Q&A: Upscaling supply chain analysis with sector-by-sector risk data

by Jess Middleton and Sam Haynes,

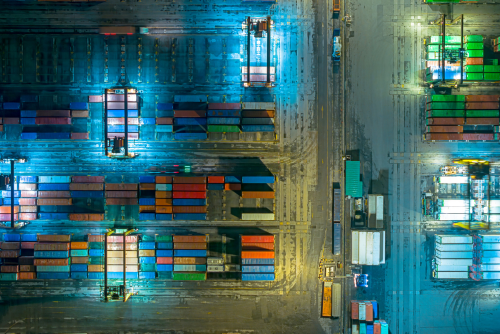

The risk and regulatory landscape surrounding sustainable procurement and human rights and environmental due diligence is rapidly evolving, meaning that performing robust supply chain analysis has never been more important.

But risks vary not just from country to country, they also differ from sector to sector. Modern slavery risks run higher in agriculture and manufacturing than they do in advertising. Water pollution is a greater concern in mining than it is in professional services.

Our Industry Risk Dataset assesses sector-specific risk exposures across 51 social, environmental and political issues in 80 industries and 198 countries, providing a data-driven approach to supplier risk screening, due diligence and regulatory reporting processes.

In this Q&A, our Head of Data and Analytics Sam Haynes (SH) outlines the key elements of the dataset, and how users can make the most of our new subnational Site Scoring service.

Q: Why did we launch the Industry Risk Dataset?

SH: We saw an opportunity to improve efficiencies and streamline supply chain risk analysis by providing an additional lens to our data, based not only on geographic location but also on specific sectors.

This is vital, because risk exposures vary significantly between industries. The threats associated with sourcing agricultural products are inherently different to those associated with sourcing IT services, for example.

By accounting for both location and sector, the dataset enables our clients to home in on the specific hazards and risks associated with the industries their suppliers operate in, enhancing supply chain analysis for reporting and sustainable procurement assessments.

Q: How does the dataset work?

SH: The dataset integrates three key components: location, industry characteristics and dynamic event-based data.

We take country-level risk scores from our suite of global risk indices and combine those with sector-specific risks, which are based on the underlying characteristics of the given industry. We then utilise data science and machine learning techniques to track and categorise events, such as incidents of child labour or health and safety violations, related to specific industries and countries.

Thanks to our new Site Scoring service we can now provide insights at the subnational level, allowing clients to granularly assess their exposures based on both industry and subnational risk characteristics.

Q: How do we assess the risk characteristics of a specific industry, and what risk issues do we cover?

SH: Generating our industry risk scores is essentially a vast research exercise. We developed a series of questions aimed at understanding the different characteristics of 80 key industries and their potential vulnerabilities to various risk issues.

We researched how these industries operate, and the quirks that might make them more susceptible to certain threats. Our in-house thematic experts then reviewed and validated these assessments, enabling us to objectively evaluate what an industry does and whether that makes it more or less exposed to some kind of reputational or operational risk.

The dataset covers 51 risk indices encompassing the vast majority of the ESG and sustainability issues we typically see in supplier codes of conduct, such as modern slavery, occupational health and safety and water pollution, as well as data related to operational and supply chain resilience, including natural hazards and political risk issues.

Q: What do we mean by event-based data?

SH: To provide dynamic industry-specific insights, we track and log hundreds of thousands of news articles, press reports and political violence incidents. We use natural language processing and geolocation models to tag these events based on location, affected industry, and the risk issue involved – and then assess the relevance of each event to the particular risk.

This event data is used to adjust the industry and country components, allowing for relative comparisons of risk levels across industries within a country. Industries with numerous highly relevant reports related to a risk issue will score poorly, while those with few or no reports will perform comparatively better.

Q: How do our clients utilise the dataset?

SH: Supply chain due diligence laws such as the Corporate Sustainability Due Diligence Directive (CSDDD) and the German Supply Chain Act (LkSG) are very demanding.

Companies are now expected to have a deep understanding of the potential harms and impacts within their supply chains. But modern supply chains are vast and complex, so companies need to prioritise and direct their identification and mitigation efforts towards the most salient risks. They need to do that as efficiently as possible, which makes flagging the highest risk sectors vital.

Our data provides a structured, independent view of risk across the key sectors in every country, enabling our clients to better understand their potential blind spots and focus their auditing and other mitigation efforts on the biggest threats.

Increasingly, we’re also seeing clients expand their view of supply chain risk beyond sustainable procurement issues to encompass a wider range of potentially disruptive threats. Alongside environmental, social and governance issues, the Industry Risk Dataset provides insight into risks such as civil unrest, climate change, natural hazards, conflict and human security. This allows users to understand exposure to acute perils that may affect supply chain continuity and integrate strategies to build resilience to such issues within their sourcing networks.

Q: What are the benefits of our new subnational industry Site Scoring service?

SH: Many of our indices measure risk down to the subnational level, and this granular view has now been integrated into the Industry Risk Dataset. This means that our clients can access risk scores that are specific to both a subnational location and a particular industry.

This is a significant enhancement, because two suppliers operating in the same place but within different industries face their own specific threats, as do two suppliers within the same industry but in different locations of a given country. For example, sourcing agricultural products from California comes with its own specific set of risks when compared to sourcing from elsewhere in the US.

This data is available via our API, with users able to integrate these subnational, sector-specific scores directly into their own processes or supplier management systems. The aim of this new integration is to enable further differentiation, allowing users to better target their risk mitigation efforts based on precise location and industry contexts.