Labour rights unravelling as Asia’s garment sector comes apart at the seams

by Sofia Nazalya,

South East Asia’s 40 million garment workers are at the sharp end of the coronavirus crisis. The pandemic has devastated the sector, leaving thousands unemployed and facing poverty, while the health and safety of those who continue to work is at serious risk in factories that are not geared up for social distancing.

With economic pressure mounting on Asian garment manufacturers in countries, such as Cambodia, Bangladesh, Indonesia, Myanmar and Vietnam, the knock-on implications for fashion and retail companies trying to maintain supply chains from these locations are manifold.

Poor labour rights set to worsen across the region

Asia’s garment hubs already perform poorly across our labour rights indices, with all rated high or extreme risk for forced labour, child labour and occupational health and safety. However, we expect an increase in these risks across the board as staff are laid off and livelihoods are threatened. As a result, laid-off workers are likely to turn to exploitative employment that increases the risks of forced labour. The chances of children entering the workforce will also rise exponentially, as families attempt to make up shortfalls in earnings.

The health and safety of garment workers who continue to work in factories is a serious risk. In Cambodia and Bangladesh, workers have little choice but to continue working in packed facilities in order to provide for their families and pay off microloan debts. It’s highly doubtful that social distancing measures will be effectively enforced, heightening the risk of infection.

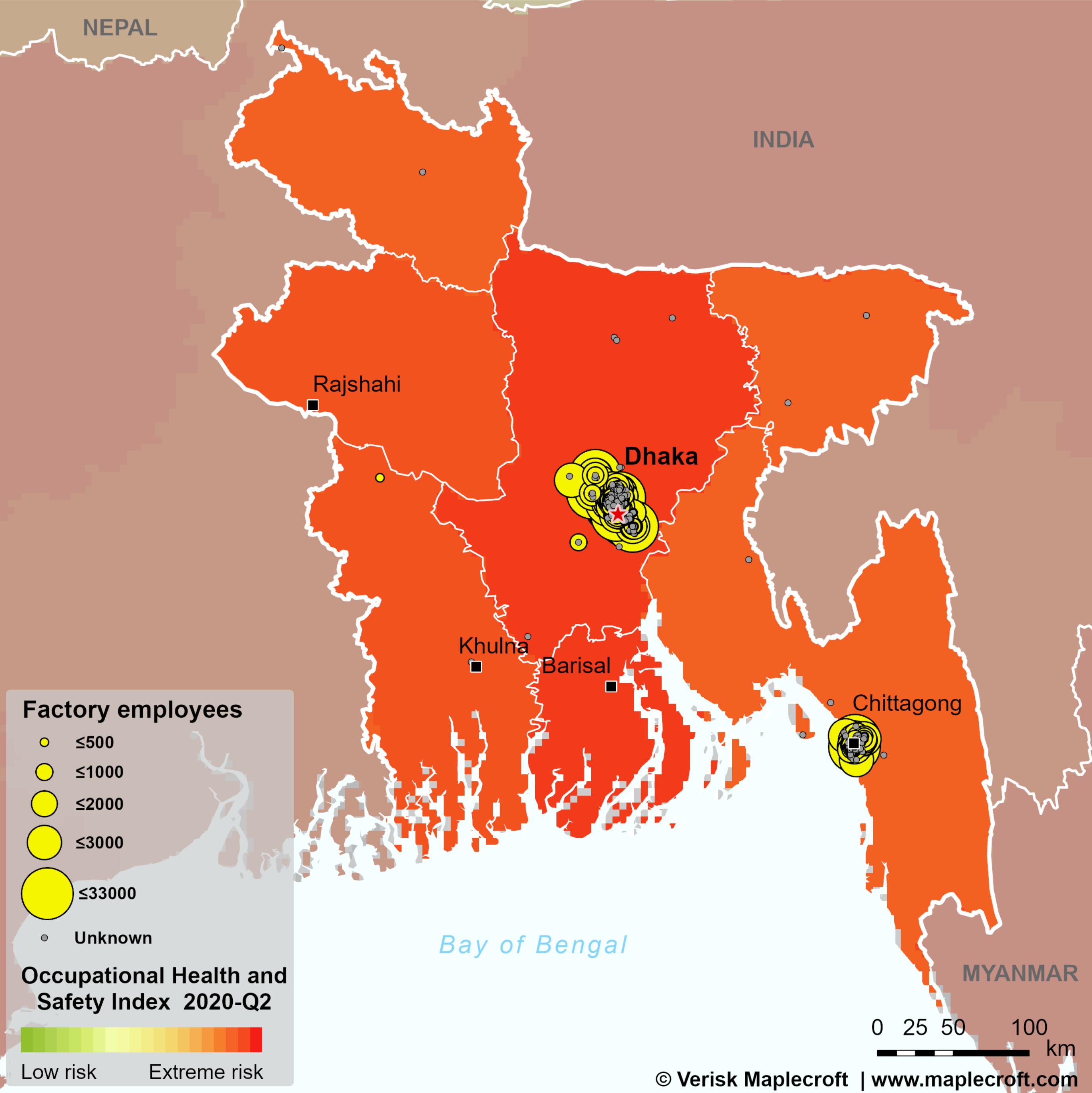

Our subnational index for Occupational Health and Safety shows that the central area of Bangladesh, constitutes a higher risk than the rest of the country.

Dhaka administrative region is home to most of the country’s garment manufacturing factories and was already rated extreme risk for OHS prior to the pandemic. We are likely to see the region’s score worsen even more.

Pressure ratcheting up on retail and fashion brands

Over the next several months, global retail companies will face increasing pressure by international and grassroots labour advocacy groups to ensure that the most vulnerable workers in their supply chain are not left behind. In particular, retail companies will be pressed to meet payments for orders placed, and to ensure that suppliers that do continue with operations enforce strict health and safety measures.

Some companies have already begun to implement measures to mitigate impacts of COVID-19 on garment workers. Such measures include establishing COVID-19 wage funds and committing to payment for orders already placed. However, these actions are unlikely to be a lasting solution for workers who ultimately face sustained unemployment.

As the pandemic continues to spread across Asia and the world, we expect layoffs of garment workers to continue in 2020-Q2, reflecting the serious economic disruption facing the sector.

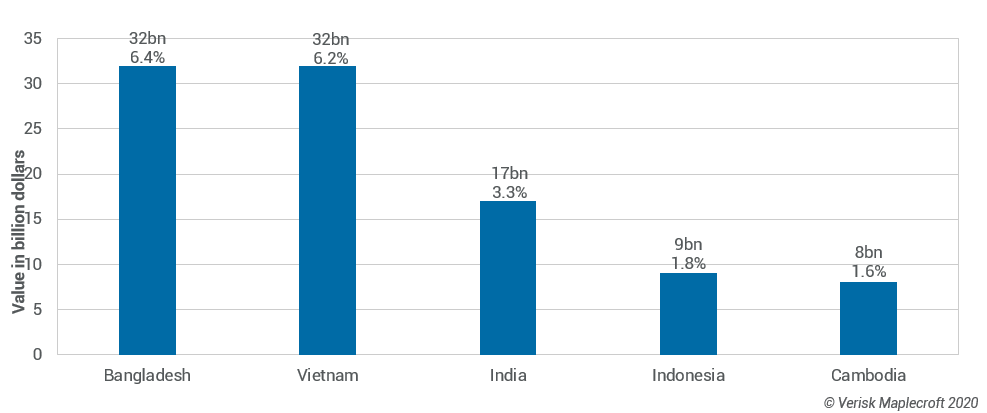

Lower consumer demand, supply chain disruptions and inability to source raw materials will result in continued losses for the industry. In particular, workers in the top five Asian garment manufacturing hubs are at grave risk (see figure below).

The effects will be felt most severely by informal workers – a group that is already highly vulnerable to forced labour and human trafficking risks. Considering the substantial percentage of garment workers in Bangladesh and Myanmar that continue to be employed informally, this will present significant challenges for procurement departments that need to ensure illegal working practices do not seep into their supply chains.

Combustible mix of risks will need new solutions

Government support for laid off workers across Asia’s garment producing countries is unlikely to cover their financial losses. The Bangladesh Garment Manufacturers and Exporters Association (BGMEA) has criticised the Bangladesh government’s USD588 million stimulus package for the export sector as insufficient. According to BGMEA, by the start of April, 1,082 factories had already reported the loss of close to USD3 billion dollars as orders were cancelled or suspended.

Garment workers in Cambodia face similarly dismal prospects. Prime Minister Hun Sen recently announced suspended garment workers would receive USD70 a month – USD40 coming from the state, with the employer paying the rest. This represents 37% of the current minimum wage – a sizable cut from the USD114 initially promised.

So, what can we expect? Massive layoffs will ignite labour unrest and union activity as workers protest unfavourable working conditions and demand wages owed. In the capitals of Bangladesh and Cambodia, thousands of laid off workers have already held protests demanding wages owed and severance pay, which may only be the start.

This leaves fashion and retail companies facing a combustible mix of reputational risks that cannot be offset by onsite inspections, along with ongoing disruptions from shortages of material and potential flare ups of civil unrest in their key hubs. These are difficult times in which a business-as-usual model won’t work. Getting creative about managing risk using data screening or assessing suppliers using tools, such as SMART SAQs, is going to be essential in the coming months. Doing this now could avert some of the effects of this crisis and ultimately help prepare for the next.