Gaps between sovereign ESG leaders and laggards to grow despite positive outlook

by Camilla Ogunbiyi,

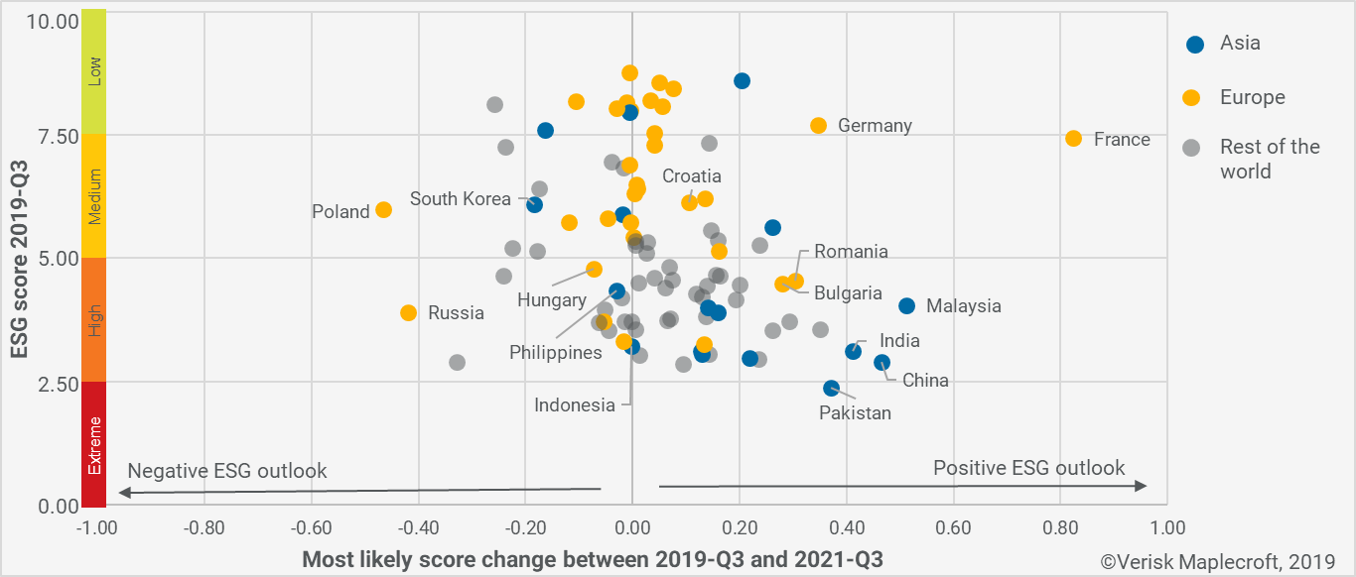

Our latest ESG outlook to 2021 projects ESG risks are likely to decline at a global level. Among the 95 emerging and developed markets covered by our forecast, we expect 74% will improve their overall ESG score. Improvements are incremental for many, but the direction of travel is clear and testament to the growing capacity of many governments to address ESG issues, particularly concerning corruption and governance1.

However, while various European and Asian countries are among those showing the greatest potential for improvement, these regions also demonstrate significant internal divergence; between developed and emerging markets in Europe on the one hand, and between China, India and most other Asian markets on the other. More broadly, global convergence is unlikely to be swift, if it happens at all. Just as many emerging economies have stalled in a middle-income growth trap, developed – particularly developed European – markets are likely to remain far ahead on ESG performance.

Europe: EU drives governance improvements but internal divergence will increase

Our forecast confirms, to some degree, the role the EU continues to play in raising governance standards among member states. Some of the newest member states, Croatia, Romania and Bulgaria for example, are among those we forecast to show the most improvement. This positive outlook is largely driven by stronger whistle-blower protections enacted at the European level, which must be legislated for by member states within the coming two years.

This drive towards improved governance standards within the EU is, however, not uniform. Indeed, we expect Hungary and Poland’s respective ESG scores to have deteriorated by 2021. For Hungary this is driven partly by a projected increase in corruption, despite the EU-wide regulatory improvements for whistle-blowers. Meanwhile for Poland our negative outlook largely reflects our expectation of greater social risks, where we consider it likely forced labour violations will become more frequent.

Divergence in Europe is perhaps most obvious though when it comes to environmental risks. A growing split between Western Europe and Central and Eastern Europe is preventing joint regulatory action. This division is another factor in the gaps exhibited in our ESG forecast. Most notably, the positive outlook for Germany and France is partly a result of improvements in the environmental pillar, whereas Poland’s negative outlook reflects the country’s increasing risk of water stress – just as it drags its feet on strengthening environmental protections.

Key Asian markets underpin positive emerging market outlook

Among emerging markets, we forecast Malaysia, China, India and Pakistan will likely see the greatest improvements in the ESG space. Our positive outlooks for Malaysia and China are underpinned almost solely by confidence in corruption risks receding as a result of more effective anti-corruption bodies in both, though particularly in Malaysia. In India, meanwhile, the improved outlook is also governance-related, though within the environmental pillar. We expect India to strengthen its environmental governance through the introduction of an independent environment ministry.

Pakistan is also notable for its positive outlook, though this is driven primarily by our expectation of reduced social risks. We forecast an increase in the number of labour inspectors which will likely contribute to less severe forced labour violations.

Learn more about our forward-looking index projections

For other Asian emerging markets however, our outlook is far from bright. Indonesia and the Philippines, for example, face greater risks from water stress. This also applies to South Korea, which is the most notable laggard among emerging Asia. In addition to heightened water stress, we also forecast a small but credible possibility that more severe forced labour violations will dent its ESG score by 2021.

What's the outlook for developed and emerging markets?

Improvements in ESG outlooks come in many shapes and sizes: while reductions in corruption risk represent perhaps the most important factor underpinning many positive forecasts, others are driven by expectations of lower social or environmental risks. However, the clear pattern that emerges from our data is that ESG risks are slowly but steadily rising up the agenda of many governments in developed and emerging markets alike. Nonetheless, clear signs of divergence within regions and globally suggest that emerging markets remain a long way from reducing their ESG risks to match those in developed markets, most notably Western Europe.