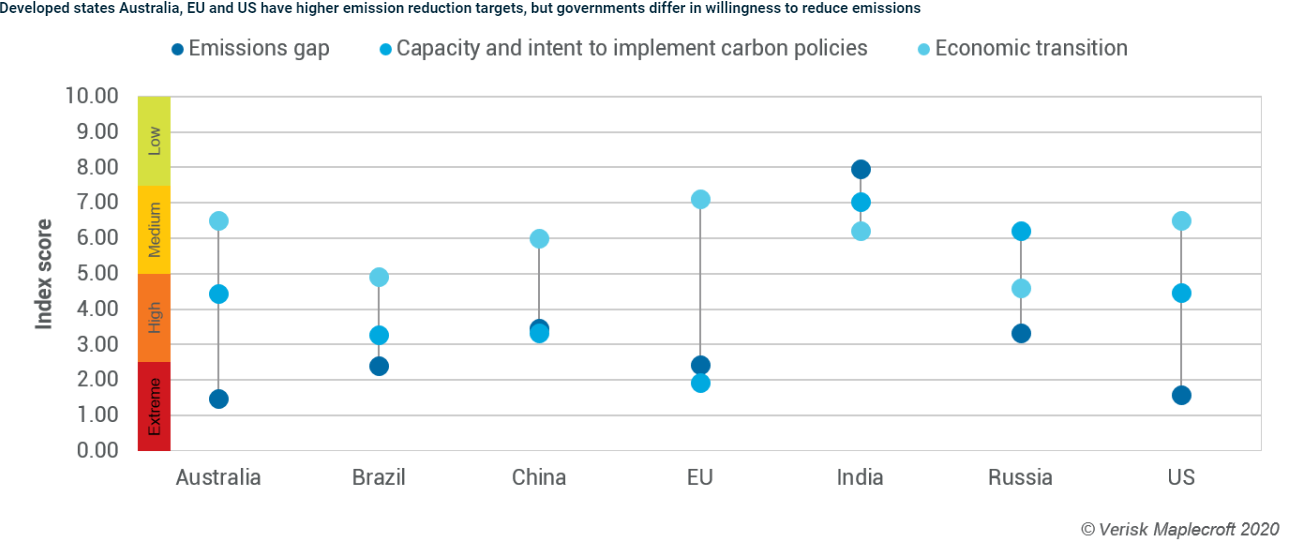

As the pandemic forces governments to provide economic stimulus, the crisis presents an opportunity to put economies on track for the energy transition. While climate change is a global challenge, a small number of countries account for the large majority of emissions: China, the United States, the EU, India, Russia, Brazil and Australia were responsible for two-thirds of global emissions in 2017.

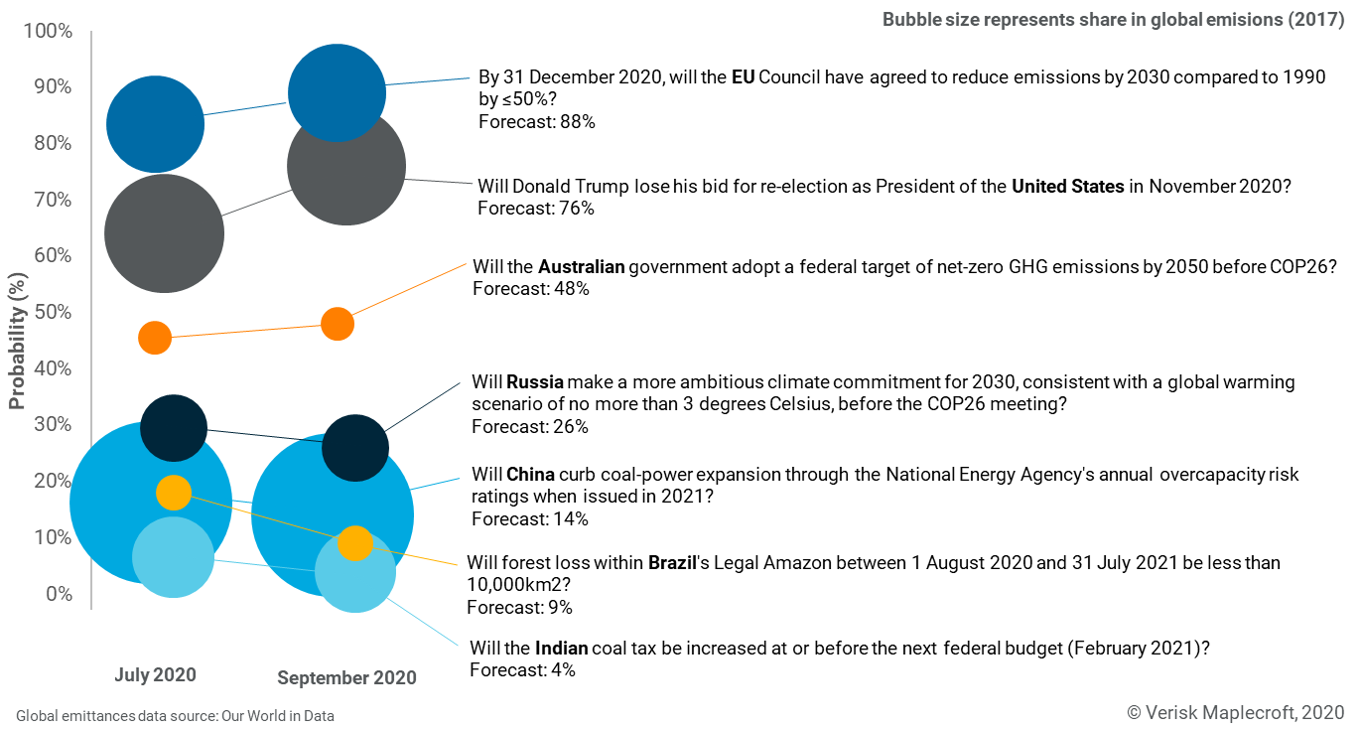

In our latest judgment-based forecast, we zero in on these major emitting countries and ask a series of questions generally aimed at forecasting the likelihood of policy action that would imply greater commitment to reducing emissions (see visual below). While we expect the EU and the US to enter 2021 with stronger energy transition ambitions, the other countries are likely to prioritise economic recovery over climate action amid the biggest recession in recent history.

Economic concerns top climate ambitions in developing countries

Coal dependency is a particular burden for greater climate action among many of the biggest polluting states. With economic growth paramount to government stability in many developing countries, we expect China, Russia, India and Brazil to prioritise a swift economic recovery over a green recovery.

Beijing’s long-term energy targets and growing public pressure to reduce pollution make higher caps on coal production likely in the medium term. However, the government’s desire to use a lower coal price and planned infrastructure projects to stimulate economic growth will increase coal demand in 2020.

Our forecasters see a mere 16% likelihood that China's National Energy Administration's Risk Rating in 2021 will curb coal expansion with more regions being marked as at risk of over-capacity.

Parallels can be drawn to our India and Russia forecasts. For New Delhi, recent moves to auction 41 coal blocks to stimulate industrial production and a push-back against 2022 emission cuts make it unlikely that the coal tax will be increased before the next Federal budget. Indeed, industry lobbying and a desire to keep revenues equivalent to about 3% of indirect taxes amid the recession drive our forecast of only a 7% likelihood of an increase in India's coal tax in the next budget due in February 2021.

Find out more about our Environmental risk and climate change solutions

For Russia, the energy transition directly threatens the economic model, as the O&G sector accounts for 39% of the economy. With the Kremlin unappreciative of the risks of climate change, a track record of unambitious emission targets and a powerful corporate lobby, we forecast only a 29% likelihood of the government raising its 2030 climate commitment before COP26 to put the country on track for a 3 degrees Celsius warming scenario, up from its current +4 degrees Celsius.

Our forecast on the area of the legal Amazon to be deforested in the one-year period up to July 2021 indirectly captures the trajectory of Brazil’s energy transition. President Bolsonaro’s support for agri-businesses and resource exploitation, and reluctance to rein in illegal burning, has seen the loss of the Amazon accelerate to above 10,000km2 in 2019, and we forecast a 56% likelihood of deforestation to exceed 12,000km2 by 2021. With emissions in the legal Amazon estimated to contribute around 36% of Brazil’s total emissions, this suggests dire consequences for Brazil’s emissions status.

Australia, the outlier

The high share of fossil fuels in Australia’s exports drives our forecasted 55% likelihood that the federal government will fail to adopt a federal 2050 net-zero target by the start of COP26. The Queensland state election in October will be a key signpost: unless the government’s climate change scepticism emerges as an electoral liability, we expect it to continue using it against the Labor opposition. This makes Australia an outlier among the developed countries, which are major emitters, as we generally expect developed economies to be more likely to take policy action advancing the energy transition.

Optimism for climate action in major developed states

Just as the pandemic hit Europe, the EU Commission was gearing up to get support for its Green Deal. Centred around a 2050 climate neutrality pledge, this would firmly place the EU at the helm of global climate leadership. The pandemic initially diverted attention, but this week’s stimulus package deal allocating up to EUR550 bn (or 30% of the budget, up from the proposed 25%) for climate mitigation measures until 2027 highlights the bloc’s willingness to use the crisis as an opportunity for climate action. We forecast the EU Council to raise its 2030 emission reduction target from its current 40% to 50% or more over 1990 levels before year’s end.

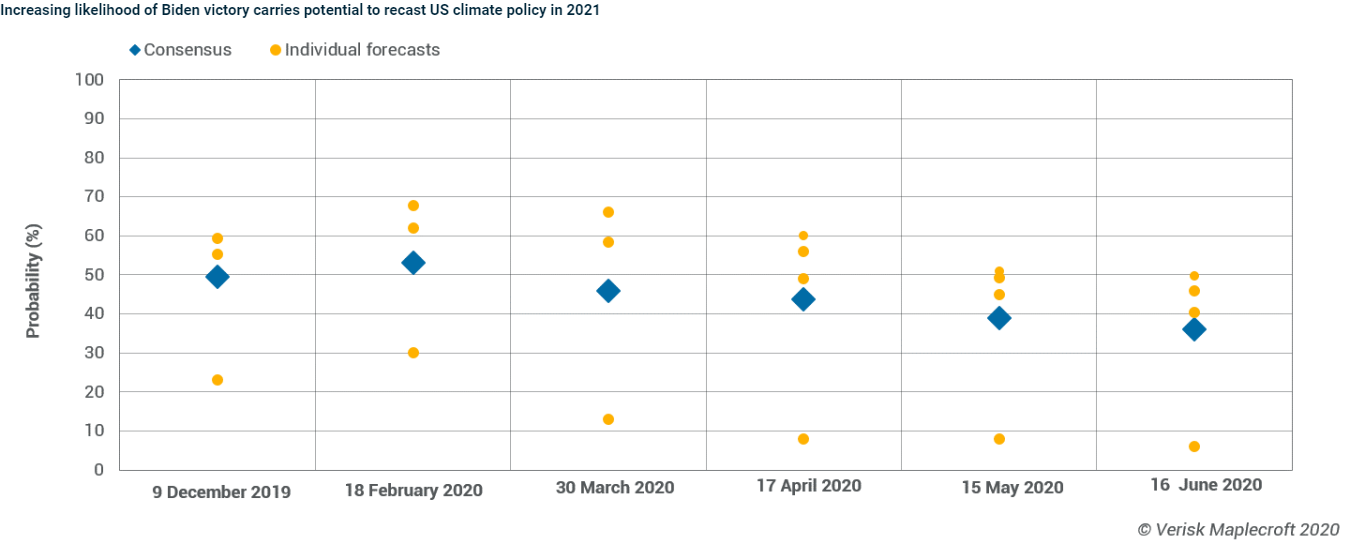

Meanwhile, the pandemic has raised the likelihood of a Democratic victory in November’s US presidential elections. We now forecast a 64% likelihood of Joe Biden winning the election; a result, which would recast US climate policy from 2021 (see visual below). Biden has pledged to reverse President Trump’s decision to take the US out of the Paris Agreement, introduce a 2050 net-zero target and adopt a Green New Deal.

Disappointing COP26

Given the uncertainty over the length of the pandemic and its economic impact, we expect that most of the largest polluting countries will seek to avoid adding to the economic burden faced by their companies by strengthening energy transition policies. This will make for an unambitious COP26.

Postponed to November 2021, COP26 is meant to be a crunch point for global climate action, as signatories to the Paris Agreement need to submit their Nationally Determined Contributions (NDCs). Countries were expected to raise their ambitions to reduce emissions but among major emitters, only the EU and the US are likely to do so. This suggests that the EU’s ambition to lead by example has been ineffective and US global leadership and soft power is likely now insufficient to advance the climate action leadership, even if Biden wins the US election.