Investors in Chinese tech firms exposed to Xinjiang abuses

by Sofia Nazalya,

There are two reasons why Washington’s latest move in the stand-off with China should make tech firms sit up and take note. For one thing, the Trump administration’s decision in October to add 28 Chinese entities to its trade blacklist marks the first time the US has cited human rights violations as a reason for penalising Chinese companies. Secondly, the blacklist features several prominent tech firms, some of which have been singled out by Beijing as its national ‘AI champions’.

The US trade war with China has overnight morphed into a broader strategic confrontation, with the tech sector in the eye of the storm. Though the ramifications could go well beyond just this sector.

Blacklist forces reassessment of firms tied to Xinjiang

The blacklist announced on 8 October 2019 penalises organisations with alleged involvement in human rights violations in China’s western Xinjiang region, and effectively bars the sanctioned firms from buying products from US suppliers without prior approval from the US Department of Commerce, which operates a ‘presumption of denial’ policy – meaning that the application will be denied in most cases.

The decision intensifies reputational risk for institutional investors with interests in the Chinese tech firms that were sanctioned, including Megvii, Sensetime and Hikvision. We therefore expect that most responsible investors will reassess their dealing with any Chinese organisations alleged to be involved in perpetrating mass human rights violations in Xinjiang.

The new trade restrictions will have a sizable operational and financial impact on US chipmakers, such as Nvidia, Ambarella, Intel and Qualcomm, which supply components to Chinese tech companies on the blacklist. Shares of Ambarella and Nvidia both dropped 12% on the NASDAQ within 24 hours of the announcement of the ban.

Conversely, non-Chinese tech firms stand to benefit, as investors look elsewhere for opportunities. Hanwha Techwin, a South Korean video surveillance provider, has seen its share price rise by more than 4% following news of the blacklisting of its Chinese rivals.

Chinese tit-for-tat measures likely

China’s Foreign Ministry said on Monday that it would continue to take firm measures “to protect its sovereign security”. The latest move by the Trump administration will only confirm to Beijing the need to roll out its own ‘Unreliable Entity List’ – an idea first mooted in May 2019 and aimed at targeting foreign entities that boycott or cut off supplies to Chinese companies for non-commercial purposes.

Although Beijing aims to bolster its ‘semiconductor sovereignty’ under its Made in China 2025 industrial policy, companies like Hikvision, SenseTime and Megvii are still heavily dependent on US semiconductors. The ban will spur these national champions to plough additional funding into developing their own chips and other core technologies.

Xinjiang to rise up the risk agenda for F&B, tech and apparel firms

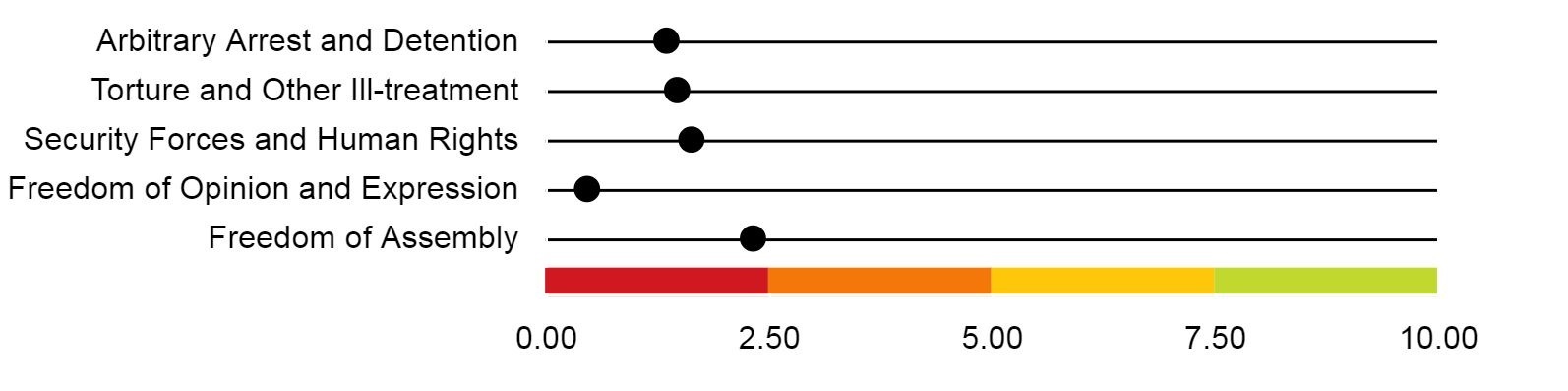

The Trump administration’s decision to penalise organisations with alleged involvement in human rights violations in China’s western Xinjiang region reflects growing international condemnation of Beijing’s arbitrary detention of up to a million Uyghurs and other predominantly Muslim ethnic minorities in internment camps. China is categorised as extreme risk in several of our key human rights indices (see figure above).

The US Congress is already taking steps to put pressure on Beijing via the Uyghur Human Rights Policy Act. If passed, the Act would introduce a ban on any US-made product or service linked to the mass internment or forced labour of Uyghurs. We expect ICT, apparel and food-processing companies with links to Xinjiang to face significant operational and financial disruption as a result.

The prospects for further provocations, sanctions and reciprocations between these two trading giants can only grow.

Learn more about Human rights due diligence