Sovereign ESG Ratings

Setting a new standard in sovereign ESG analysis

What’s different about our Sovereign ESG Ratings?

Industry-leading, proprietary sources

Our Ratings draw on ~350 of Verisk Maplecroft’s 1200+ proprietary indicators across 37 separate issues and 9 ESG dimensions, assessing the entire current and potential sovereign issuer universe.

Environment and human rights focus

Our framework puts heavy emphasis on environmental factors, across physical and transition climate risks and natural capital, as well as fully incorporating ethical human rights and labour rights issues.

Innovative use of cluster analysis

We use a novel quantitative scoring methodology, based on cluster analysis, that captures the non-linear complexity of the sovereign ESG world more effectively than traditional weighted averages.

Dynamic, independent ratings and scores

With their unique source data, our headline sovereign scores are over 3x more dynamic than a weighted average, making them current, relevant, and fully independent of government influence.

~350

proprietary indicators

37

Separate issues

9

ESG dimensions

x3

more dynamic

Guides & research papers

Research demonstrates our ratings and scores can provide powerful signals of potential market movements, as well as exposing hidden momentum and potential ESG tipping points.

How to use our Sovereign ESG Ratings in portfolio management

Download our guide to learn how asset managers can use our Sovereign ESG Ratings for portfolio construction and both high-level assessments and detailed analyses of issuers’ sustainability credentials.

Sovereign ESG Ratings: Setting a New Standard

Our whitepaper finds human rights and transition risk are now highly material for sovereign bond pricing.

Our Sovereign ESG Ratings can help you price in sustainability factors more effectively and create portfolios that tightly align with your values

Anticipate changes in sovereign debt pricing

With pricing in of sovereign ESG factors still inefficient, our E and G ratings can be leading indicators of spread changes

Track the ESG momentum that matters

Watch for ESG ‘tipping points’ to minimise downside risk and capitalise on emerging investment opportunities

Use one single specialist source

Access all material and ethical sovereign ESG risks for every current and potential issuer, all through one provider

Complete framework

Our sovereign ESG framework builds on a principled approach to issue selection and a robust design, testing and feedback process

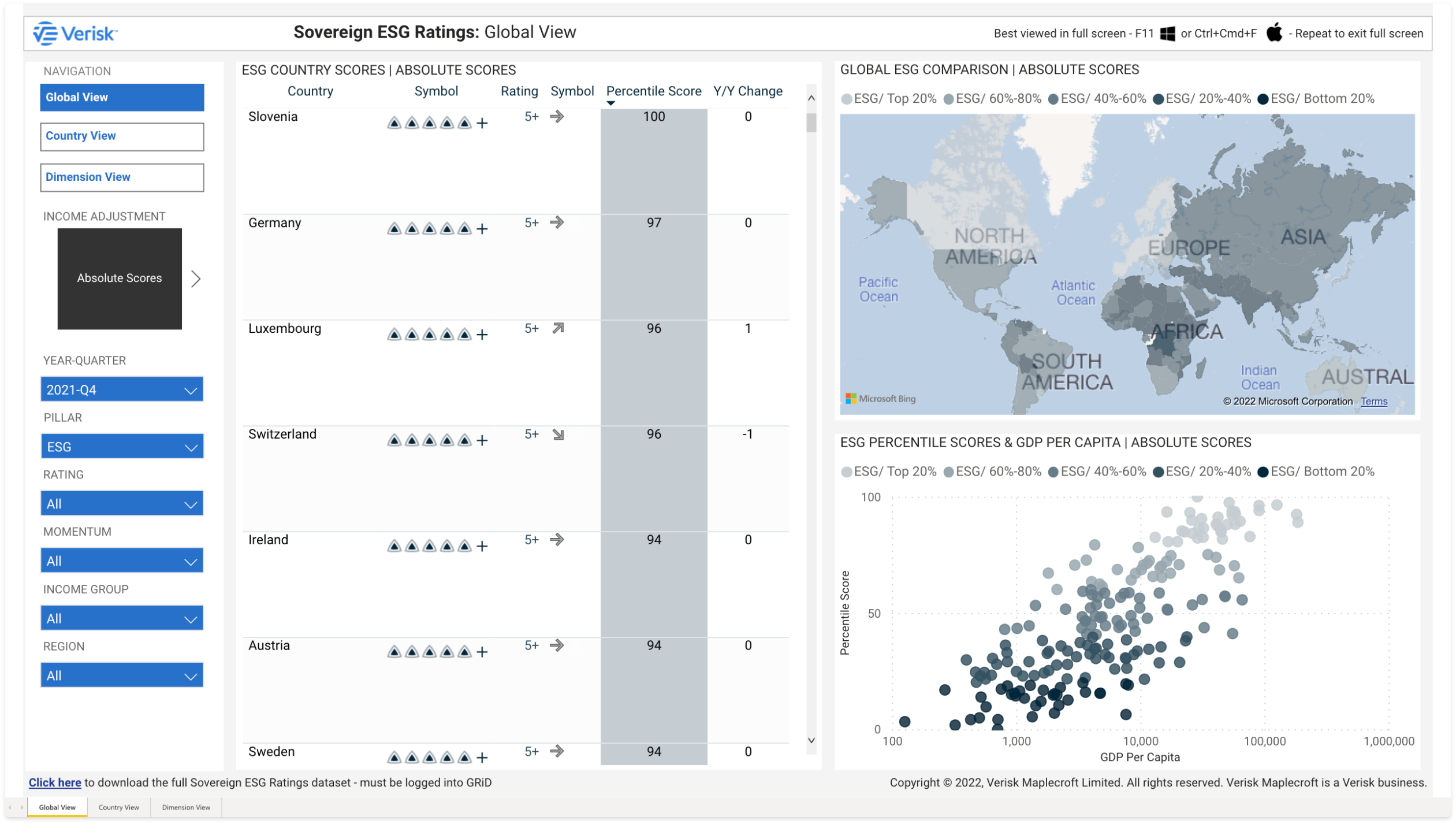

Intuitive ratings

Simple, ‘values-neutral’ ratings and scores enable easy understanding of performance, strengths and weaknesses, and momentum

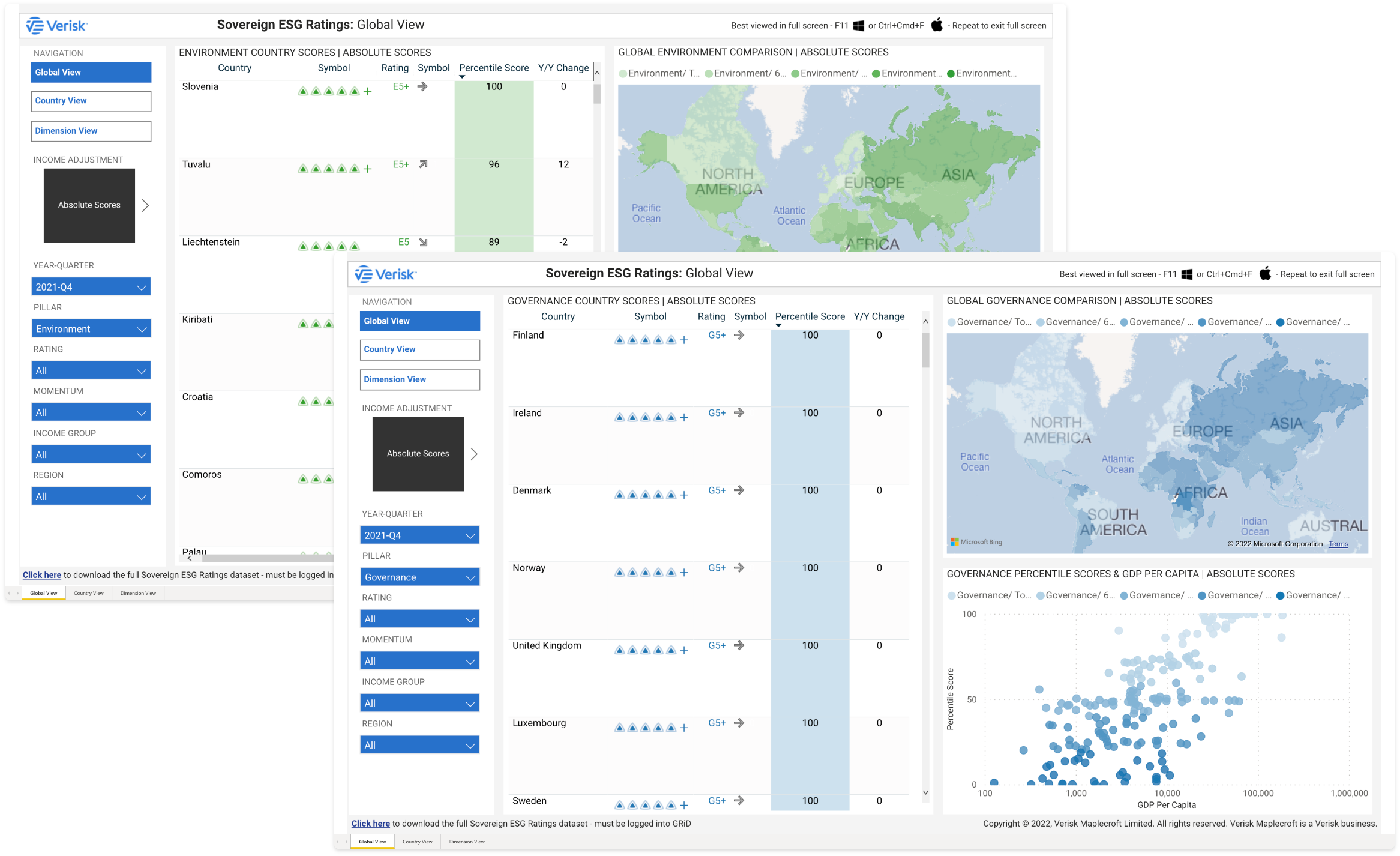

Dedicated dashboard

Every material ESG issue, for every sovereign issuer, all in one place. Designed for high-level screening and deep-dive analysis

Want to discuss how our Sovereign ESG intelligence can support you…

Sovereign ESG Ratings use cases

Asset managers

Our Ratings deliver our independent ‘house view’ on sovereign ESG, providing a robust foundation for incorporating ESG into sovereign debt strategies, or as an external benchmark for your own approach

Asset owners

Our Ratings provide the specialist third-party view you need to monitor the sustainability of your sovereign holdings and ask your manager’s the right questions to ensure they’re fulfilling your mandate

Advisors & intermediaries

With investors increasingly engaging sovereigns on ESG issues, our Ratings offer advisors and intermediaries a respected tool to articulate issuers’ ESG stories, and evaluate and benchmark managers’ sovereign ESG strategies

Supporting asset owners with sovereign ESG incorporation

Request a complimentary ESG assessment of your sovereign debt holdings:

> Request your ESG assessment report

Alternatively you can get in touch to discuss how we can help you: