Global Risk Data

Decoding the global risk landscape

For multinational companies and financial institutions, knowing how, where, and why you are exposed to sustainability and resilience risks is fundamental to the success of your business.

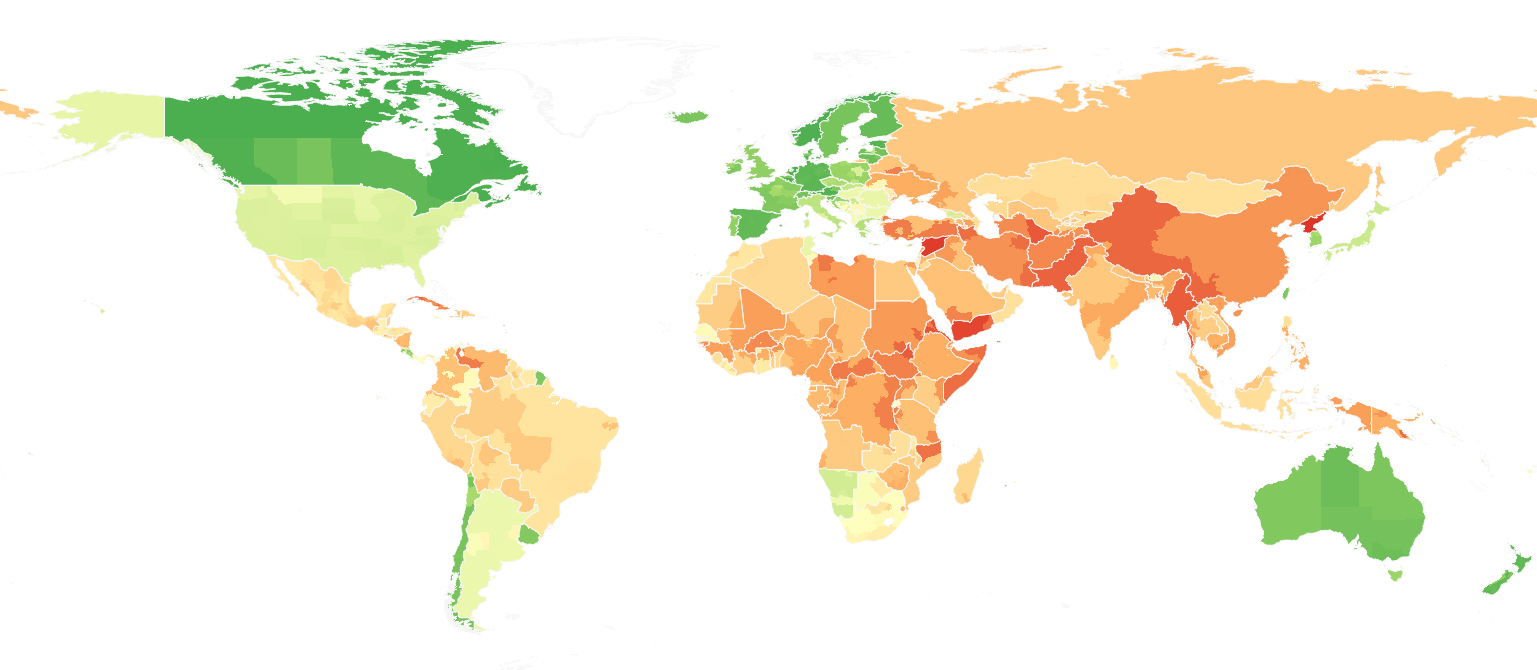

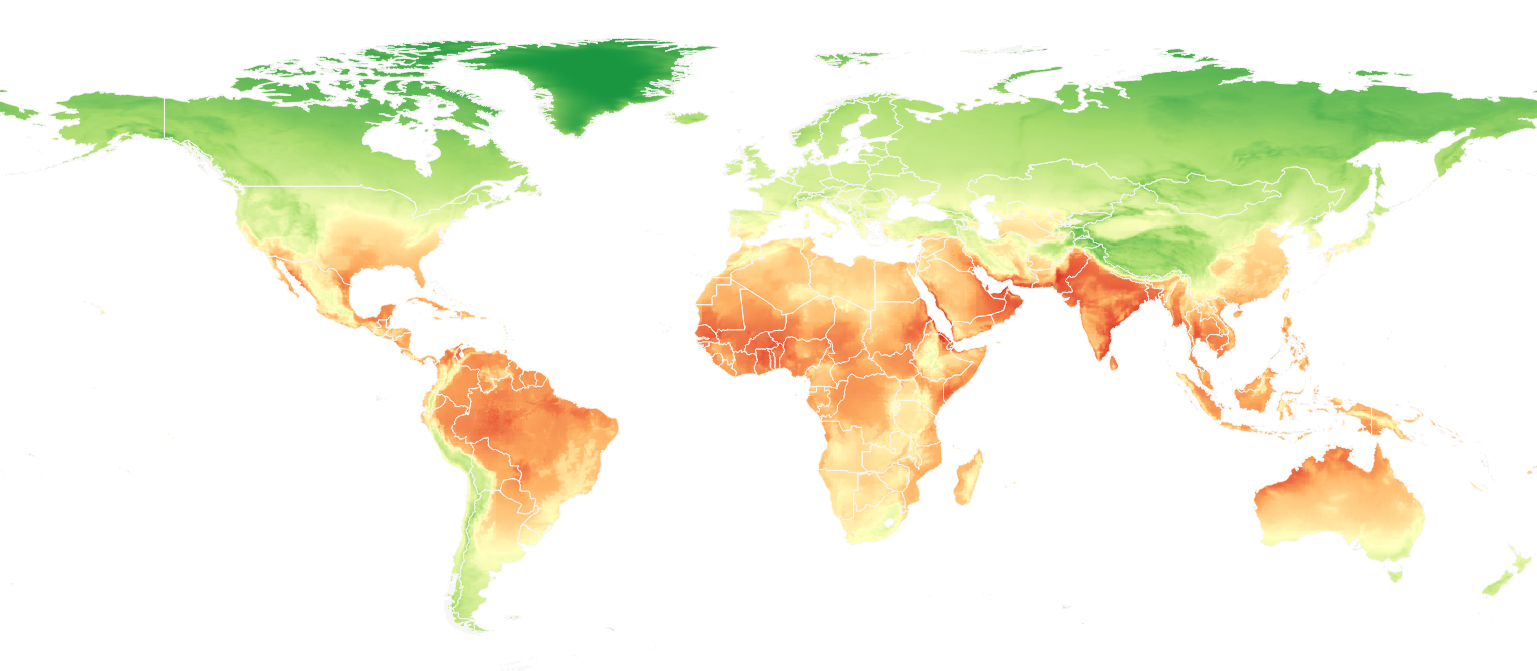

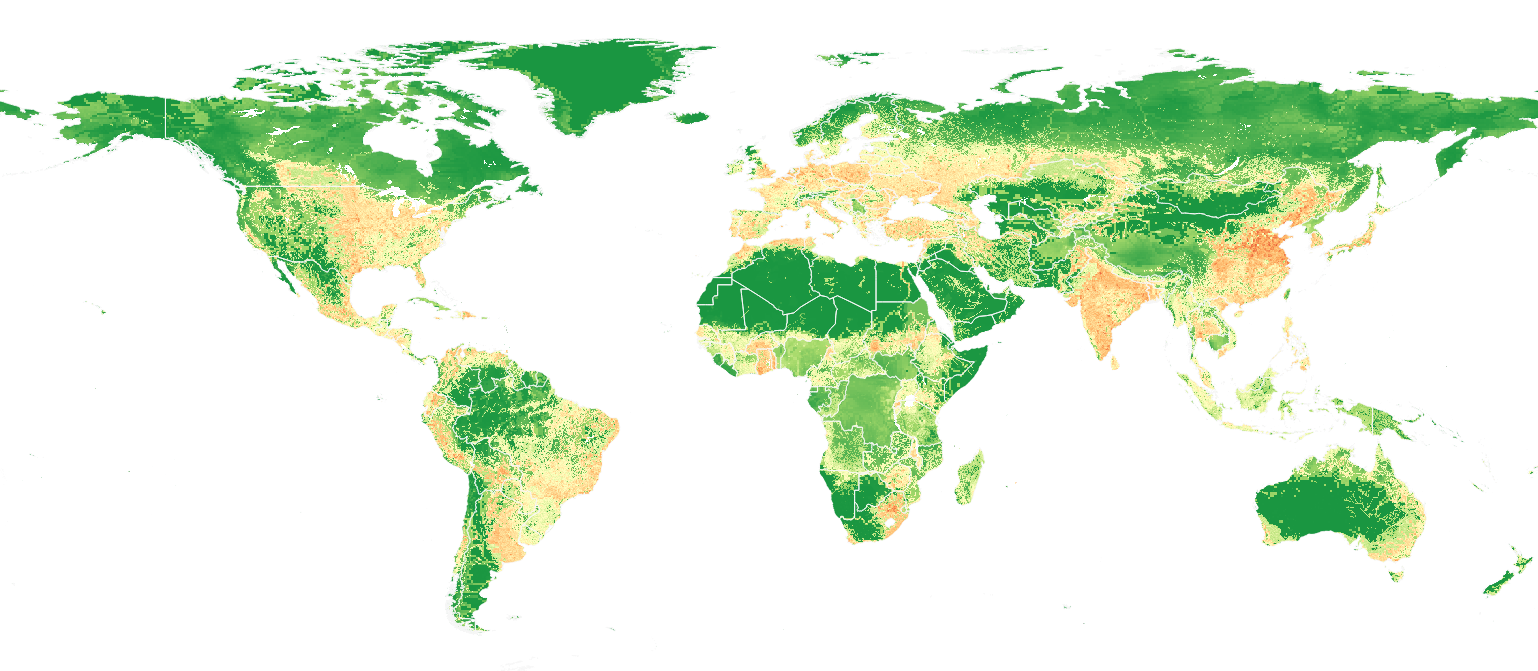

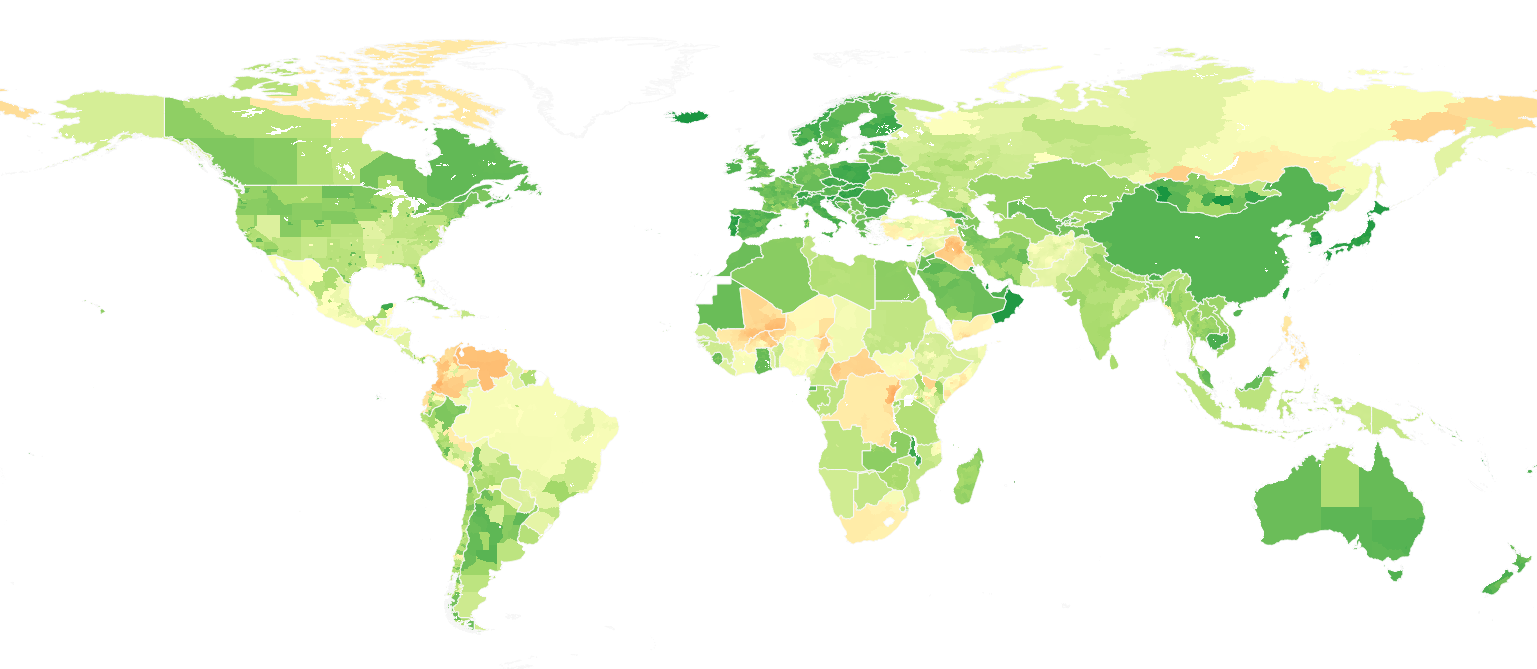

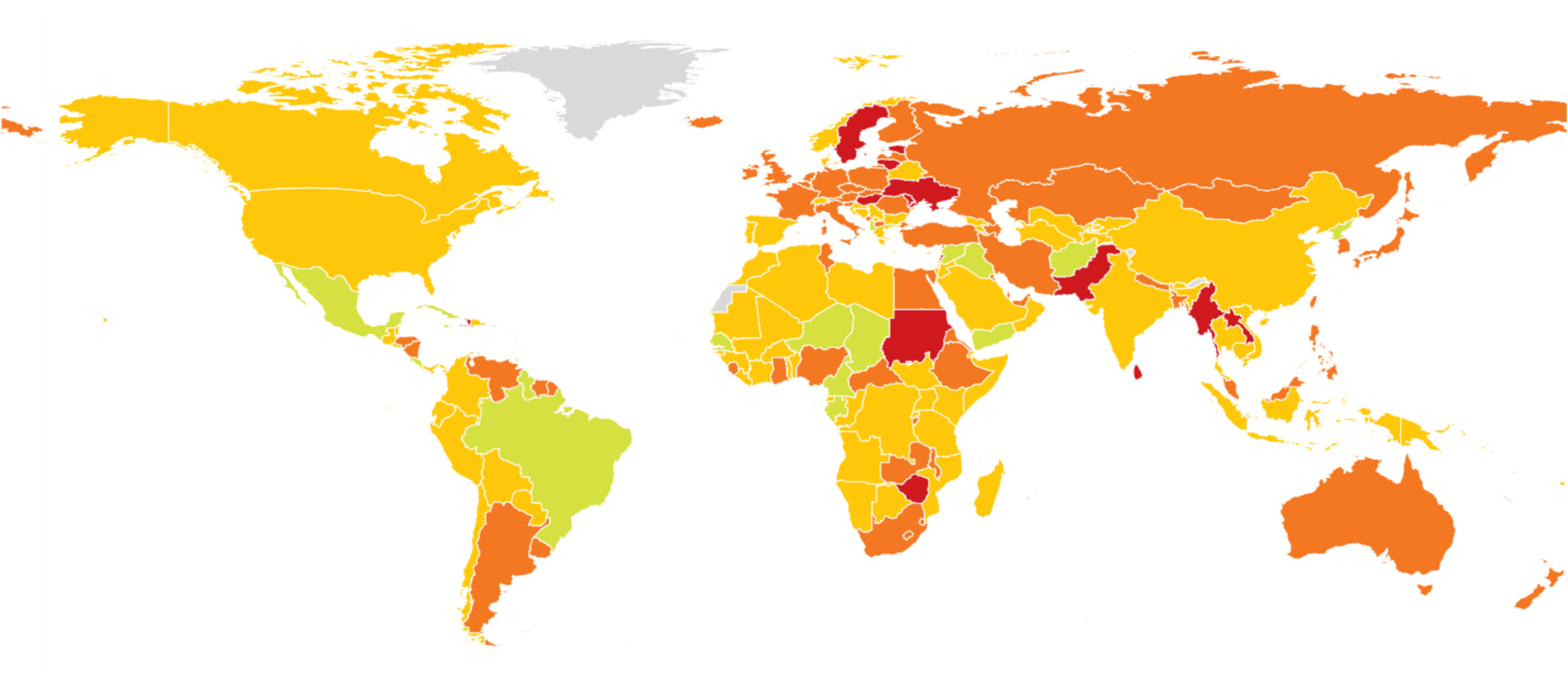

We have spent over 15 years mapping the global risk landscape; developing specialist geospatial datasets and predictive models that enable businesses to look at individual issues, or at the whole ecosystem of interconnected risk. Our data can visualise the geographic distribution of climate change impacts and resulting socio-economic vulnerabilities years into the future. We can assess the human rights implications of government policies, conflict, and resource security, and trace the drivers fuelling political risk and social unrest to anticipate instability.

Why is this important? In an increasingly complex and uncertain world, it enables our clients to further their understanding of how risks develop and form; where threats to resilience and sustainability will emerge; where mitigation strategies need to be put in place; and, significantly, where commercial opportunities exist.

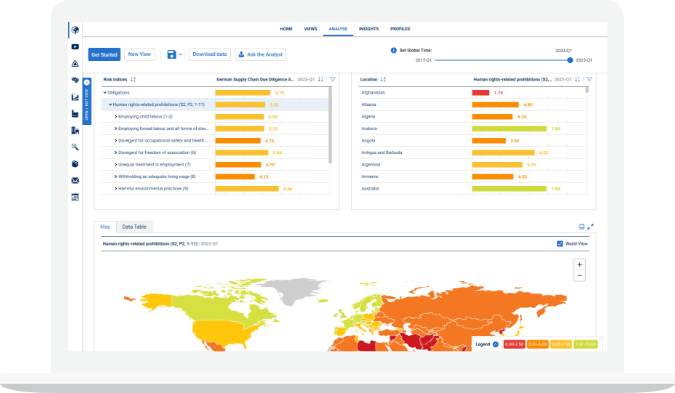

Managing risks in your operations, supply chains and investments has become increasingly challenging. By simplifying the risk identification process, our geospatial risk data enables you to quickly and accurately pinpoint, prioritise, and respond to over 190+ risk issues for any location worldwide and track the trajectory of the issues that matter most to you in the evolving risk landscape.

With our industry-leading portfolio of global risk data, we are uniquely placed to help organisations put human rights, political risk, and environmental factors at the heart of their decision making.

Using our data to manage risk

-

Resilience

Build business resilience by monitoring disruption risks to your assets, people, suppliers, and brand

-

Sustainable supply chain

Identify sustainability risks in your supply chain and operations

-

Sustainable finance

Make better investment decisions across ESG issues, sovereign risk, and new market entry

-

Strategic overview

Gain a holistic picture of interconnected global risks to inform strategy

-

Compliance

Simplify compliance with existing, new, and emerging human rights and environmental legislation

-

Market entry

Identify and high-grade market opportunities

-

Screening

Pinpoint assets most exposed to climate change and natural capital risks

-

Risk management

Linking your internal priorities to the external risk environment

Our data

The breadth and depth of our global risk data is unmatched. Our proprietary risk indices feature scores, rankings, and maps for all countries covering the most pressing ESG, climate, and political risks impacting business and how they interact with the world today.

198

Countries

190+

Risk Issues

35%

Subnational

-

Climate

Learn more -

Environment

Learn more -

Human rights

Learn more -

Political risk

Learn more -

Economic

Learn more

-

Commodity risk

Learn more -

Industry risk

Learn more -

Sovereign ESG Ratings

Learn more -

Asset Risk Exposure Analytics

Learn more

Want to learn about the deeper levels of the indices, the methodology or how they can help you?

Getting the right data

Getting the right data

Credible

Our data is used and publicly referenced by the world’s largest organisations. Our corporate clients have a combined market capitalisation north of $15tn, while the assets under management of our financial clients totals over $30tn

Independent

Our proprietary datasets provide an objective and independent view of risk absent of bias or any government influence, enabling you to remove subjectivity from the decision-making process

Easy to use

Instantly flag high risk locations by uploading location data for your operations or suppliers into our interactive platform, or integrate it into your systems through data downloads and APIs

Robust

Confidence and trust are everything. Our data models go through a vigorous, multi-stage review to ensure the highest levels of accuracy, with clients able to see exactly how and why our scores are derived

Flexible

We will understand your requirements and build a tailored package drawing from our 190+ risk issues, covering 198 countries, over 150 commodities and 80 sectors. Our data is customisable, so you only take what you need

Helping you understand your risks and identify opportunities

By bringing together 1,000s of reputable data sources in proprietary methodologies that combine AI, the expert judgement of our analysts and data science techniques we provide a unique, rigorous, and accurate picture of the global risk landscape.

Data sources & signals

Data transformation

Verisk Maplecroft Risk indices & data

Getting the data right

Trend analysis

With over seven years of data, you can track the trajectory of risk in key locations using annually and quarterly updated indices to understand the context of emerging events

Depth and breadth

We cover the full spectrum of human rights, climate, ESG and political risks, enabling you to understand the entire global risk landscape and how issues interconnect through a consistent scoring methodology backed by expert judgement and cutting-edge analytics

Human rights

Climate

Environment

Political risk

Economic risk

Transparent

All of the underlying methodologies and indicators used to build our risk data are open to interrogation, while our country, thematic or data specialists are on hand to answer any questions or provide expert advice

Understanding your risk is the first step in identifying opportunity

Get in touchLearn how our data and analysts can help support

Get in touchRelated content

Solutions

Global Risk Dashboard (GRiD)

Your single source of global risk intelligence

Solutions

Delivery solutions

Our data your way by API, connecting to Power BI, GIS platform or one of our alliances