Carbon pricing too weak for major emitters to meet climate targets

by Franca Wolf,

Less than three months before the long-awaited COP26, our latest forecasts on the commitment of major emitters to the energy transition suggests that a lack of momentum will hamper robust emissions reduction on the pathway to a net-zero world in 2050. Carbon pricing is one of the most effective mechanisms to reduce emissions and promises to be a key point on the COP26 agenda, but it is still in its infancy on a global scale. Moreover, a closer look at existing carbon pricing schemes highlights inconsistencies even in those emitters that have been making strides. In the absence of carbon pricing schemes capturing a larger share of emissions at a higher price, the road to net-zero will be rocky.

Weak ambition ahead of COP26

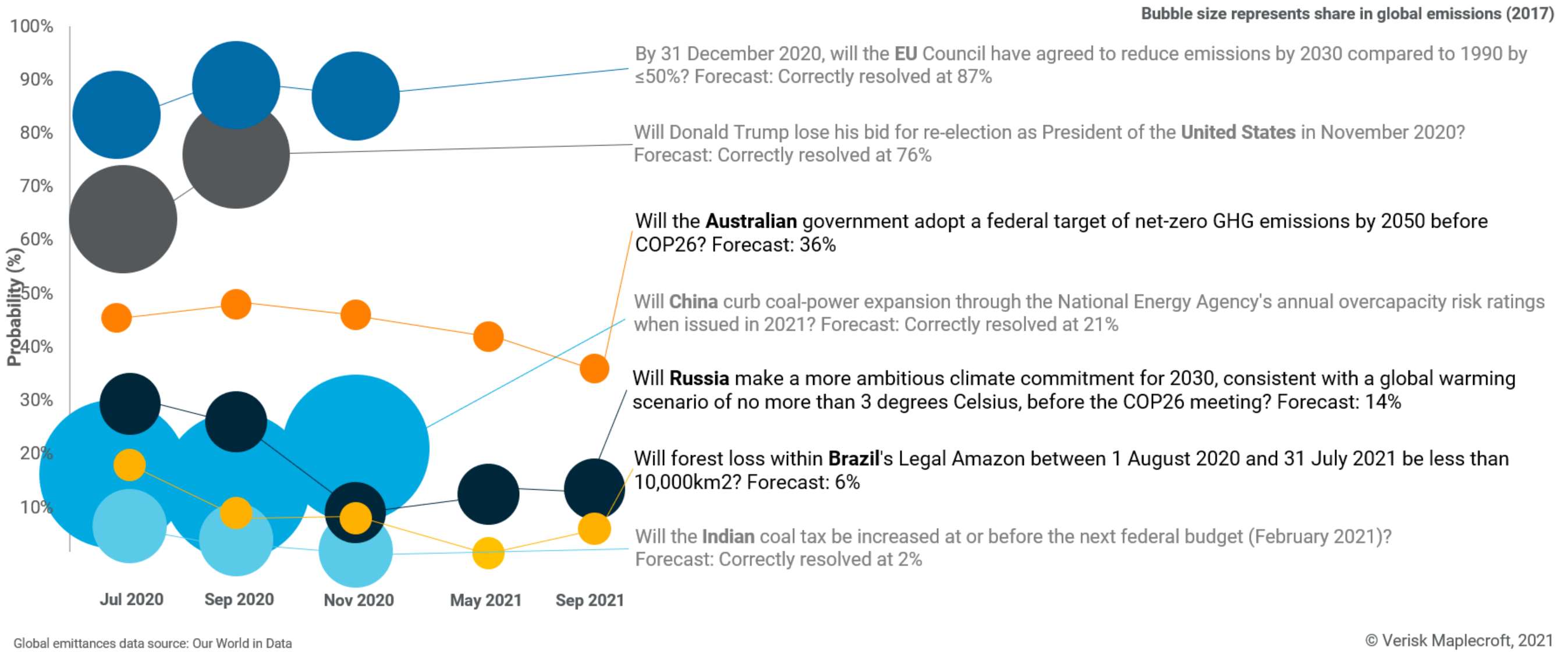

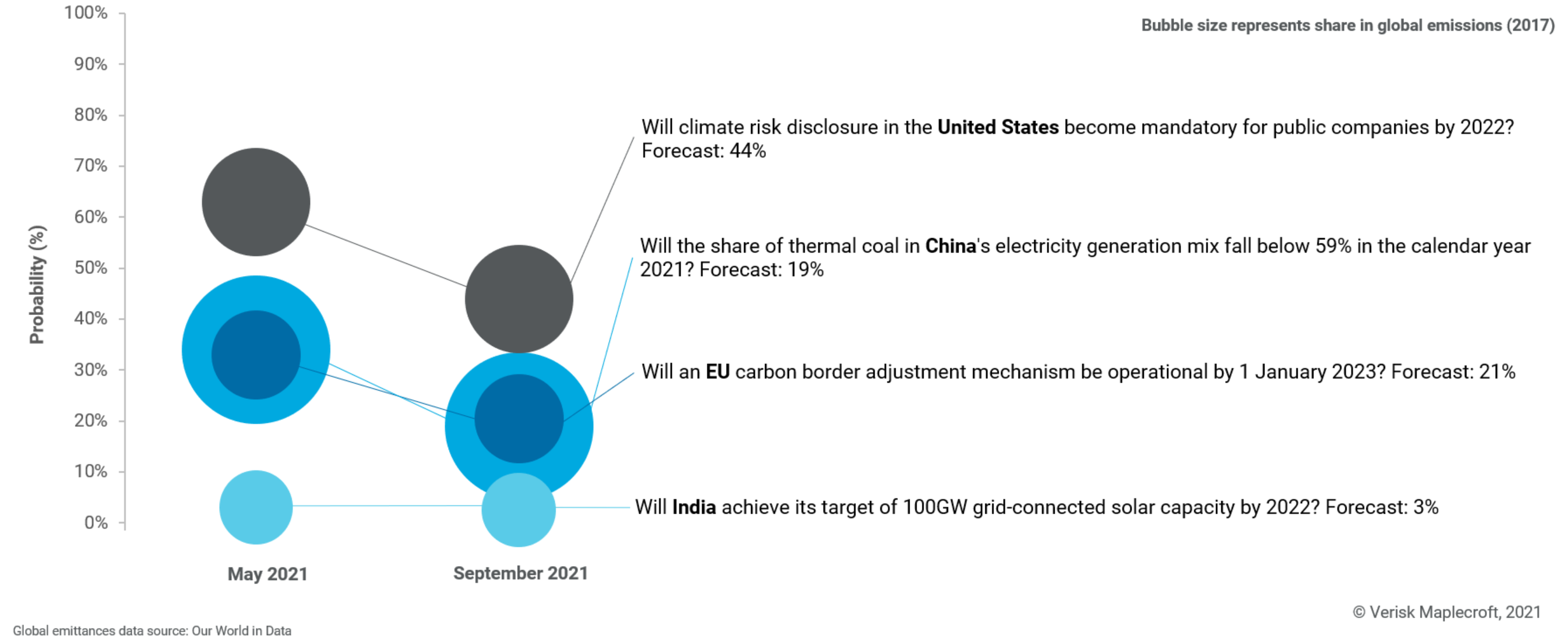

In the latest update of our judgment-based forecast series assessing the political commitment to the energy transition in seven major emitters (Australia, Brazil, EU, China, India, Russia, US), we continue to see a gap between predominantly developed economies looking to strengthen their climate action while poorer economies prioritise post-pandemic growth. For example, we consider it virtually impossible that India will achieve its solar energy targets in 2021. Conversely, the US and EU have both raised ambitious climate policy plans – mandatory climate risk disclosure for the US and the carbon border adjustment mechanism in the EU – but we forecast that implementation is still some time away.

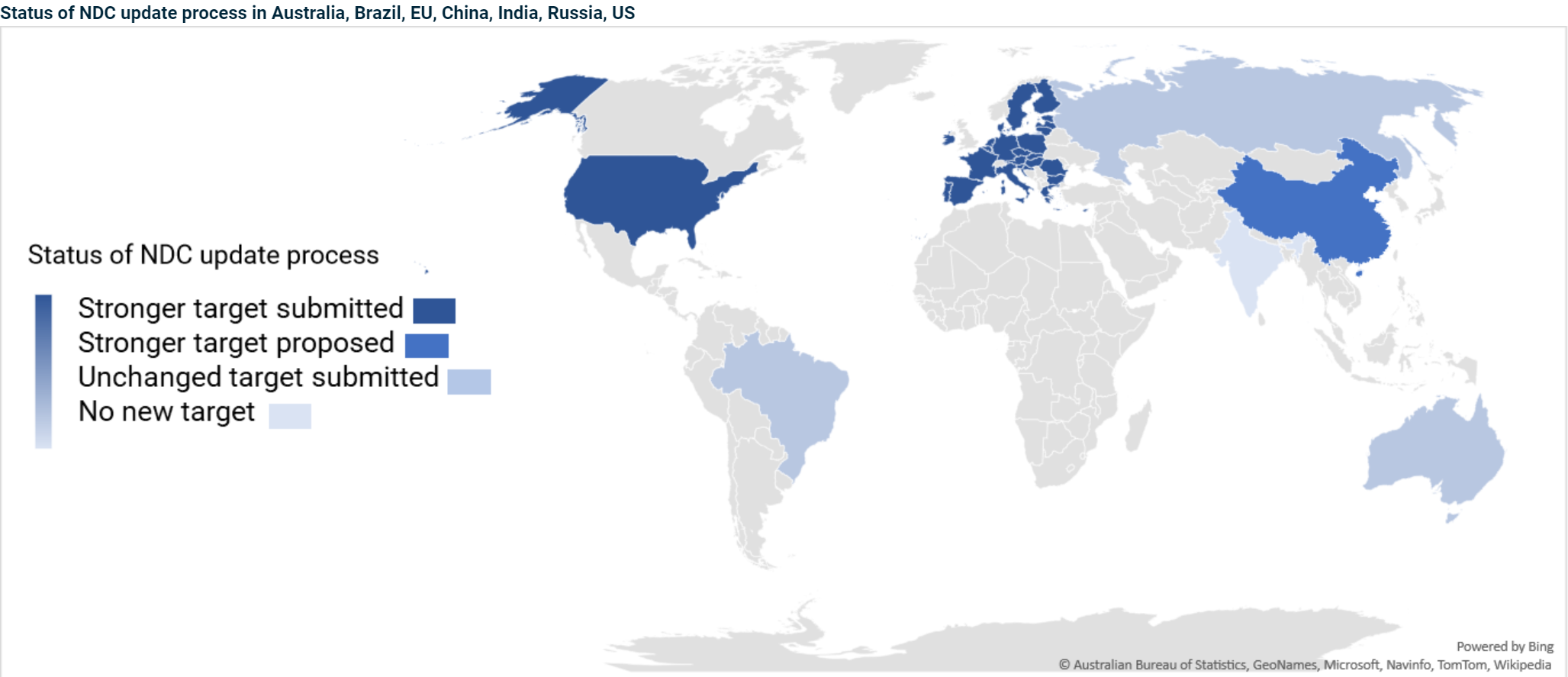

COP26 is about ensuring that countries move to a pathway to become carbon-neutral by mid-century; given so few are on this trajectory, parties will be asked at the summit to increase their GHG emissions reduction targets and accelerate decarbonisation efforts. However, among our seven major emitters, only the EU and US submitted more ambitious nationally determined contributions (NDCs) while China proposed stronger targets.

Inaction on the part of Australia, Russia, India and Brazil which leaves them far from becoming climate-neutral by 2050 is confronted with the lack of policies and mechanisms to reach existing targets in the EU, US and China.

Pricing emissions

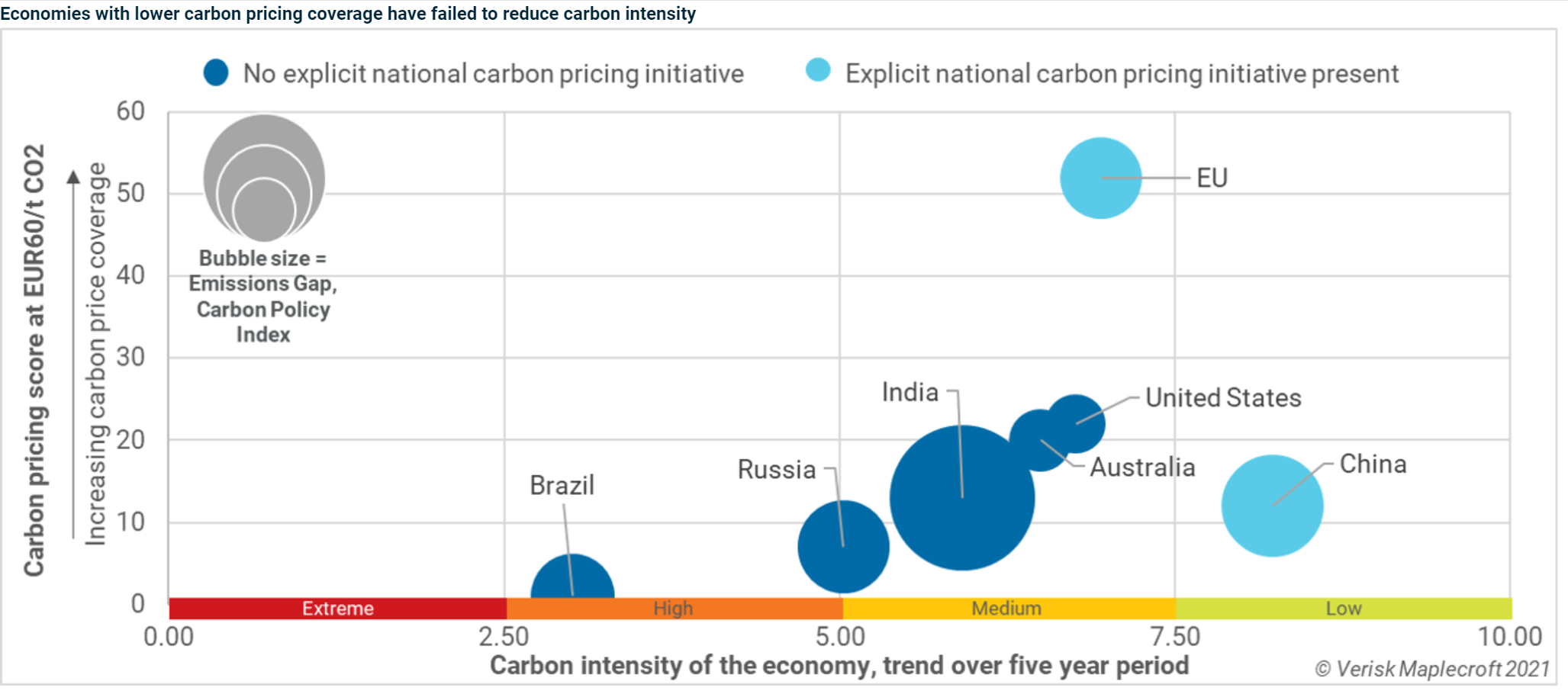

Carbon pricing schemes are an effective way of reducing country’s emissions. However, only 64 carbon pricing initiatives have been implemented globally, covering less than 22% of the world’s GHG emissions. Among our seven forecasted emitters, only the EU and China have explicit carbon pricing initiatives with their Emissions Trading Systems (ETS) and national carbon taxes in EU states.

Not only is the share of emissions which are captured by carbon pricing schemes too low, but carbon prices are also too low to effectively incentivise lower emissions production: Only the EU ETS price falls within the carbon price range of USD40-80/tCO2 that the High-Level Commission on Carbon Prices sees as necessary to meet the Paris targets; and prices will need to reach USD50-100/tCO2 by 2030. The price of China’s ETS would need to increase more than fivefold to reach just the lower limit of the necessary carbon price range.

Moreover, free permit allocations or tax-free allowances reduce the effective carbon price coverage in all emitters. According to an OECD study, none of the major emitters succeeded in pricing all energy-related carbon emissions at the EUR60/tCO2 (the halfway point in the required carbon price of USD40-80/tCO2 for 2020). The EU has the highest carbon pricing score at 52, meaning that 52% of emissions are sufficiently priced. The seven major emitters only average 18% emissions pricing coverage.

The lack of robust emissions reduction policies, particularly carbon prices, means that the world’s major emitters are not on track to reach carbon neutrality. For business, this translates into regulatory uncertainty as governments will need to adopt climate policies with little warning to meet agreed targets, leaving insufficient time to prepare for measures such as high carbon levies.

What is the conclusion?

The IMF has urged the G20 to adopt a carbon floor price among its members to ease agreement for an international carbon pricing scheme. However, the lack of robust carbon pricing in the seven major emitters highlights that a global agreement is not on the cards at COP26, or even in the next five years.

Climate inaction stands in the way of ambitious measures to reduce emissions in countries including Russia, Brazil, India and Australia. But weak prices and limited coverage of existing carbon pricing schemes in the EU and China highlight how major emitters everywhere will face a disorderly transition.