Coronavirus travel restrictions forecast to impact supply chains and operations throughout 2020

by Camilla Ogunbiyi,

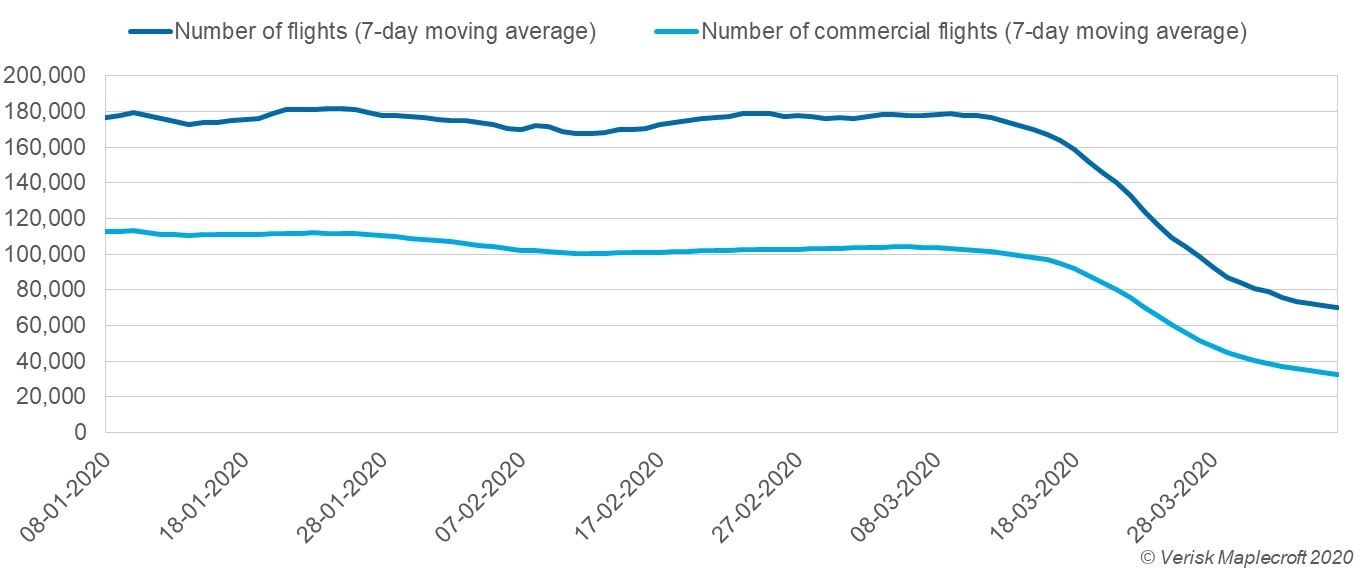

Travel restrictions enforced in the wake of the coronavirus are causing widespread disruption in supply chains. Seasonal workers are prevented from picking fruits and vegetables across Europe, the slump in air traffic is restricting the shipment of African fruit and vegetable to international markets, chemical deliveries to fight the locust swarm in East Africa are delayed, while aid and aid workers are unable to reach African countries in need.

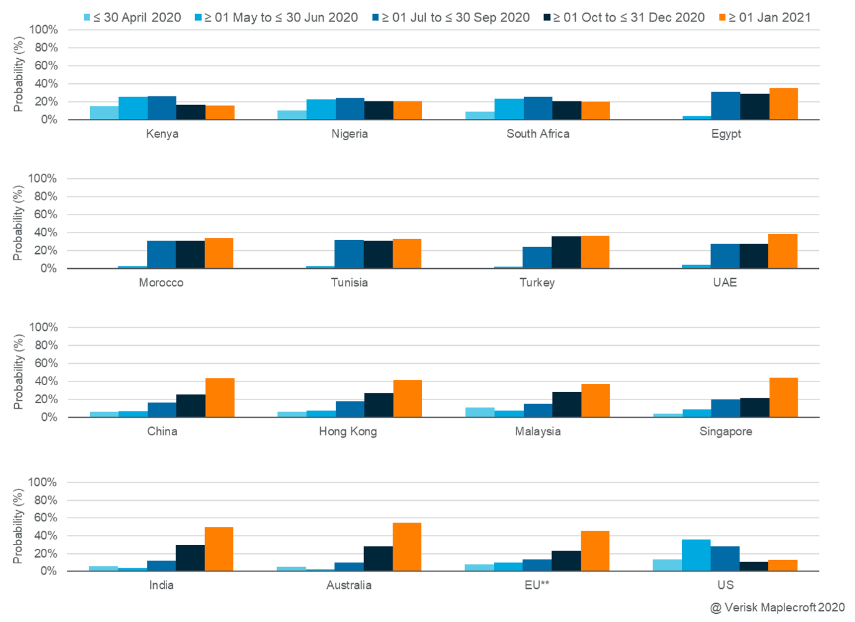

Our team has undertaken a series of forecasts to help companies understand if this is a new normal that businesses will need to adapt to or a temporary disruption. We forecast that the US and sub-Saharan Africa are most likely to be the first to ease entry restrictions owing to economic pressures and political imperatives. However, we expect restrictions to remain in place into the fourth quarter of 2020 in many countries, particularly in Asia and Europe – possibly even extending into 2021.

US and sub-Saharan Africa likely to lift restrictions first

Most countries have imposed restrictions temporarily for a few weeks or a month, but we broadly expect travel restrictions to remain in place beyond April. Among the countries covered by our forecasts, Kenya and the United States have the highest probabilities of lifting restrictions during April – but we set the probability of this at just around 15% for both countries. The two countries are, however, along with Nigeria and South Africa, the most likely to end restrictions before the end of June (see figure below).

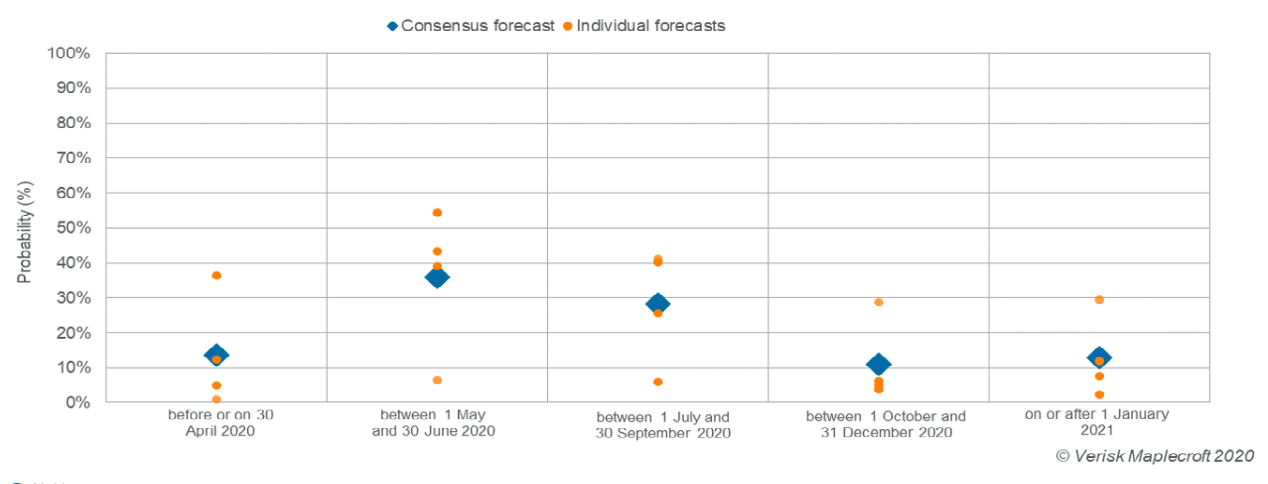

The economic pressures and supply chain disruption arising from the restrictions are the key drivers of our expectation that restrictions in sub-Saharan Africa will be relatively short lived. Meanwhile, US forecasters point to President Trump’s aim to ease coronavirus restrictions as soon as possible and pressure from the airline industry. However, our US forecast reflects a split view (see figure below), with one forecaster expecting the travel restrictions to remain in place until late in 2020 or even into 2021; the three other forecasters, however, overwhelmingly expect restrictions to be lifted before the end of June. These conflicting assessments of the US outlook reflect the unpredictability of the Trump White House.

MENA, Europe and Asia likely to maintain restrictions towards the end of 2020 or even into 2021

In contrast to the US and sub-Saharan Africa, we expect European, MENA and Asia-Pacific states to maintain restrictions significantly longer. Our forecasts for countries in these regions all imply close to or more than 2/3 chance that entry restrictions imposed in relation to COVID-19 will remain in place until the last quarter of 2020 or into 2021.

Within this group, North African countries are those most likely to first ease restrictions with around 1/3 probability that restrictions are lifted before the end of September. As with sub-Saharan Africa, the economic hit to countries – in this case reliant on tourism – would be a key reason for a quicker easing of restrictions.

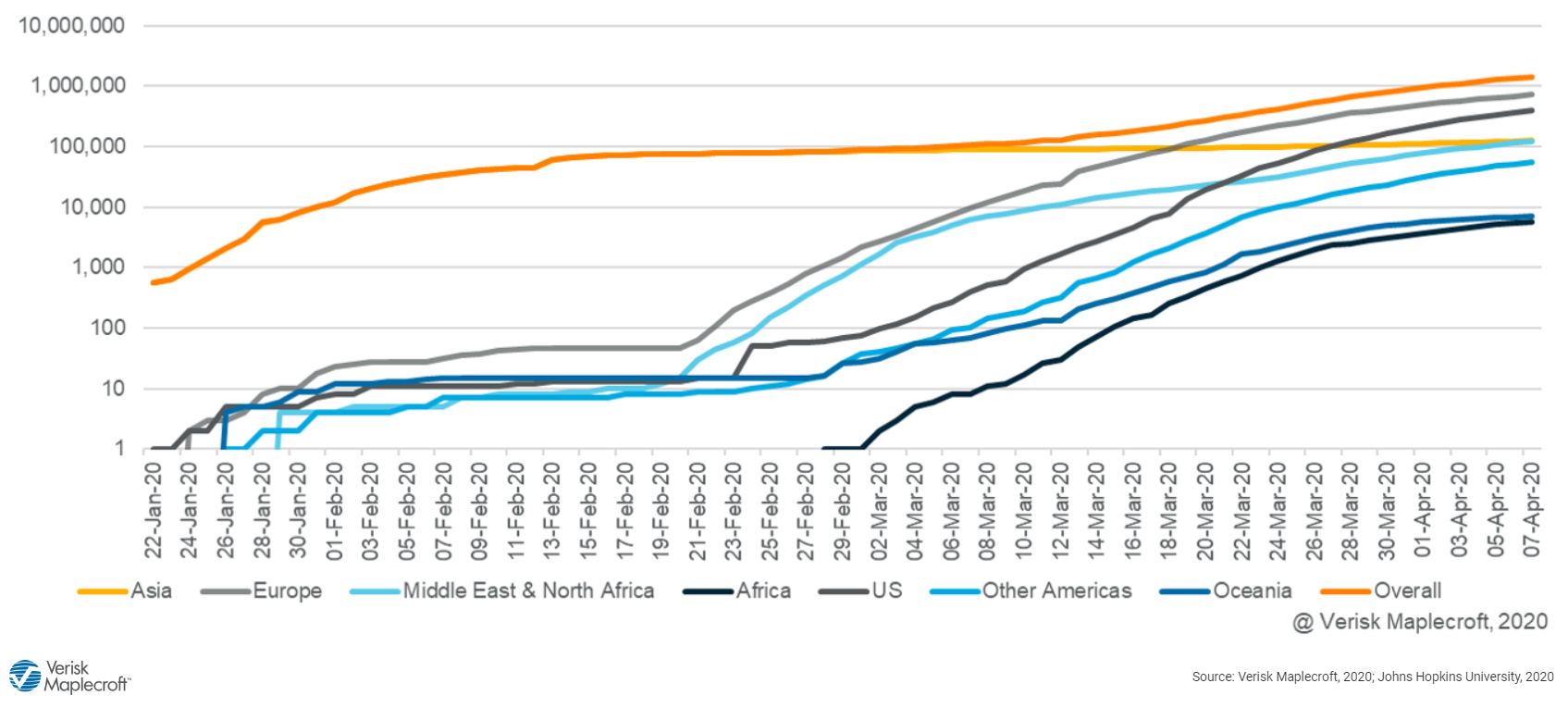

The main reason that we expect restrictions to remain in place the longest in these regions is the emphasis of governments on ensuring that public health systems can cope with the pressure from the disease. Given the unprecedented and widespread nature of the outbreak and the remote chance of a vaccine hitting markets before 2021, these governments are likely to maintain entry restrictions for at least six months. The continued growth in cases in many parts of the world – as illustrated by the trajectories of outbreaks in the figure below – and the risk of further waves of infection as domestic lockdowns are eased only reinforce this view.

Outlook

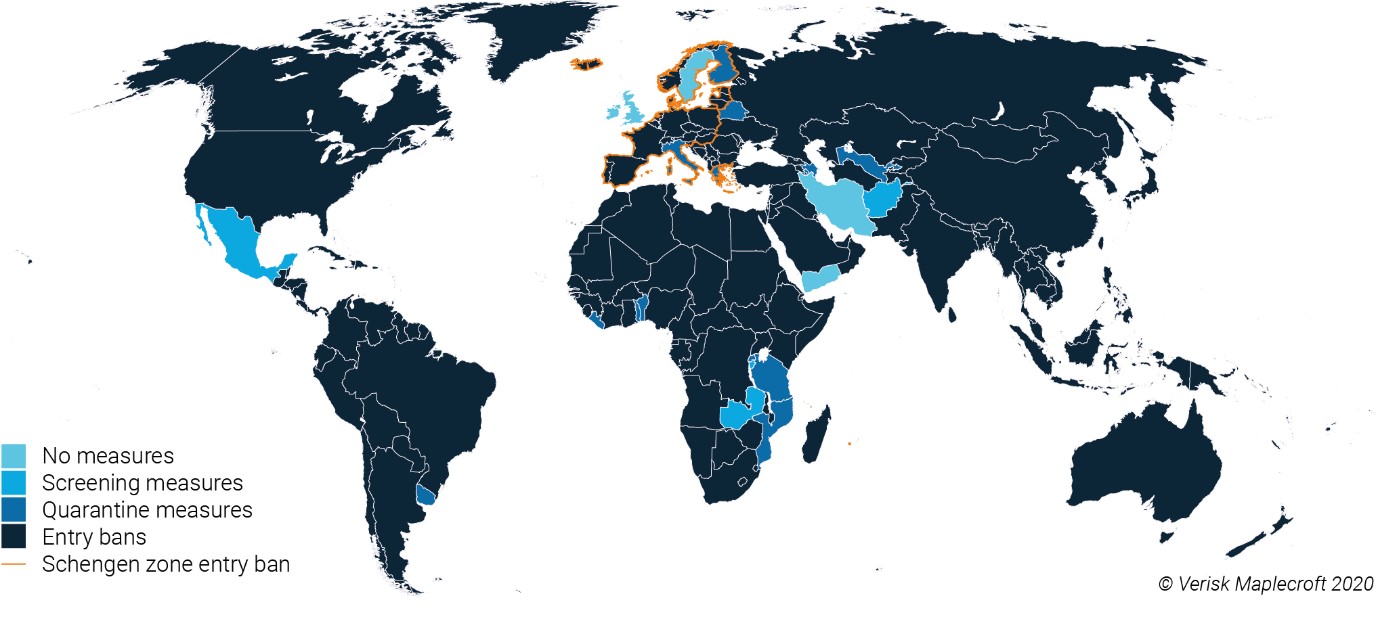

While we expect restrictions to remain in place for much of 2020 for most of the world, they are likely to evolve, gradually adapting as the outbreak unfolds and eventually winds down. For example, where entry restrictions are currently broadly applicable, countries are likely to over time limit the scope to travellers arriving from or having visited specific high-risk regions. In other cases, countries are likely to shift from entry bans to a combination of screening and quarantine measures as testing capacity improves.

For example, while we expect economic pressure to encourage an easing of restrictions earlier in sub-Saharan Africa than in other parts of the world, we also expect that these countries will continue relying on their experience from past Ebola outbreaks, which involved screening measures, in an attempt to both limit the negative impact on the economy, while reducing the risk of ‘importing’ new COVID-19 cases.

We will continue to monitor the developments and provide updates to our forecasts as the pandemic and government responses develop. Subsequent insights will explore the impact of the restrictions – for example, on supply chains and multinational corporations – in further detail.