Geospatial ESG investing

Learn more

Sovereign credit ratings don’t tell the whole ESG story

Sovereign credit ratings don’t tell the whole ESG story

Eileen Gavin - 26 November 2021

A recent study by Amundi Quantitative Research, using our Environmental, Social and Governance (ESG) analytics, has shown that independent sovereign ESG data is an essential complement to credit ratings.

Amundi researchers used 183 proprietary sovereign ESG indicators from our Global Risk Analytics Dataset, alongside a further 86 indicators from other sources, to create 26 ESG themes. These were then tested for their impact on the sovereign bond spreads of 67 countries between 2015 and 2020, both directly and indirectly via credit ratings. Critically, the study used our highly granular data to assess factors at indicator level, without relying solely on aggregate ESG scores.

Sovereign risk analysis needs indicator-level ESG data

The findings of the study reinforce our longstanding position that granular, indicator-level ESG factors form a critical and material complement to traditional sovereign credit risk analysis.

To reach their conclusions, Amundi undertook a detailed and comprehensive analysis of their assembled dataset. The researchers used two separate, but similar, approaches to isolate the indicators with the most predictive power for modelling sovereigns’ spreads and credit ratings respectively. The results showed that each of the 26 ESG themes contained indicators that had statistically significant impact on a country’s creditworthiness.

To analyse sovereign spreads, the authors used the selected ESG indicator set and other fundamental factors, such as GDP and inflation, to build a multivariate model. They found 83.5% of the variation in sovereign spreads could be explained by the model, compared to only 70% with traditional fundamental factors alone.

This greater accuracy clearly supports the inclusion of indicator-level ESG factors in sovereign risk analysis. Together with the finding that not all ESG pillars are equal, these results also echo the high-level conclusions of our own past research. However, the report notably ascribes greater importance to environmental (E) factors.

Credit ratings don’t tell the whole story

Amundi’s strong result for E on sovereign yields is a clear contrast to their findings for credit ratings. They conclude that the governance and social pillars are the most critical, while E lags conspicuously behind – this suggests credit ratings significantly underweight or even fail to capture environmental issues. For investors who see the E pillar to be of material importance, this means credit ratings simply cannot be the sole basis for comprehensive sovereign risk analysis. Even when agencies claim to bake environmental, social and governance factors into their ratings, prudent investors must also use statistically independent ESG factors in their investment process.

Overall, the report confirms that integrating detailed indicator-level ESG factors into sovereign bond issuer analysis both complements and adds value to traditional credit risk analysis, investment decision making and the assessment of country risk premia.

The full report can be accessed here: Full report download

Eileen Gavin

Principal Analyst, Global Markets & Americas

ESG+ Matters notification

SubscribeChart of the week

Quote of the week

"If Pinochet was alive, he would vote for me"

José Antonio Kast

– Chile’s far-right conservative presidential candidate, who will contest a second-round run-off election against left-wing rival Gabriel Boric on 19 December, appeals to supporters of the country’s former dictator, Augusto Pinochet (1973-1990).

What we’re reading

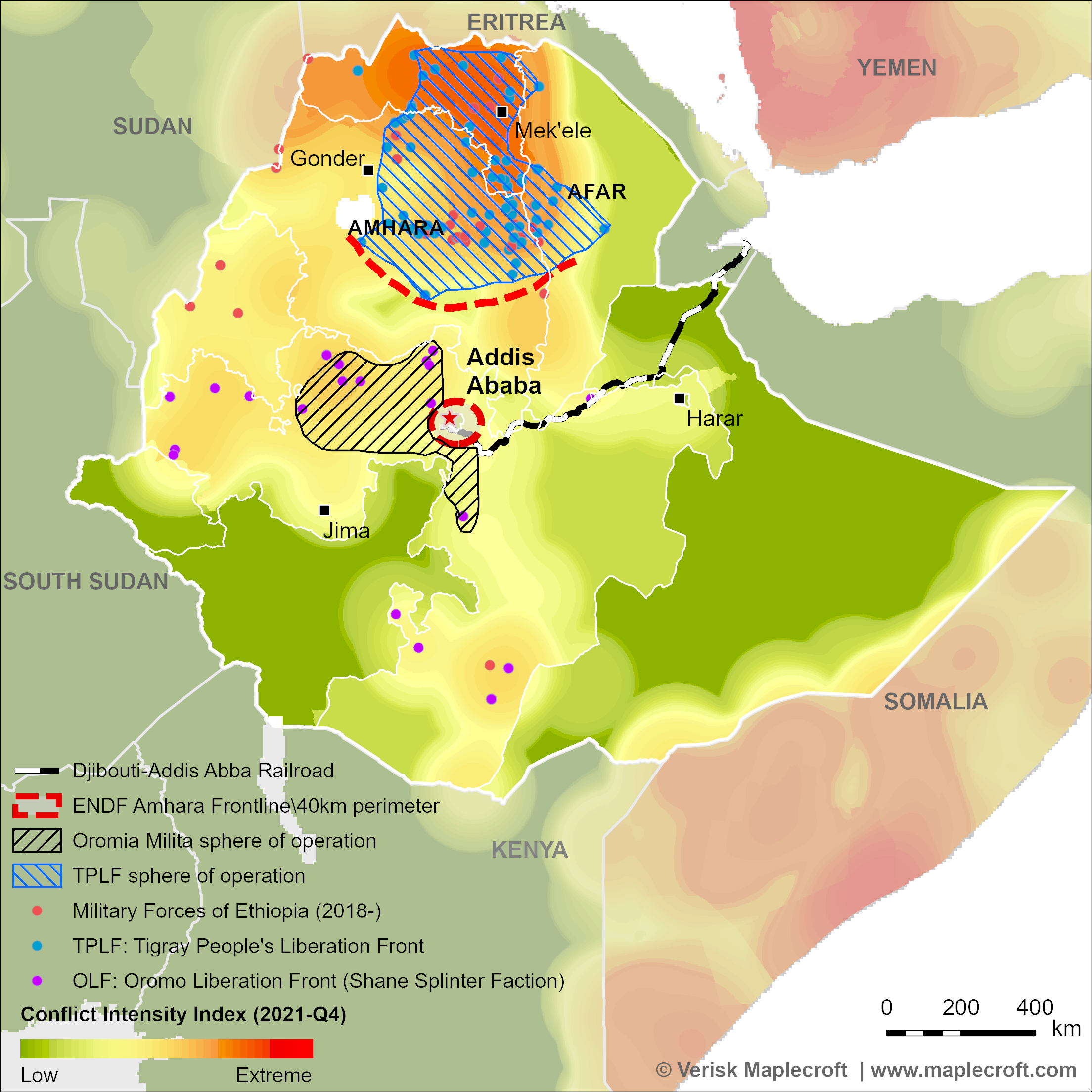

- Ethiopia: Abiy’s options shrink as rebels close in, Verisk Maplecroft Risk Insight, 25 November.

- Turning Green Into Gold Takes a Leap of Faith, Bloomberg, 24 November.

- Carbon markets’ COP26 breakthrough, The Edge, Wood Mackenzie, 24 November.

- Dancing on the edge of climate disaster, Financial Times, 23 November.

- IOSCO calls for oversight of ESG Ratings and Data Product Providers, International Organization of Securities Commissions (IOSCO), 23 November.

- How New ESG Transparency Rules Will Unleash the Next Green Wave, Nomura Sustainability, November 2021.

- NYDFS becomes first US regulator to issue climate guidance for insurers, Environmental Finance ($), 17 November

- Growth in Asian emissions will make cuts elsewhere irrelevant, Nikkei Asia, 15 November.