Economic Risk Data

Assessing the global business environment

Economic stability, financial controls, external debt and growth all constitute essential levers in the ability of a country to attract investment, minimise political unrest and navigate the energy transition. Used in combination with our ESG and political risk analytics, our Economic Risk Data enables organisations to track these issues within a consistent scoring framework as part of a holistic approach to monitoring the global risk landscape.

From trade barriers and labour costs, to financial crime and external debt, our Economic Risk Data offers an accessible and accurate view of the key macroeconomic and business environment issues that can influence the success of an organisation in a country and ensure the political stability needed to offer certainty in investment decisions and the operational environment.

Used by leading multinationals across the globe, our indices help:

-

Contextualise

Contextualise a country’s macroeconomic performance against its peers

-

Assess

Assess the characteristics of the country’s economy to determine the viability for market entry

-

Measure

Measure key indicators across labour costs and human capital

The data

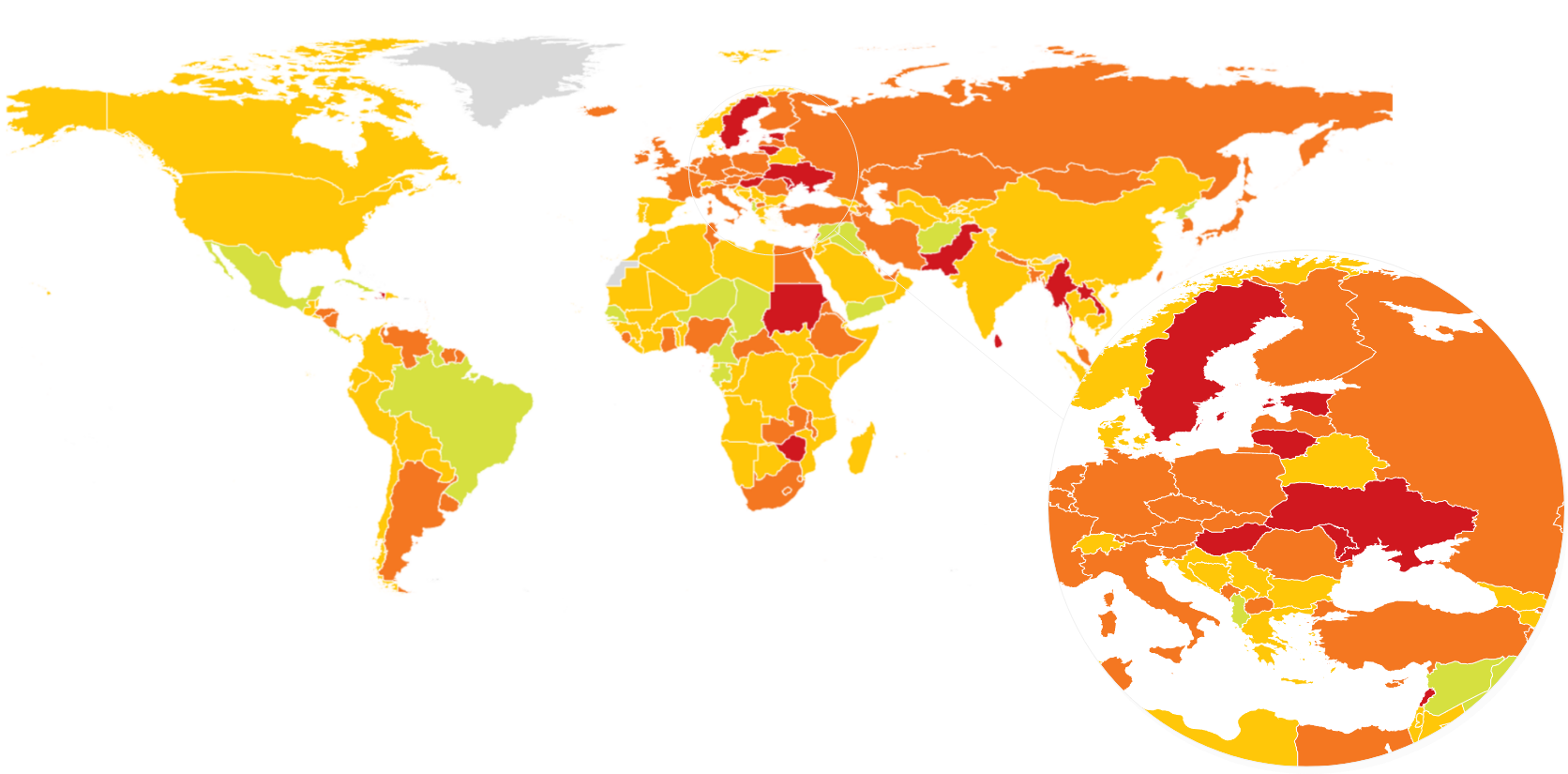

Our Economic Risk Data enables organisations to contextualise a country’s economic performance and better understand the business environment for existing operations and new country entry.

198

Countries

27

Indices

4%

Subnational

Example issues include:

Economy

Economic growth

External debt burden

Access to foreign capital

Dependence on commodity exports

Dependence on fossil fuel imports

Business

Infrastructure

Barriers to entry

Human capital

Labour costs

Digital inclusion

Interconnected factors in other datasets: Poverty, Education, Political risk, Civil unrest, Food security, Energy security, Regulatory frameworks

Want to learn about the deeper levels of the indices, the methodology or how they can help you?

Benefits

Benefits

Convenient

Easily identify and analyse threats across the full spectrum of economic and business risks through our GRiD platform and data, or integrate into internal systems via our API

Credible

Our reputation as the world’s leading provider of global risk analytics offers you the confidence and accuracy you need to make critical decisions based on data you can trust

Consistent

All our indices use the same comparable scale, helping you identify, prioritise and compare risks across more than 190+ environmental, political, social and economic issues

Features

Advanced analytics

Created using a unique combination of data modelling, market tracking and expert judgement by our analysts to ensure the highest degree of accuracy

Transparent

Detailed index definitions, methodologies and source information are fully available

Granular

Location scores and interactive maps identify risks at both national and subnational levels across the globe, enabling deeper analysis and more targeted risk prioritisation

Put economic performance in context alongside the full range of political, environmental and human rights risks