Geopolitical & country risk

Forward looking, strategic insight on key markets and global issues

Make faster, smarter decisions

Interconnected

Tap into a full-spectrum global risk service combining data and analysis to connect political, environmental, social and economic issues and their potential impacts

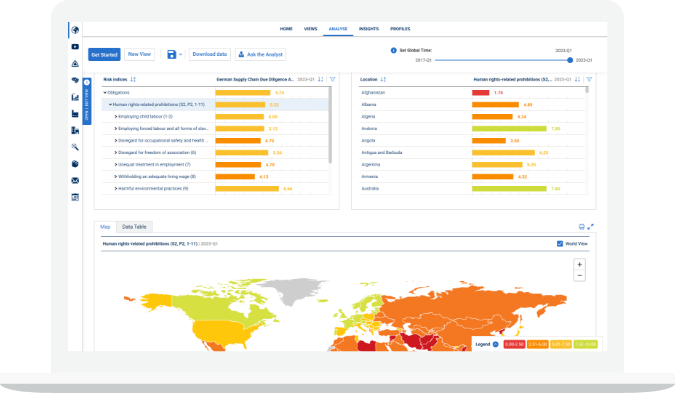

Geospatial

Use 170+ global ESG and political risk indices to identify risks and opportunities according to the geographic location of your operations, investments or assets

Decision-making

Monitor the trajectory of risks and recognise early warning signals through cutting-edge data, forecasting, horizon scanning and scenario analysis

Strategic

Understand how a fast-moving and uncertain global risk landscape is likely to evolve and what it means for your business, supply chain or commercial goals

Independent

Remove subjectivity from your decision-making and challenge internal assumptions through objective, expert analysis backed by proprietary risk data

Accessible

Utilise an extensive team of experienced ESG, geopolitical and industry experts as part of your extended team to answer the questions that matter most to you

What sets us apart

Targeted

We tailor our services according to our clients’ strategic priorities, providing the right blend of data and analysis they need to identify, manage and mitigate risk and pinpoint the opportunities that are key to their success

Our skillset

With a team of 50+ expert analysts, consultants and data scientists, alongside the world’s most comprehensive portfolio of global risk analytics, you have access to an unrivalled depth of expertise and a unique set of resources

People

Underpinning everything we do are our expert analysts and consultants who are on hand for in-person briefings, to answer your questions, and shine a light on the global ESG and political issues that are material to you

Learn how our data and analysts can help support

Anna Gilmour

Head of Global Risk Insights, Corporate Risk and SustainabilityLearn how our data and analysts can help support

Get in touchRelated content

Solutions

Global risk data

Global risk datasets covering 190+ environmental, social, political, economic issues for 198 countries, 200+ commodities and 74 industries