A man with a plan: Brazil's incoming economic tsar

Investors overly optimistic about Bolsonaro victory

by Jimena Blanco,

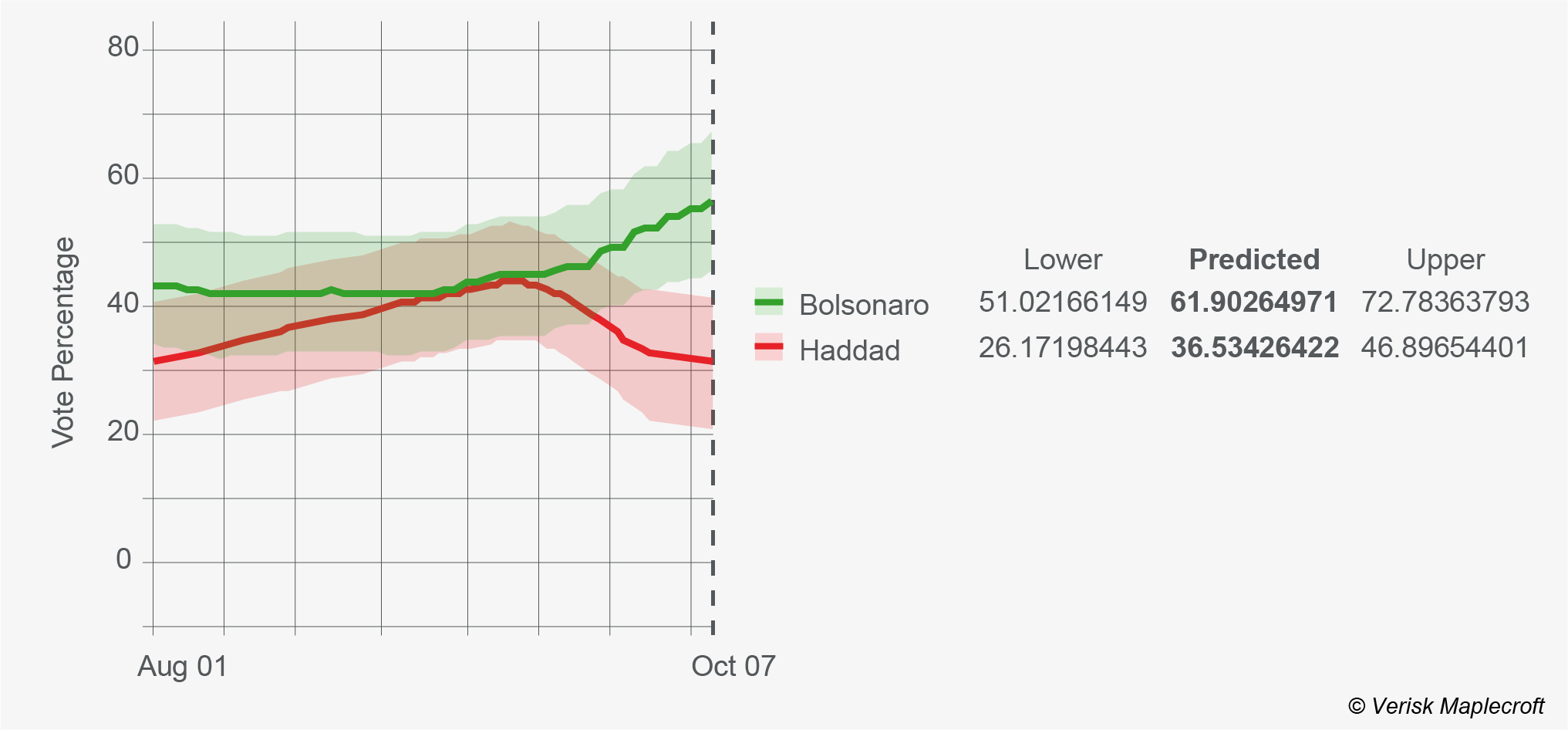

Ahead of the presidential election run-off, our core policy outlook scenario has gained strength.

We can now say with a reasonable degree of certainty that extreme right-winger Jair Bolsonaro, who has quickly consolidated his first-round triumph, will secure a comfortable victory.

Second, Bolsonaro will confirm the Chicago School graduate Paulo Guedes as his ‘economy tsar'. Using this super-ministerial mandate, Guedes immediately will look to launch a radical programme of privatisations and spending cuts to tackle the country’s persistent structural problems, including a near double-digit fiscal deficit, an unsustainable pensions system, a high public debt burden, and declining external competitiveness.

The latest Datafolha poll puts support for Bolsonaro on 59% - a massive 18 percentage point lead over his left-wing rival Fernando Haddad of the PT. A big bandwagon effect is helping Bolsonaro, who has boasted of being on cruise control as he approaches the finish line.

Allegations that the Bolsonaro campaign has benefitted from illicit funding for its WhatsApp campaign, along with other social media manipulations, are unlikely to hurt. Nor does the fact that Guedes is being investigated for the alleged mismanagement of public pension funds having any impact (he has denied any wrongdoing). Riding a wave of popularity, the duo appear able to brush-off these issues.

Cutting red tape and privatising

Among Guedes’ market-friendly proposals, a key ambition is to implement a radical programme of privatisations and spending cuts, designed to cut Brazil’s public debt by 20%. It is not yet clear which of Brazil’s 147 major state companies will be offered, although the core oil and electricity firms, Petrobras and Eletrobras, will be excluded for the moment. To reassure nationalists, there is talk of the State keeping a golden share in key privatised companies.

Guedes is also looking at a major simplifying tax reform, aiming to merge a wide and complex range of existing taxes into a single universal tax, set at 20%. The idea is that profits and dividend taxes might also be set at 20%.

Less has been said about spending cuts, perhaps because they are unpopular and the election campaign isn’t over yet. But sources close to the Guedes team say he will start by reversing some of the increased spending in the 2019 budget. It is also planning to reduce the primary budget deficit (excluding interest payments) to zero by 2020 – an ambitious target.

Elsewhere, the central bank (BCB) will retain its nominal autonomy, with Guedes previously suggesting that current BCB president Ilan Goldfajn would be invited to stay on in his post. Albeit that is now under question. Bureaucracy will be cut. Regulations to protect the environment will be relaxed.

Risks to the long-term outlook

Short-term prospects for a post-election Brazil are good. Exuberant financial markets may help the country experience a Trump-style surge in the first year (with a stronger Brazilian currency helping to contain inflation, boost purchasing power, and encourage domestic consumption). But whether this will be sustainable will depend the new governments’ ability to push through reforms that are likely to be unpopular.

There are significant risks to the outlook. One uncertainty revolves around the fact that, in political terms, Bolsonaro and Guedes remain an odd couple. Bolsonaro has a long history of right-wing nationalism and economic protectionism.

The risk is that his apparent conversion to Guedes’ brand of neo-liberal, pro-market policies may not last. While Brazil’s financial markets have soared on prospects of a Bolsonaro victory, they have also dropped whenever there are signs of disagreements between the two men.

In September, Bolsonaro disowned comments by Guedes, who said he was considering re-introducing the unpopular financial transactions tax (CPMF). Although Guedes had favoured selling Eletrobras, Gustavo Bebbiano, the president of Bolsonaro’s Partido Social Liberal (PSL), overruled him, on the grounds such a national flagship could not be touched. Any future break in the Bolsonaro-Guedes alliance would heavily rattle markets.

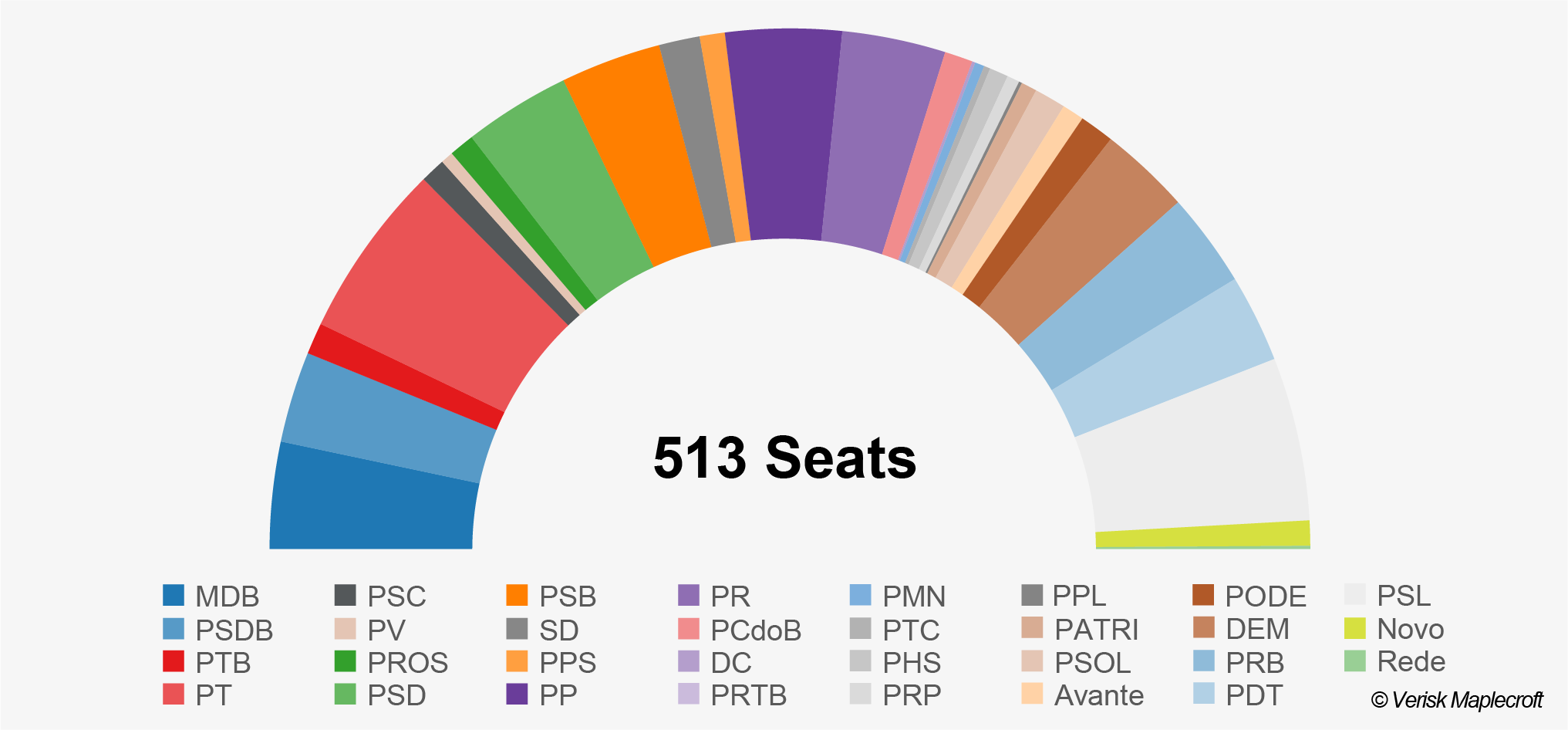

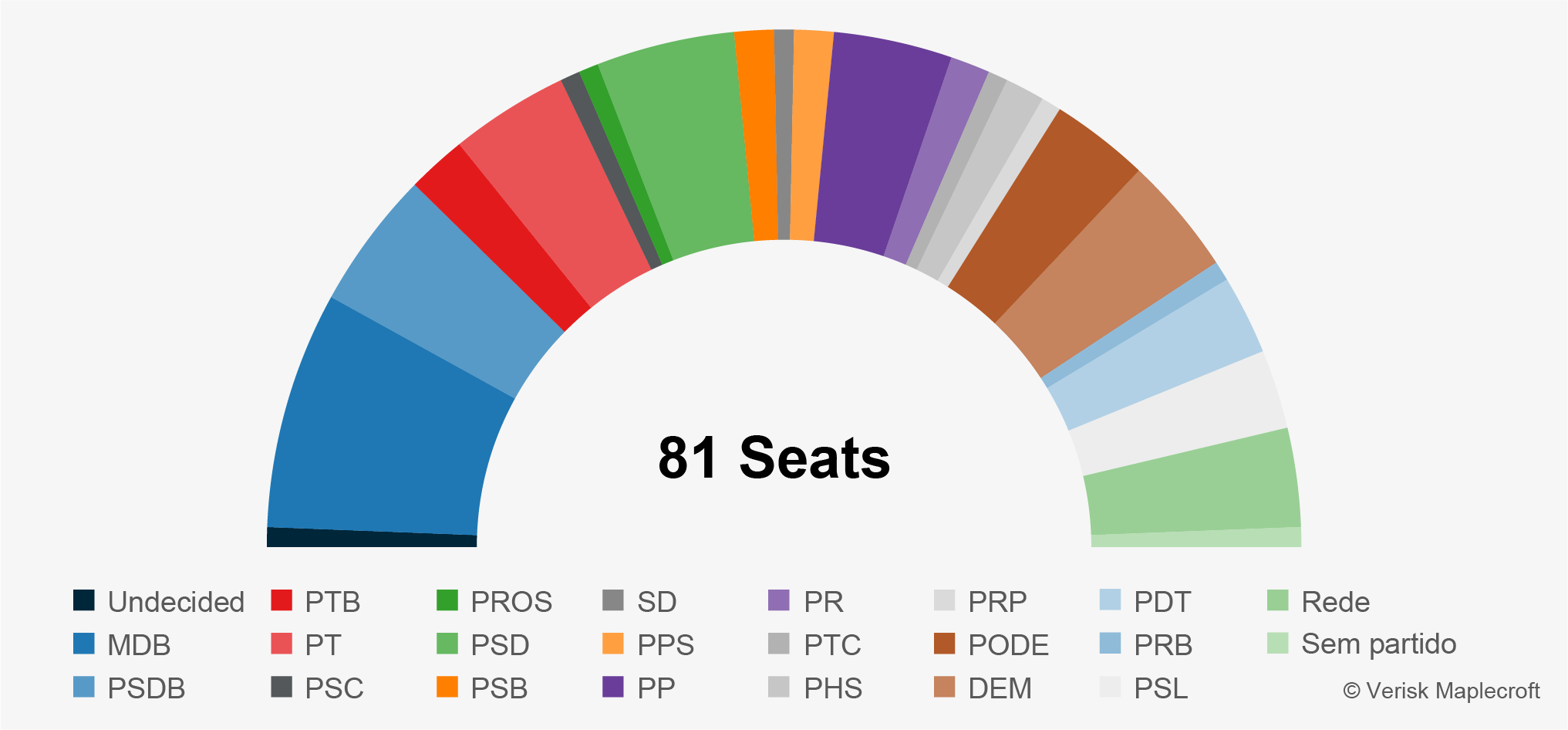

We're also concerned with what is politically feasible. While traditional political parties were severely punished in the congressional ballot, the new federal congress is the most fragmented ever, with no fewer than 30 parties represented. While Bolsonaro’s PSL has emerged as the second-largest in the lower house, it controls just 52 of the 513 seats.

Some market-friendly parties from the political centre (a group known as the centrão) may be willing to support Bolsonaro’s economic reforms, but they will want to negotiate terms and favours for doing so – precisely the kind of pork-barrel politics Bolsonaro claims to despise.

The pension reform challenge

Getting a Guedes-approved reform package though congress thus is likely to be a major initial challenge. The first big test of the new government’s effectiveness will be pension reform, one of most critical steps to tackling the fiscal deficit. The outgoing government negotiated an ultimately rather diluted pension reform package, but could not muster the necessary support in congress to get it approved. Notably, Bolsonaro voted against that compromise.

Some business leaders would still like to see that proposal pushed through early next year, at least as a partial solution, pending a deeper reform. But Bolsonaro has said he wants to start again from scratch, moving from a defined-benefits to a defined-contributions system, rather like the privatised system introduced in Chile in the 1980s. Rather predictably, Bolsonaro has also ruled out any modification of the highly generous pensions received by current military officers.

Find out more: The risks of a Bolsonaro presidency

Read the article