Climate litigation woes rise for energy firms at home, but legal jeopardy set to go global

Environmental Risk Outlook 2021

by Franca Wolf and Liz Hypes,

The Hague District Court’s landmark ruling against Royal Dutch Shell to set more ambitious emission reduction targets is part of a rising tide of legal action that will have global implications for heavy emitting businesses. 100s of climate litigation cases have been filed since 2000, but this is only scratching the surface of what we'll see in the future.

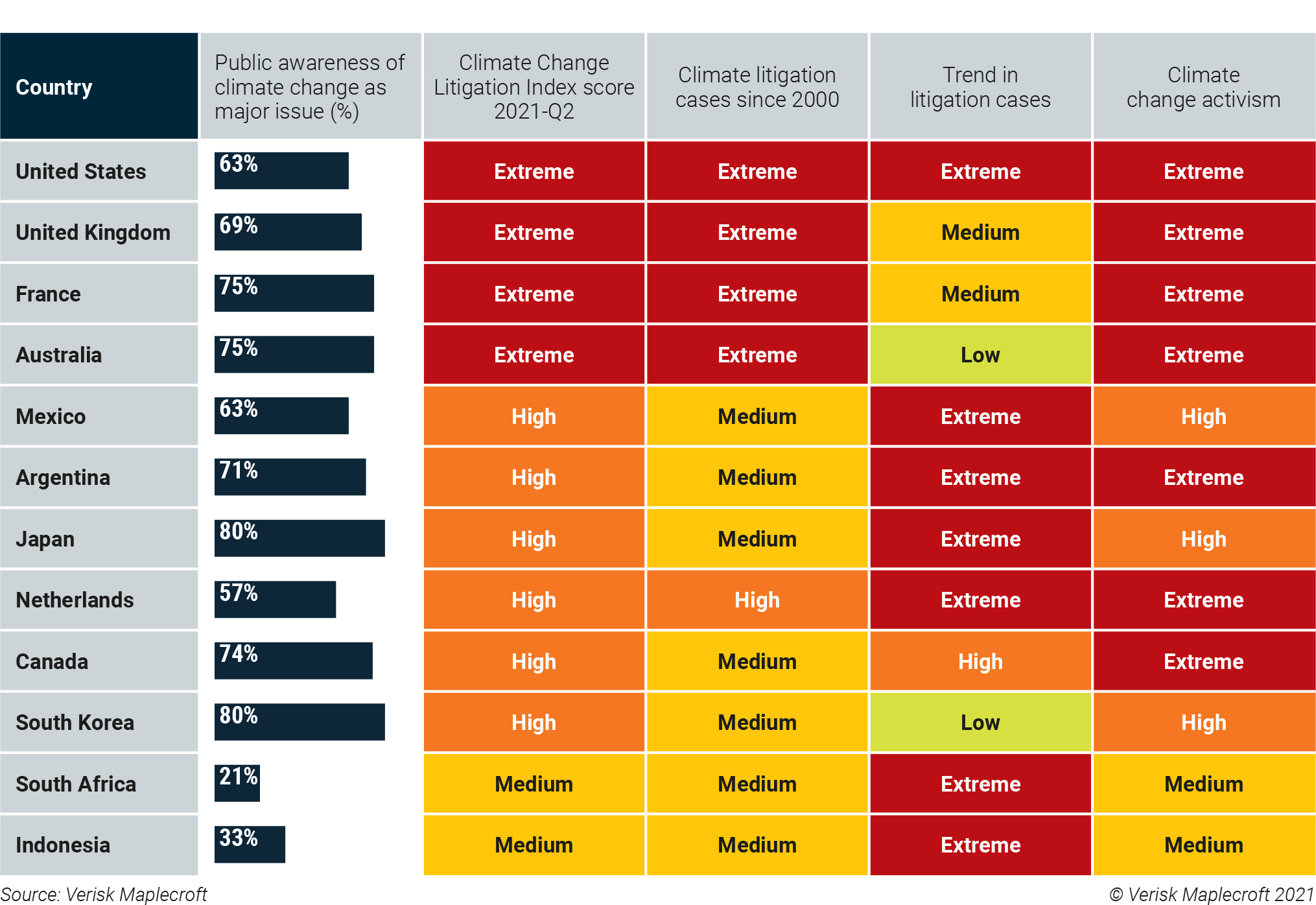

Our new Climate Litigation Index, which assesses the likelihood of climate lawsuits being filed and pursued against companies in 198 countries, finds that those operating in developed economies – especially the US, UK, EU and Australia – currently face the highest risk of legal action.

However, the picture could be changing. Limited civil and political rights and a weak rule of law reduce the potential for climate lawsuits in many parts of the developing world: but our data points to a shift in major emerging economies, which might not bode well for the carbon-intensive companies operating there. While these lawsuits have so far focused on pressuring governments to increase the regulatory burden on companies, activists are increasingly targeting corporates directly, and they will now be emboldened by events in the Netherlands.

Climate litigation risk greatest in developed markets

The Climate Litigation Index pinpoints current hotspots and areas of emerging risk by considering historic climate litigation, public awareness of climate change as a serious issue, climate activism, and the strength of a country’s judicial system.

Over the past two decades, climate lawsuits have been filed in 52 countries across North and South America, Europe, Asia Pacific and Africa. There is a stark variation in the number of total cases filed across geographies: the US and EU account for 90% of climate-related lawsuits globally since 2000, but corporates should be aware that cases are starting to move into new territories.

Our data shows that climate activism is more pronounced in developed economies, such as the UK, Japan and the US, where public awareness of the issues tends to be higher. The skilful mobilisation of climate activism, widespread acceptance of climate change as a serious threat, and a strong legal precedent for utilising litigation as a corporate and regulatory motivator underlie these countries’ high and extreme risk classifications in our index. An aware and mobilised public can use the courts to push governments to implement stronger climate policies. This is what we saw happen in the Netherlands in 2015, when the Urgenda Foundation successfully sued the government for stricter 2020 emissions reduction targets, forcing The Hague to introduce additional measures, following a 2019 appeal.

And this is not an isolated incident, as shown by the lawsuits highlighted in Figure 1. Cases like these are opening the door for other activists to pressure governments for more ambitious climate policies – especially ahead of COP26.

Climate lawsuits breaking new ground in emerging markets

Now, we are beginning to see climate litigation shift towards new markets, including major emerging economies such as Argentina, South Africa and India, where climate activism is a less intrusive yet burgeoning issue. Unlike in developed countries, in emerging markets the drivers behind the rising trend in climate litigation are more varied, and there are more human rights-based and governmental ‘failure to act’ cases.

One of the most recent high-profile human right cases involves six Portuguese children and young adults in September suing 33 European countries for moving too slowly to reduce greenhouse gas emissions, invoking human rights arguments over threats to their “right to life.” With the success rate of climate cases in new markets continuing to rise – almost 60% of cases outside the US have had favourable outcomes for the prosecution – we are seeing climate litigation expand into countries where climate activism is lower but the threat of climate change is more significant.

For corporates, the growing body of legal precedent for climate lawsuits is translating into a three-fold risk. The most immediate is a changing regulatory environment as governments react to public demand on climate policy, as this can directly constrain the operating environment. However, the damage to brand reputation from high-profile court cases is also not insignificant.

Even if a judgment is favourable, association with highly emotive environmental issues is not going to improve investor and consumer perceptions. A verdict the other way could even lead to divestment and consumer boycotts. Finally, the expanding nature of climate litigation and therefore uncertainty when it comes to financial penalties – which can potentially amount to billions of US dollars – only adds to the financial risks.

From smoking to smokestacks – companies risk fines reminiscent of tobacco trials

While governments have been the prime target of climate litigation to date, corporations whose operations – and increasingly their financial backers – are seen as directly contributing to climate change are being singled out. With 83% of global GHG emissions resulting from fossil fuels in 2018, it is unsurprising that oil and gas, coal and electric utilities are most at risk of climate liability lawsuits.

Since 2017, more than 30 climate litigation lawsuits have been filed against fossil fuel, steel and cement companies in the US. While most of these cases are ongoing or have ruled in favour of the defendants, the outcomes are arguably less important than the information that comes to light – drawing parallels to the tobacco trials of the 1950s-60s; this information not only darkens public perception of firms, it also drives further activism against them, and may trigger new lawsuits or shifts in regulation. It’s all about momentum, and the momentum is gaining.

30+

Number of climate lawsuits filed against fossil fuel, steel and cement companies in the US since 2017

This new era of censure through the courts shows that “not enough action” is no longer just a brand image issue – companies are facing genuine legal risks from which the repercussions may be significant. And it’s triggering a real discussion around what is the scope of their responsibility during the climate crisis.

Other energy-intensive sectors should expect to be the objects of climate litigation in the near future – especially metals and mining, agriculture and transport, which are increasingly being targeted by regulators and civil society over their emissions. Financial backers of these industries are also increasingly likely to be targeted like the 2021 ClientEarth v. Belgian National Bank case as more ESG-conscious investors push companies to address environmental risks in their supply chain, including commissioned assets.

More lawsuits and new defendants

The 2020’s are a key decade for climate action. Therefore, sovereigns and corporates should expect more climate lawsuits to come down the line, whether in the form of rights-based cases; the non-fulfilment of green recovery promises; or the failure to protect communities from more frequent extreme weather events.

Corporations also face new arenas of climate litigation risk, as activists expand the legal basis for lawsuits, focusing on fraud and consumer protection, company regulations, or planning and permitting laws to bring companies to court. Other aspects of environmental performance may also be targeted: with natural capital risks coming to the fore, some in the legal community are calling for a crime of ‘ecocide’ to be established – a distant possibility right now, but one that could encompass a huge range of corporate liabilities.

As the jurisdictional reach of climate lawsuits continues to expand outside of the US and EU, companies in all sectors and countries will need to consider how to mitigate their risk. For energy and mining companies, the very nature of their sectors means they are unlikely to be able to completely negate the risk of being sued. However, any company that can demonstrate comprehensive monitoring and disclosure of climate risks across their supply chain, as well as proactive stakeholder engagement to build social licence to operate in their immediate communities, will be better placed to avoid the courthouse.