Anadarko: Above-ground risk in rival bids

Comparing Chevron vs. Occidental deal scenarios

by Cornelius Graubner,

What do you need to know about the competing bids for Anadarko?

Occidental Petroleum announced a competitive bid for Anadarko Petroleum on Wednesday, offering a cash and stock proposal representing a 20% premium to the USD50-billion bid put forward by Chevron on April 12. Using our Corporate Exposure Tool (CET), we've compared the implications of both Anadarko acquisition scenarios from an above-ground risk perspective.

Chevron's portfolio is more resilient to an Anadarko acquisition

We find that while the addition of Anadarko’s positions will add risk exposure to the upstream portfolio of both Chevron and Occidental, Occidental stands to add key disruption risks to a much greater degree than Chevron.

Anadarko’s portfolio holds disruption risks

An Anadarko acquisition would bring important synergies to both Chevron and Occidental. The company’s portfolio is anchored by tight oil assets in the United States, but is complemented by material positions in deepwater, conventional and liquified natural gas (LNG). In the United States, assets in the Rockies have been a major contributor to production growth in recent years, with the Niobrara in the DJ Basin the company's most valuable asset. However, the Permian is the core growth position. The Gulf of Mexico deepwater assets remain important, but with limited new project development on the horizon. International exposure is focused on Africa, where the company owns minority stakes in the Ghana Jubilee & TEN deepwater projects, declining production onshore Algeria, and an operated interest in the Mozambique Area 1 LNG project. In the latter, the development plan is approved and awaits final investment decision.

The Corporate Exposure Tool helps you to analyse scenarios with any of our 160+ environmental, social, governance, and political risk issues. We identified water stress, terrorism threat, and severe storm hazard as three key risk factors that Anadarko will add to either Chevron or Occidental. Water stress is closely related to tight oil extraction. Horizontal wells require a large amount of water to operate and are mainly located in areas of severe water stress, which raises both cost and social license concerns. Terrorism is a threat in the areas of Algeria and Mozambique in which Anadarko operates, and raises concerns of safety for personnel and facilities. Severe storms are frequent in the Gulf of Mexico and in Mozambique, where oil-related infrastructure remains susceptible to disruption from force winds and associated flooding.

Scenario analysis: Chevron + Anadarko and Occidental + Anadarko

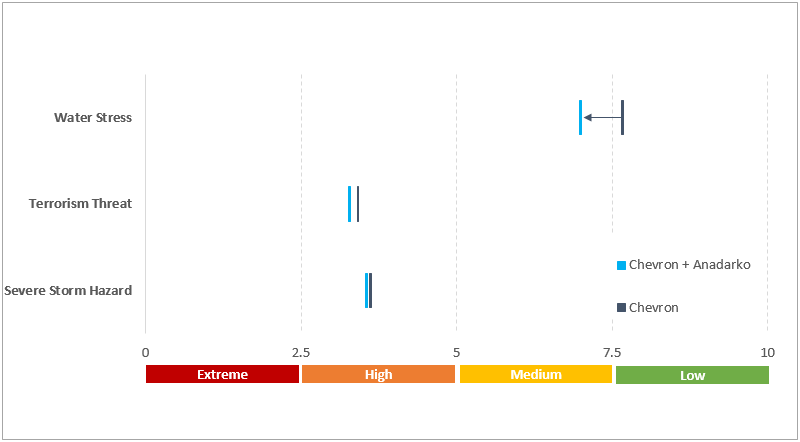

Weighted average risk exposure of global upstream commercial asset portfolio, calculated based on 2020 production

Water stress is a key addition of risk adjusted for production in a Chevron + Anadarko scenario. An Anadarko acquisition will push Chevron’s current low exposure (7.76/10.00) past the threshold to medium risk (7.14/10). As the relative weight of tight oil production against conventional assets increases over the next year, the exposure to water stress will further increase to 6.31/10.00 by 2024. The exposure to terrorism threat and severe storm hazard will also increase through the addition of Anadarko’s assets to Chevron’s portfolio, but not to a significant degree.

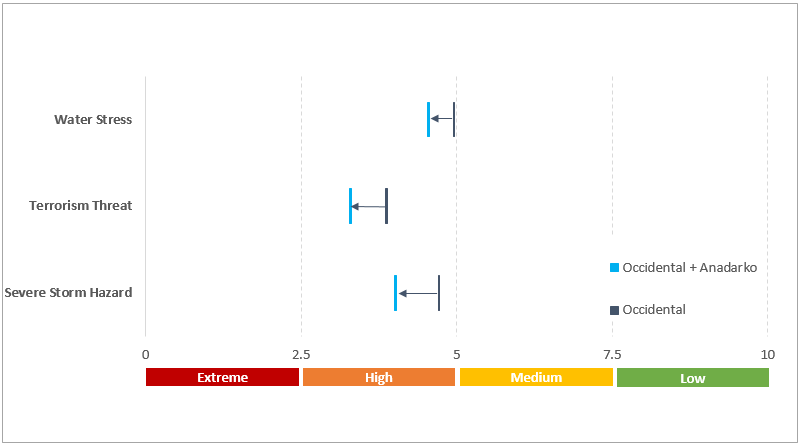

Weighted average risk exposure of global upstream commercial asset portfolio, calculated based on 2020 production

Volume growth in Permian deepen Occidental’s water risk exposure

For Occidental, the acquisition of Anadarko’s global positions results in a degradation of risk exposure on each of the three issues we examine. On water stress, while the absolute difference in risk exposure is smaller than for Chevron, Occidental would see a slight improvement of exposure from 4.97/10.00 (high risk) in 2020 to 5.07/10.00 (medium risk) in 2024. However, the addition volume growth from wells in the water-stressed Permian would cement Occidental + Anadarko risk profile in the high-risk band, reaching 4.47/10.00 by 2024.

Terrorism threat and severe storm hazard also a concern

For terrorism threat and severe storm hazard, the exposure of Occidental’s production is on a negative trajectory. An Anadarko acquisition would reinforce that trend as exposure scores worsen by 0.58 for terrorism threat and 0.41 points for severe storm hazard in the Occidental + Anadarko scenario.

- Water Stress The index evaluates total water use relative to total annual available flow (accounting for upstream consumptive use). It does not include access to deep subterranean aquifers of water accumulated over centuries and millennia.

- Terrorism Threat The index identifies the extent to which countries are directly threatened by known terrorist groups. Terrorism can have numerous direct and indirect detrimental consequences for the business environment, from physical destruction of assets to increased operating costs.

- Severe Storm Hazard The index quantifies the physical threat posed by severe storms. Severe storms can bring high winds, torrential rains and hail storms, as well as lightning strikes.