Why it matters

Deforestation will rise up the agenda for companies in 2020, as they contend with challenges emanating from very different directions. Consumer concern over global forest loss is nothing new, but investors are now also ratcheting up the pressure on corporates over their exposure to deforestation across global operations and supply chains. And, as November’s crunch COP26 climate talks hove into view, countries that have promised forestry policies as a means of cutting their emissions will suddenly have to separate the wood from the trees.

Almost 140 country pledges submitted under the 2015 Paris Agreement mention forest landscape restoration, of which about a third include a numerical target for land use, land use change, and forests (LULUCF). But the lack of progress means forests are still being converted to farmland for commodities such as palm oil, soy, cocoa, beef and minerals.

If countries are serious about halting forest loss they will need to regulate. And these new policies will bring additional costs to companies, impact commodities and supply chains, and could mean even tougher scrutiny for sectors driving forest loss – such as agriculture, mining, and oil and gas – as well as for their investors.

Watch out for

States will be rushing through laws protecting forests, potentially with little scrutiny or consideration. The COP25 climate talks in December 2019 achieved very little despite the background of huge fires in the Amazon and Australia.

Without any concrete agreement, pressure is ramped up for the COP26 summit in Glasgow at the end of the year, when countries will be asked to step up their carbon mitigation efforts to bring them in line with the goal of limiting global temperature rise to “well below” 2°C. Separately, an international biodiversity pact tipped for agreement at talks in Beijing this year would also add impetus to creating new protected areas in forests.

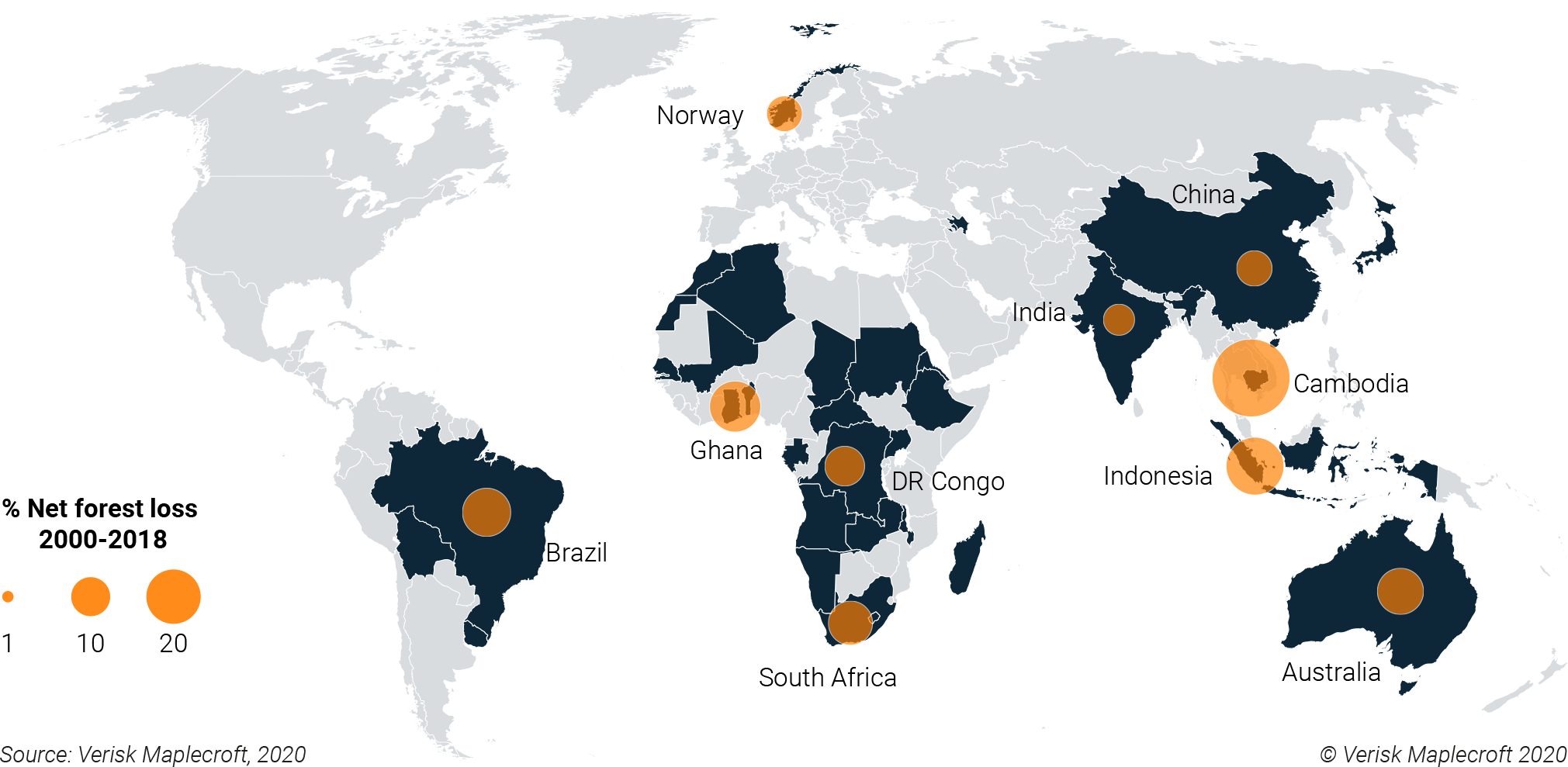

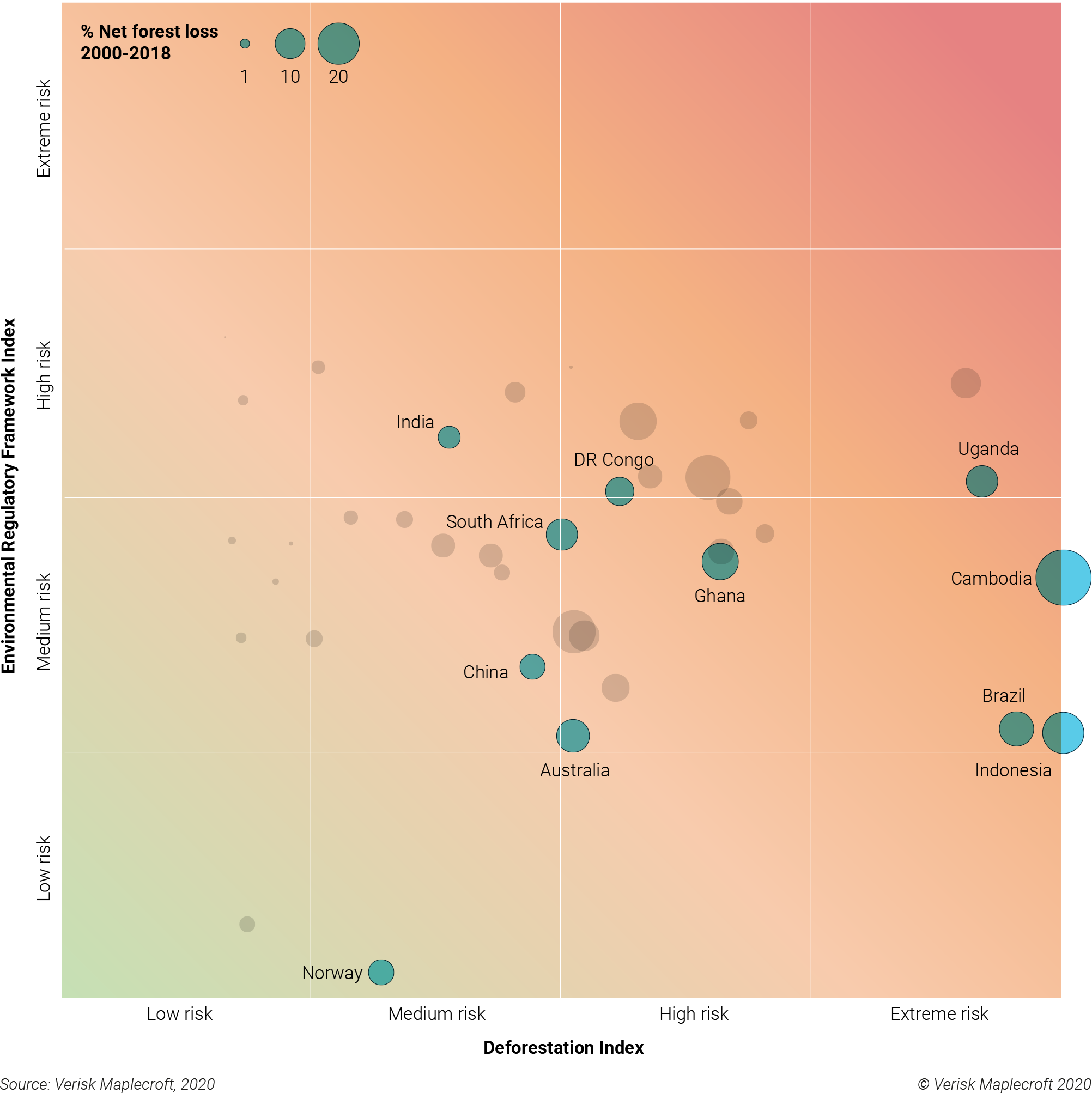

Of the 38 nations that outlined targets or measures to address LULUCF in their Paris Agreement pledges, 19 are high or extreme risk in our Deforestation Index, including key commodity-producing countries. What’s more, of those 19 countries, eight – including DR Congo and Uganda – are high or extreme risk in our Environmental Regulatory Framework Index, indicating that even if these nations really intended to get to grips with forest loss, their efforts could well be undermined by weak policies, structures and institutions.

Companies operating in these countries will need to be aware of the potential for new forest policies over 2020 that would restrict the activities of sectors associated with forest loss. Moreover, the implementation of these policies is unlikely to be smooth sailing, creating considerable uncertainty that makes forward planning far more difficult.

Download our Environmental Risk Outlook webinar recording

Next steps

Companies need to pinpoint risk and act to limit their exposure. Most organisations will probably be aware of the impact their direct operations have on forest loss. The next steps are to track that impact, set measurable targets to reduce it and, ideally, disclose progress publicly through a recognised benchmark. This shows investors and consumers that the company is proactively dealing with deforestation risk and is well placed to deal with any regulatory changes in the countries where it operates.

However, visibility along supply chains is trickier: tracing suppliers and their contribution to forest loss becomes increasingly difficult once you move beyond tier 1. But identifying at-risk commodities in sourcing regions can help lower your exposure to deforestation. For example, our research identifies a strong correlation between increasing cattle numbers in Brazil’s Amazon states with the growth in the incidence of fires.

Soy, palm oil, gold and sugarcane are all associated with forest loss in different parts of the world. And, as the focus on forests grows over 2020, companies sourcing these materials need to be extra vigilant to insure against damaging regulatory, reputational and environmental threats.